Tether Trading Volume Falls to Multi-Year Lows, Market Cap Rise Is ‘Questionable:’ Kaiko

Trading with Tether’s USDT stablecoin has fallen to multi-year lows, making the token’s rise to near all-time highs in market capitalization “questionable,” crypto market research firm Kaiko said in a Monday report.

As stablecoins’ primary use is for trading, USDT’s recent increased supply to $83 billion while the token’s use falls, “seems inordinate,” according to Kaiko.

Dollar-pegged stablecoins, with a combined market capitalization of $129 billion, have become the backbone of the digital asset ecosystem, bridging traditional currencies with crypto and facilitating cryptocurrency trading. USDT, issued by Tether, is the most widely used stablecoin measured by market cap and trading volume.

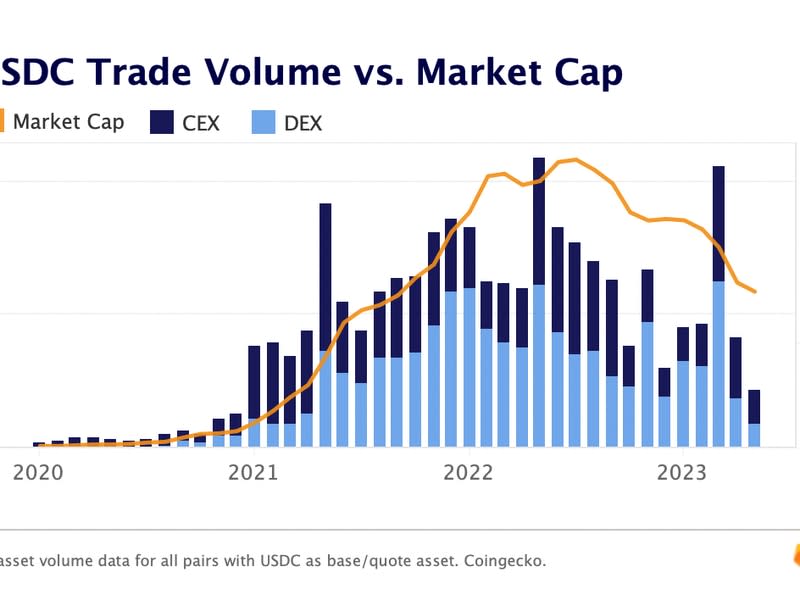

USDT has climbed this year to near its all-time high market cap in May 2022 of $83.4 billion. The rise has mainly stemmed from bank failures and a U.S. regulatory crackdown hitting rival stablecoins, including Circle’s USDC and Paxos’ BUSD.

Read more: USDC Outflows Surpass $10B as Tether’s Stablecoin Dominance Reaches 22-Month High

The token’s trading volume, however, has sharply declined recently due to a combination of lackluster crypto trading during a crypto bear market and Binance, the world’s largest exchange, reintroducing trading fees for USDT asset pairs. This weekend, USDT’s daily trading volume fell below $10 billion for the first time since March 2019, according to data by analytics firm CoinGecko.

“When looking at actual usage of the stablecoin on both centralized exchanges and decentralized exchanges, the increase seems inordinate,” Kaiko said.

Curious case of USDT growth

The crypto industry has been scrutinizing Tether for years about what assets back the value of USDT and the lack of audits. At the end of March, Tether held roughly $82 billion of assets including U.S. treasury bonds, gold and bitcoin for $79 billion of stablecoins, according to the reserves report signed by BDO Italy.

As trading volumes are falling, and assuming that trading is the dominant use case for stablecoins, a respective decline in market capitalization would be anticipated, according to Clara Medalie, Kaiko’s research director. USDC and BUSD stablecoins’ market caps have shrunk in tandem with trading volumes. “But we are not seeing this trend for Tether,” Medalie said.

One possible explanation for USDT’s trend-defying growth is the rotation to off-shore exchanges from regulated ones as U.S. regulators are increasingly separating crypto from the traditional financial system. “Traders that normally used U.S. dollars no longer have this as an option, thus are turning to Tether,” Medalie said.

Another explanation might involve the Tron blockchain and its lower fees compared to Ethereum. The majority of USDT tokens are issued on the crypto billionaire Justin Sun-founded network, with Binance owning the largest USDT addresses on Tron. “There could be a relationship between Tron, Tether, and Binance, perhaps with market makers opting to use the network due to its low fees, and supplying liquidity to Binance with USDT,” Medalie added.

Tether had not returned a CoinDesk request for comment by the time of publication.

Yahoo Finance

Yahoo Finance