Technical Overview Of EUR/USD, USD/JPY, AUD/USD & USD/CAD: 05.12.2017

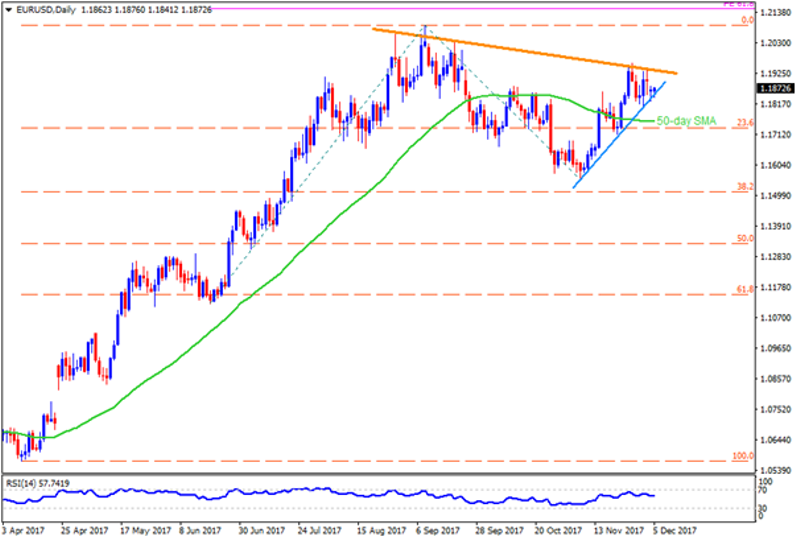

EUR/USD

While more than three-month old descending trend-line has been restricting the EURUSD’s advances, a bit smaller upward slanting TL seems limiting the pair’s near-term declines. However, the RSI is around overbought region and the US tax-plan is about to become a law, which in-turn indicates the pair’s downside. Hence, a daily close below the 1.1845 trend-line can act as a trigger to quickly fetch the pair towards 1.1800 and then to the 50-day SMA level of 1.1755. Given the quote continues declining beneath 1.1755, the 1.1685 and the 1.1660 could please sellers. Alternatively, pair’s successful break above resistance-line, at 1.1940 now, can propel it to the 1.2000 round-figure and then to the 1.2030 ahead of pushing buyers to aim for 1.2100 mark. Should Bulls refrain to respect the 1.2100 resistance-figure, 61.8% FE level of 1.2155 might appear on the chart.

USD/JPY

Even after taking a U-turn from the immediate channel-resistance, USDJPY’s present downside is likely limited till the channel-support figure of 112.30, which if broken could further drag the pair to 111.85 and to the 111.65 rest-points. If prices keep declining below 111.65, chances of the pair’s plunge to 111.00 and then to the 110.80 can’t be denied. In case of the pair’s reversal, the 112.70 and the 113.05-10 horizontal-line are expected immediate resistances to challenge its strength while channel-resistance figure of 113.35 may confine following up-moves. Moreover, pair’s ability to conquer the 113.35 could help it target the 113.75 and the 114.00 resistances.

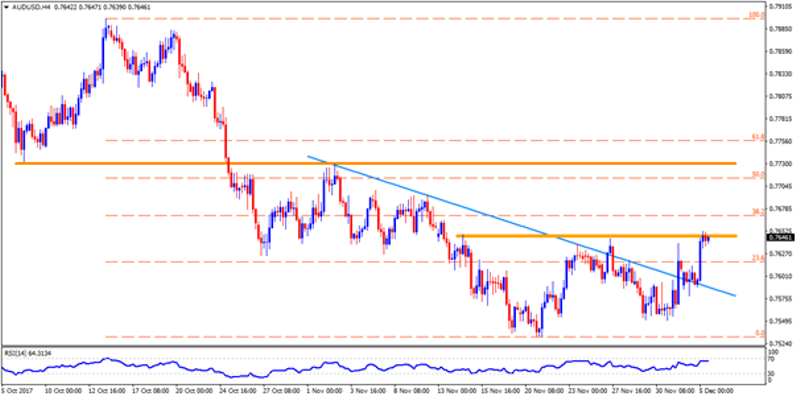

AUD/USD

AUDUSD’s ability to break the month-long TL resistance failed to propel the pair as 0.7645-50 horizontal-area is currently holding it captive. Should the quote manages to surpass 0.7650, it can easily rise to 0.7690 before looking towards the 0.7730-35 zone. Further, during the pair’s sustained trading beyond 0.7735, the 0.7750, the 0.7775 and the 0.7800 are likely consecutive resistances that it may confront. Meanwhile, 0.7620 and the 0.7590 may act as adjacent supports if the pair ticks down, breaking which 0.7550 and the 0.7530 could gain sellers’ attention. Moreover, the 0.7515 and the 0.7470 could please Bears if 0.7530 is broke.

USD/CAD

Having repeatedly bounced from 1.2665-60 horizontal-line, the USDCAD seem now declining in direction to 1.2595 and then to the 100-day SMA level of 1.2565 if it closes below 1.2660. Though, the 1.2520 and the 1.2480 may limit the pair’s additional downside. On the contrary, pair’s daily close above 1.2665 may again pull it back to 1.2710 and then to the 1.2750 while 1.2780 and the 1.2825 likely acting as strong resistances then after. In case of the pair’s sustained trading above 1.2825, the 1.2850 might offer intermediate halt to its upward trajectory targeting the 1.2910-20 horizontal-area.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance