TELUS (TU) to Sell Financial Solutions Business for Core Focus

TELUS Corporation TU recently announced that it has inked a definitive agreement to divest its financial solutions business to Dye & Durham for an undisclosed amount. The divesture is likely to enable the company to focus on core businesses and increase its liquidity, as it aims to navigate through the challenging macroeconomic environment.

Headquartered in Vancouver, Canada, Dye & Durham is a leading provider of cloud-based software and technology solutions to a diverse set of customers. It offers standardized business processes that ensure greater operational efficiency, automate workflow and streamline access to public records for professionals across all sectors of the economy.

TELUS’ financial solutions business will complement Dye & Durham’s portfolio across the digital financial ecosystem with an established pool of customers. These include various products across payment processing, real estate technology and digital banking managed solutions within the financial services vertical. Per the deal, TELUS International will be the preferred technology partner of Dye & Durham, while TELUS will be its preferred communication partner. This, in turn, is likely to be beneficial for both the companies and create additional revenue-generating opportunities across the small and medium sector markets.

TELUS will utilize the net proceeds from the transaction to pursue strategic growth initiatives and connect more homes with fiber network while expanding its 5G network connectivity. The company will also use part of the sale proceeds to reduce debt, improve liquidity and enhance new businesses like TELUS Health and TELUS Agriculture. As of Sep 30, 2021, it had $1,480.2 million of net cash and temporary investments with $14,492.4 million of long-term debt.

TELUS Agriculture is a new business unit dedicated to providing innovative solutions to support the agriculture industry with connected technology. It supports more than 100 million acres of agricultural land, backed by a team of more than 1,200 experts across Canada, the United States, Mexico, Brazil, the United Kingdom, Slovakia, Armenia, Germany, China and Australia. TELUS Health connects patients with physicians through mobile apps and aims to enhance patient experience and medication management through digital solutions.

TELUS has launched 5G networks in several places across Canada. It acquired a 100% stake in Mobile Klinik to grow its wireless business. It is well-positioned to benefit from the increasing penetration of smart devices, wireless data services and wireline fiber-optic networks. The company expects balanced growth across businesses, backed by investments in high-speed broadband technology. Strategic acceleration of broadband network investment program is expected to not only enhance TELUS’ fiber build-out across key markets in British Columbia, Alberta and Eastern Quebec but also expand its 5G footprint.

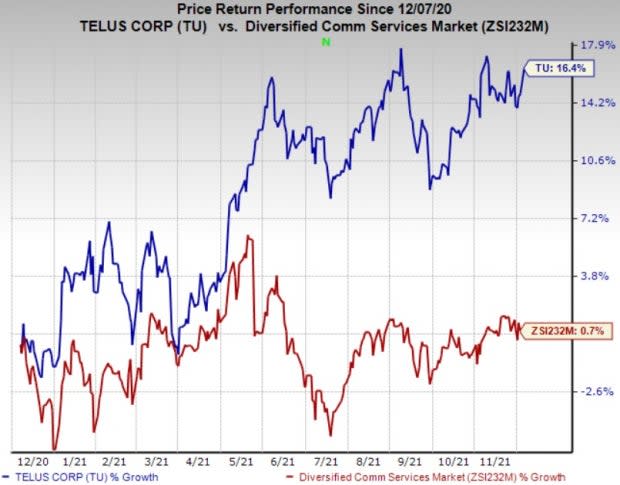

The stock has gained 16.4% in the past year compared with the industry’s rally of 0.7%. We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

A better-ranked stock in the broader industry is Clearfield, Inc. CLFD, sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Clearfield delivered an earnings surprise of 50.8%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 68.2% since January 2021. Over the past year, Clearfield has gained a solid 139.6%.

Qualcomm Incorporated QCOM, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. It has a long-term earnings growth expectation of 15.3% and delivered an earnings surprise of 11.2%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 35.4% over the past year. Qualcomm is likely to benefit in the long run from solid 5G traction and a surge in demand for essential products that are the building blocks for digital transformation in the cloud economy.

Sierra Wireless, Inc. SWIR carries a Zacks Rank #2. It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 6.2%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TELUS Corporation (TU) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Sierra Wireless, Inc. (SWIR) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance