Texas Instruments' (TXN) Latest Launches Aid Analog Portfolio

To meet the requirements of a wide range of space missions, Texas Instruments TXN introduced device-screening specifications called space high-grade plastic (SHP) and SHP-compatible analog-to-digital converters (ADCs), namely ADC12DJ5200-SP and ADC12QJ1600-SP.

TXN also bolstered its radiation-tolerant Space Enhanced Plastic (Space EP) portfolio with a new family of pulse-width modulation (PWM) controllers, namely TPS7H5005-SEP.

With its latest endeavors, Texas Instruments expanded its space-grade analog semiconductor product offerings in highly reliable plastic packages, thus helping reduce launch costs by enabling designers to lower the system-level size, weight and power.

The SHP specification ensures integrated circuits to meet the rigorous design requirements of deep space missions even in extremely harsh environmental conditions.

We believe, the recent move is likely to aid Texas Instruments in gaining solid momentum across various space applications. This, in turn, will contribute well to its analog semiconductor business.

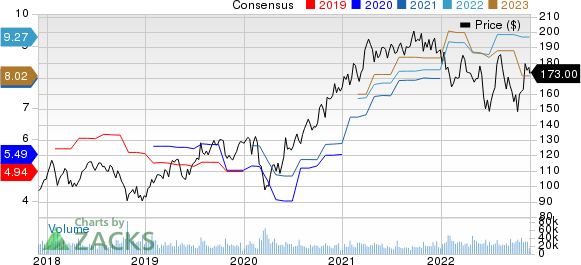

Texas Instruments Incorporated Price and Consensus

Texas Instruments Incorporated price-consensus-chart | Texas Instruments Incorporated Quote

Behind the Headlines

The new ADCs help maximize data communication speeds and reduce thermal resistance while developing small designs.

With the launch of these ADCs, Texas Instruments positioned itself well to expand its presence in the booming analog-to-digital converters market, which is steadily benefiting from global technological advancements.

Per an IMARC Group report, the global analog-to-digital converters market is expected to hit $3.3 billion by 2027, witnessing a CAGR of 5.4% between 2022 and 2027.

The launch of the TPS7H5005-SEP PWM controllers remains a huge addition to TXN’s Space EP portfolio, as these support multiple power-supply topologies and field-effect transistor architectures.

With TPS7H5005-SEP, Texas Instruments is well poised to capitalize on the prospects present in the growing PWM controllers’ market, which per a Future Market Insights report, is anticipated to reach $9.1 billion in 2022 and $15 billion by 2032, seeing a CAGR of 5.1% between 2022 and 2032.

The growing prospects of Texas Instruments in the above-mentioned promising markets are likely to raise investor optimism on the stock in the days ahead.

Shares of Texas Instruments have lost 6.1% on a year-to-date basis compared with the industry’s decline of 38.2%.

Analog Segment in Focus

With this latest move, Texas Instruments strengthens its analog segment offerings.

The underlined segment is integral to Texas Instruments as it generates the majority of the total revenues.

In the third quarter of 2022, the segment generated $3.99 billion revenues (76.2% of total revenues), up 13% from the year-ago quarter’s level.

Therefore, Texas Instruments’ growing efforts toward expanding the analog segment are likely to continue driving its financial performance in the near and the long term.

Zacks Rank & Stocks to Consider

Currently, Texas Instruments carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer & Technology sector can consider some better-ranked stocks like Asure Software ASUR, Agilent Technologies A and AMETEK AME. While Asure Software sports a Zacks Rank #1 (Strong Buy), Agilent Technologies and AMETEK carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Asure Software has lost 10.9% in the year-to-date period. The long-term earnings growth rate for ASUR is currently projected at 14%.

Agilent Technologies has lost 7.8% in the year-to-date period. The long-term earnings growth rate for A is currently projected at 10%.

AMETEK has lost 5.7% in the year-to-date period. The long-term earnings growth rate for AME is currently projected at 9.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance