TELUS (TU) Q2 Earnings & Revenue Top Estimates, Increase Y/Y

TELUS Corporation TU reported adjusted earnings per share of C$0.32 per share (25 cents per share) in second-quarter 2022 compared with C$0.26 per share in the prior-year quarter. The bottom line beat the Zacks Consensus Estimate of 22 cents.

Quarterly total operating revenues increased 7.1% year over year to C$4,401 million ($3,449 million) owing to high service revenue in TELUS technology solutions and TELUS International. The top line beat the consensus estimate of $3,439 million.

The upside reflects higher demand for premium bundled offerings and strong customer retention efforts that resulted in total customer net additions of 247,000 in the reported quarter.

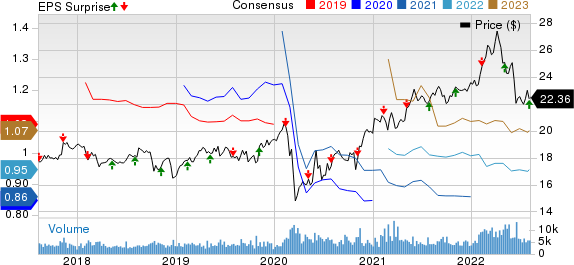

TELUS Corporation Price, Consensus and EPS Surprise

TELUS Corporation price-consensus-eps-surprise-chart | TELUS Corporation Quote

Quarterly Segmental Results

TELUS reports revenues in two segments — TELUS technology solutions (TTech) and Digitally-led customer experiences — TELUS International (DLCX).

In the second quarter, TTech revenues (arising from contracts with customers) rose 4% year over year to C$3,701 million, primarily driven by higher mobile network revenues and solid performance across fixed data, agriculture, customer and health services. Mobile network revenues rose 6.4% year over year to C$1,623 million due to increasing mobile phone ARPU and subscriber growth.

Fixed voice services revenues declined 6.1% year over year to C$201 million. This reflects the ongoing decline in legacy voice revenues from technological substitution and price plan changes. This was partly offset by strong demand for bundled product offerings and migration from legacy to IP services offerings.

Health services revenues increased 7.9% to C$137 million, driven by the positive impact of business acquisitions, higher uptake of virtual care solutions, health benefits management services growth and TELUS Health Care Centres.

The segment’s adjusted EBITDA of C$1,436 million increased 6.1% year over year, led by an increase in direct contribution from mobile and fixed products and services, partly offset by higher employee costs and bad debt expenses. Adjusted EBITDA margin came in at 38.4% compared with 37.9% in the year-ago quarter.

Revenues from TELUS International (DLCX) soared 21.1% year over year to C$797 million. Operating revenues (arising from contracts with customers) rose 22.2% to C$672 million, primarily driven by growth within the tech and games sectors, banking and financial services and eCommerce and fintech vertical.

The segment’s adjusted EBITDA of C$186 million increased 35.6% from the year-ago quarter’s figure. Adjusted EBITDA margin was 23.4% compared with 20.9% in the prior-year quarter.

TELUS PureFibre network covered more than 2.8 million premises at the end of second-quarter 2022, up from nearly 2.6 million premises in the year-ago quarter.

Other Details

Adjusted EBITDA increased 8.9% year over year to C$1,622 million, driven by higher Internet and data service revenues, higher mobile revenues from an accretive subscriber base and increased contribution from the DLCX acquisition.

Cash Flow & Liquidity

In the second quarter, TELUS generated C$1,250 million of cash from operating activities compared with C$1,244 million in the year-ago quarter. Free cash flow for the same period decreased 2.4% to C$205 million.

Capital expenditures (excluding spectrum licenses) soared 15.4% year over year to C$1,054 million on the back of increased 5G investments, enhanced product development and digitization to increase system capacity and reliability.

As of Jun 30, 2022, the company had C$382 million of net cash and temporary investments with C$21,628 million in long-term debt compared with C$774 million and C$21,319 million, respectively, as of Mar 31, 2022.

2022 Outlook

TELUS expects adjusted EBITDA to grow in the range of 8-10%. Free cash flow is anticipated to be between $1 billion and $1.2 billion. The company is confident in boosting its operating momentum through an accelerated broadband expansion program and synergies from the recent acquisition of Lifeworks.

Zacks Rank & Stocks to Consider

TELUS currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Cadence Design Systems CDNS, Badger Meter BMI and Arista Networks ANET. Cadence Design Systems, Badger Meter and Arista Networks (ANET) each sport a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CDNS 2022 earnings is pegged at $4.11 per share, rising 5.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.7%.

Cadence’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 9.8%. Shares of CDNS have jumped 24.1% in the past year.

The Zacks Consensus Estimate for BMI’s 2022 earnings is pegged at $2.30 per share, up 7% in the past 60 days.

Badger Meter’s earnings beat the Zacks Consensus Estimate in three of the preceding four quarters, with the average being 12.6%. Shares of BMI have lost 5.5% of their value in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $3.99 per share, increasing 8.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 34.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TELUS Corporation (TU) : Free Stock Analysis Report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance