TFSA Investors: Earn $60/Month With These 2 Top Dividend Stocks

Written by Karen Thomas, MSc, CFA at The Motley Fool Canada

The Tax-Free Savings Account, or TFSA, is a great program that shelters your investment returns from taxation. It began in 2009, and today, the cumulative contribution limit stands at $88,000. This program is a real money saver, and as such, it’s imperative that we all use it the fullest extent possible.

Here are two top dividend stocks that TFSA investors should consider buying for income of $60 per month.

BCE stock: A leading telecom stock with a 6.39% yield

BCE (TSX:BCE) is Canada’s largest telecom services company, with a market capitalization of $55 billion and a long history of stability. And with a 6.39% dividend yield, it’s the perfect stock for TFSA investors to receive a tax-sheltered stream of regular income.

There are many things to love about BCE stock, including its cash flow profile, its financial stability, and its unmatched position in the very lucrative telecom industry. For example, in BCE’s latest quarter, cash flow from operations increased 18% to just over $2 billion. And over the last five years, BCE’s annual cash from operations has grown 12.6% to $8.3 billion.

Also, BCE’s business has supported years of healthy dividend growth and stability. In the last five years, BCE’s dividend has grown at a compound annual growth rate (CAGR) of 5.1%. Similarly, this annual dividend-growth rate has held up in the 20 years as well.

Looking ahead, we can rest assured that with BCE stock, we will be relatively sheltered from future economic woes. Essentially, the very essence of its defensive business makes it so. I mean, you won’t see consumers rushing to disconnect their internet or phone service, even in dire circumstances. In fact, this is one of the expenditures that’s among the last to be cut. And this is good news for BCE and BCE stockholders.

Fortis: A utility stock yielding 3.96%

The next top dividend stock to buy to achieve $60 in monthly income, is Fortis (TSX:FTS). Fortis is a $27.6 billion utility giant with a diverse geographic footprint and asset mix. It’s also a top dividend stock that has provided its shareholders with impressive returns. In fact, over the last 20 years, Fortis stock has yielded an average annual shareholder return of 11%. In total during this time, Fortis has generated an impressive 751% return for shareholders.

Digging a little deeper into Fortis’s dividend, we see that Fortis has a 49-year history of dividend increases. The latest dividend increase was a 5.6% increase this year, and the company expects dividend growth in the range of +4-6% until 2027.

Like BCE stock, Fortis is a very defensive stock, as cutting our electricity and/or power to our homes is just not an option. Along with telecommunications, it is one of the last expenditures to be cut in difficult economic times.

How to make $60 a month from these investments

On to the fun part: how can we use these top dividend stocks to make use of our TFSA contribution limit and to earn $60 per month? Firstly, I will assume that you have $15,000 available to invest in your TFSA. This is above the annual limit, but if you’re like most people, you probably have some catching up to do on your TFSA contributions.

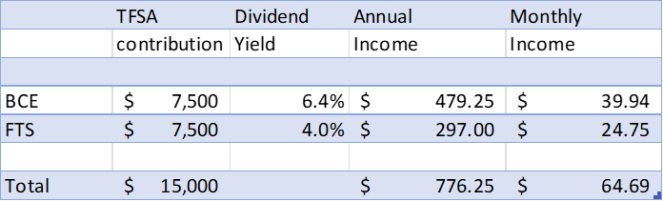

So, assuming you invest half of the $15,000 into BCE stock and the other half into Fortis stock, this is what your income would look like:

So, there you have it: an easy and safe way to make an extra +$60 of monthly income in your TFSA!

The post TFSA Investors: Earn $60/Month With These 2 Top Dividend Stocks appeared first on The Motley Fool Canada.

Free Dividend Stock Pick: 7.9% Yield and Monthly Payments

Canada’s inflation rate has skyrocketed to 6.9%, meaning you’re effectively losing money by investing in a GIC, or worse, leaving your money in a so-called “high interest” savings account.

That’s why we’re alerting investors to a high-yield Canadian dividend stock that looks ridiculously cheap right now. Not only does it yield a whopping 7.9%, but it pays monthly!

Here’s the best part: We’re giving this dividend pick away for FREE today.

Claim your free dividend stock pick * Percentages as of 11/29/22

More reading

Brookfield Asset Management Spin-Off: What Investors Need to Know

Passive Income: 4 Safe Dividend Stocks to Own for the Next 10 Years

Fool contributor Karen Thomas has a position in BCE. The Motley Fool recommends Fortis. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance