Texas Instruments (TXN) Q3 Earnings & Revenues Beat Estimates

Texas Instruments TXN reported third-quarter 2020 earnings of $1.45 per share, which surpassed the Zacks Consensus Estimate by 14.2%. The bottom line was also higher than management’s guidance of $1.14-$1.34 per share.

However, the figure decreased 2.7% year over year and 2% sequentially.

The company reported revenues of $3.82 billion, which beat the Zacks Consensus Estimate by 11.3%. The top line also exceeded the management’s guidance of $3.26 billion to $3.54 billion.

Further, the figure improved 1.2% from the year-ago quarter and 17.8% from the prior quarter.

Top-line growth was driven by improving end-market conditions. Solid demand in the personal electronics market and rebound in the automotive market remained major tailwinds.

Further, the strong performance delivered by the Analog segment contributed well. Although the Embedded Processing segment declined year over year, it grew 19% sequentially, which was noteworthy.

Notably, the company’s near-term outlook improved, which remains a tailwind.

However, uncertainties related to the ongoing pandemic remain major concerns.

Coming to the price performance, Texas Instruments has returned 17.6% on a year-to-date basis compared with the industry’s growth of 35.6%.

Nevertheless, the uptrend in personal electronics,owing to the rising demand for electronic gadgets for remote working and entertainment during this pandemic situation is likely to benefit the company in the days ahead.

Further, its strong investments in new growth avenues and competitive advantages are the positives.

Moreover, Texas Instruments’ portfolio of long-lived products and efficient manufacturing strategies are tailwinds. Additionally, continuous returns to shareholders are likely to help the stock rebound in the near term.

End-Market in Detail

Solid rebound in the automotive market, owing to North America and Europe automotive plants that resumed operations,led to a 75% surge in Texas Instruments’ revenues generated from this market sequentially. Further, revenues were almost flat on a year-over-year basis.

Further, revenues in the communications equipment space decreased by mid-single digits from the prior quarter. Nevertheless, the top line in the same market was up by mid-single digits from the year-ago quarter.

Meanwhile, the company witnessed more than20% sequential growth and 15% year-over-year growth in the personal electronics market during the reported quarter.

Further, revenues in the industrial market remained flat year over year. However, the top line in the market declined in low-single digits from the previous quarter.

Texas Instruments witnessed softness in the enterprise systems space, which was down both sequentially and on a year-over-year basis.

Segments in Detail

Analog: The company generated $2.9 billion from this segment (75% of total revenues), which increased 7% from the year-ago quarter and 18% from the previous quarter. This can be attributed to the strong performance of signal chain and power product lines during the reported quarter.

Embedded Processing: This segment generated $651 million revenues (17% of total revenues), up 19% sequentially. However, the figure was down 10% year over year primarily due to the weak performance of processors and connected microcontrollers.

Other: Revenues in this segment were $301 million (8% of total revenues). The figure was up 16.2% from the prior quarter but down 19% from the year-ago quarter.

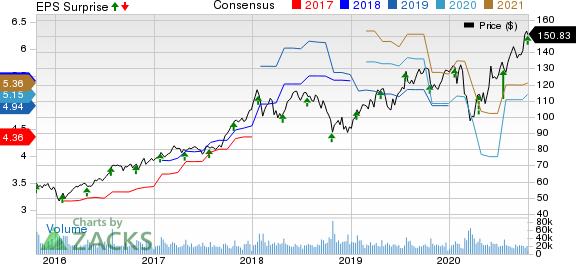

Texas Instruments Incorporated Price, Consensus and EPS Surprise

Texas Instruments Incorporated price-consensus-eps-surprise-chart | Texas Instruments Incorporated Quote

Operating Details

Texas Instruments’ gross margin of 35.7% expanded 60 basis points (bps) from the year-ago quarter.

As a percentage of revenues, selling, general and administrative (SG&A) expenses expanded 10 bps year over year to $407 million in the reported quarter. Further, research and development (R&D) expenses of $386 million remained flat from the year-ago quarter as a percentage of revenues.

In absolute terms, both SG&A and R&D expenses were up 2% and 1.8% year over year, respectively.

Operating margin was 42.2%, which expanded 10 bps from the prior-year quarter.

Balance Sheet & Cash Flow

As of Sep 30, 2020, the cash and short-term investment balance was $5.5 billion, which increased from $4.9 billion as of Jun 30, 2020.

At the end of the reported quarter, the company had long-term debt of $6.25 billion, up from $6.24 billion in the prior quarter.

Current debt stood at $550 million as of Sep 30, 2020, compared with $551 million as of Jun 30, 2020.

The company generated $1.4 billion of cash from operations, down from $1.7 billion in the previous quarter.

Capex was $146 million in the third quarter. Further, free cash flow stood at $1.3 billion.

Additionally, Texas Instruments paid out dividends worth $825 million during the reported quarter. Further, it repurchased shares worth $15 million.

Guidance

For fourth-quarter 2020, Texas Instruments expects revenues between $3.41 billion and $3.69 billion. The Zacks Consensus Estimate for revenues is pegged at $3.3 billion.

Earnings are expected to be $1.20 to $1.40 per share. The Zacks Consensus Estimate for earnings is pegged at $1.15 per share.

Zacks Rank & Stocks to Consider

Currently, Texas Instruments carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Avnet AVT, CDW Corporation CDW and NXP Semiconductors NXPI. While Avnet and CDW sport a Zacks Rank #1 (Strong Buy) at present, NXP Semiconductors carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Avnet, CDW, NXP Semiconductors are scheduled to report quarterly results on Oct 28, Nov 2, and Oct 26, respectively.

The long-term earnings growth rate of Avnet, CDW and NXP Semiconductors is pegged at 17.88%, 13.1% and 10%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

NXP Semiconductors N.V. (NXPI) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance