Teleflex's (TFX) Q2 Earnings Top Estimates, 2022 View Down

Teleflex Incorporated’s TFX adjusted earnings per share (EPS) from continuing operations of $3.39 for the second quarter of 2022 increased 1.19% from the year-ago figure as well as beat the Zacks Consensus Estimate of $3.35.

GAAP EPS of $2.23 for the second quarter showed a 26.7% improvement from the year-ago figure.

Revenues in Detail

Net revenues in the second quarter dropped 1.3% year over year to $704.5 million and 2.3% on a constant exchange rate or CER. The top line lagged the Zacks Consensus Estimate by 2.3%.

Americas’ net revenues of $412.7 million fell 0.5% from the year-ago period and 0.3% at CER due to tough year-over-year comparables. In the quarter, surgical was the biggest contributor to growth, offset by a decline in Interventional Urology.

EMEA net revenues of $145.2 million declined 7.6% year over year and improved 3.4% at CER. Surgical and Interventional Products witnessed growth. Once again procedure volumes improved as countries across the region opened up.Excluding the impact of the Respiratory divestiture, revenues rose 6.7% year over year.

Revenues from Asia rose 1.8% at CER to $76.6 million, backed by strong contributions from Southeast Asia and Korea.

Segmental Revenues

In the second quarter, the Vascular Access segment reported net revenues of $163.9 million, up 1% at CER. The Interventional business registered net revenues of $114.4 million, up 5.3% at CER.

Within the Anesthesia segment, net revenues improved 14.4% at CER to $104.7 million. The Surgical segment recorded net revenues of $99.6 million, reflecting an increase of 5.9% year over year at CER. Revenues of $79.8 million in the Interventional Urology segment declined 13.2% at CER.

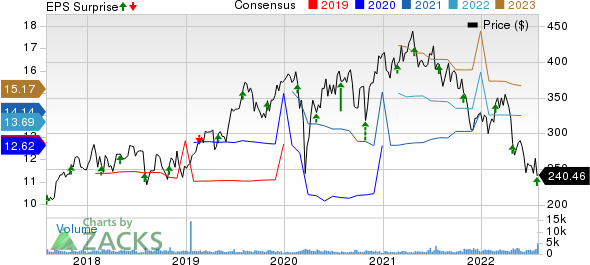

Teleflex Incorporated Price, Consensus and EPS Surprise

Teleflex Incorporated price-consensus-eps-surprise-chart | Teleflex Incorporated Quote

Meanwhile, OEM recorded revenue growth of $70 million, up 17.6% at CER. The Other product segment’s (consisting of the company’s respiratory products that were not included in the divestiture to Medline, manufacturing service agreement revenues and Urology Care products) net revenues of $72.1 million registered a decline of 10.9% year over year at CER.

Margins

In the reported quarter, gross profit totaled $388.8 million, down 2.2% year over year. The gross margin contracted 53 basis points (bps) to 55.2%.

Overall, the adjusted operating profit was $135.1 million, down 3.6% year over year. Adjusted operating margin saw a 47-bp contraction year over year to 19.2%.

Liquidity Position

Teleflex exited 2022 with cash and cash equivalents of $308.1 million, down from $466.7 million at the end of Q1.

Cumulative cash flow provided by operating activities from continuing operations at the end of the second quarter of 2022 was $101.9 million compared with $265.1 million in the year-ago period.

The company has a dividend payout ratio of 10% at present.

2022 View

Teleflex updated its 2022 non-GAAP financial guidance.

GAAP revenue growth for 2022 is now expected in the range of (0.45%) to 0.55% compared with the earlier-provided band of 2.3-3.8%. The company reduced its constant currency revenue growth for 2022 to the band of 3.25% to 4.25% (4.00-5.50%). The current Zacks Consensus Estimate for total revenues is pegged at $2.90 billion.

The company lowered its adjusted EPS from continuing operations projection for 2022 between $13.00 to $13.40 ($13.70 and $14.30), suggesting a decline of 2.5-0.5% from the comparable reported figure in 2021. The Zacks Consensus Estimate for the same is currently pegged at $13.69.

Our Take

Teleflex exited the second quarter of 2022 on a mixed note. While earnings were better than expected, revenues fell short of estimates. The company exhibited a year-over-year decline across the Americas while EMEA and Asia regions grew at CER. For UroLift, the company saw year-over-year revenue declines in all sites of service during the quarter, including hospital, ASC and physician's office. Escalating operating expenses are building pressure on margins.

Teleflex’ lowered revenue and adjusted EPS outlook for 2022, reflecting lackluster performance in the coming period increased investors’ concern.

Zacks Rank and Key Picks

Teleflex currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Quest Diagnostics Incorporated DGX, Medpace Holdings, Inc. MEDP and Alkermes plc ALKS.

Quest Diagnostics, carrying a Zacks Rank #2 (Buy), reported second-quarter 2022 adjusted EPS of $2.36, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $2.45 billion outpaced the consensus mark by 7.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Quest Diagnostics has an earnings yield of 7.1% compared with the industry’s 3.2%. DGX’s earnings surpassed estimates in three of the trailing four quarters and missed the same in one, the average being 12.1%.

Medpace Holdings, having a Zacks Rank #2, reported second-quarter 2022 adjusted EPS of $1.46, which beat the Zacks Consensus Estimate by 8.9%. Revenues of $351.2 million outpaced the consensus mark by 1.3%.

Medpace Holdings has an estimated growth rate of 22.7% for full-year 2022. MEDP’s earnings surpassed estimates in the trailing four quarters, the average being 17.3%.

Alkermes reported second-quarter 2022 adjusted earnings of 6 cents per share, beating the Zacks Consensus Estimate by 50%. Revenues of $276.2 million beat the Zacks Consensus Estimate by 1.2%. It currently has a Zacks Rank #2.

Alkermes has a long-term estimated growth rate of 25.1%. ALKS’ earnings surpassed estimates in all the trailing four quarters, the average surprise being 325.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

Teleflex Incorporated (TFX) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance