Technical Update For EUR/USD, GBP/USD, NZD/USD & USD/CHF: 26.12.2018

EUR/USD

A fortnight old ascending trend-line presently challenges EURUSD sellers around 1.1380, which if broken can quickly drag the quote to 1.1330 and then the 1.1300 but the 1.1270-65 horizontal-line could confine the pair’s following downside. In case the pair continue trading southwards past-1.1265, the 1.1215 and the 1.1200 may flash on the chart. Alternatively, the 1.1425 and the 1.1445-50 might restrict the pair’s near-term advances prior to highlighting the 1.1480-1.1500 resistance-region, comprising 100-day SMA on D1. If at all buyers conquer 1.1500 mark, the 1.1550, the 1.1570 and the 1.1620 can appear on their radars to target.

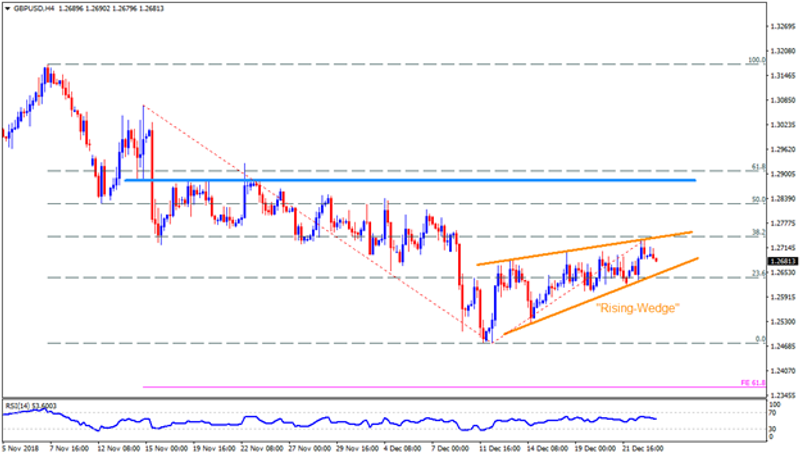

GBP/USD

With the short-term “Rising-Wedge” directing GBPUSD moves, the pair has to slid beneath the 1.2640 support in order to justify the bearish formation and aim for 1.2530. Should prices weaken under 1.2530, the 1.2475, the 1.2400 and the 61.8% FE level of 1.2365 can become Bears’ favorites. Meanwhile, pair’s sustained break of 1.2745 resistance-line defies the pattern and could extend the recovery towards 1.2810 ahead of confronting 1.2880-85 barrier. Additionally, the 1.2950, the 1.3000 and the 1.3035-40 can entertain Bulls beyond 1.2885.

NZD/USD

Unless breaking the 0.6705-0.6685 support-zone, the NZDUSD is less likely to revisit the 0.6630 and the 0.6600 round-figure; though, pair’s extended declines below 0.6600 may look for 0.6565, the 0.6500 and the 0.6460 rest-points. Given the pair takes a U-turn, the 0.6785 and the 0.6835 resistance-line could play their roles, which if ignored might give rise to the 0.6880 and the 0.6915 numbers on the chart. Assuming the pair’s successful rally over 0.6915, the 0.6970, the 0.7000 and the 0.7020, encompassing 61.8% FE, should be watched carefully.

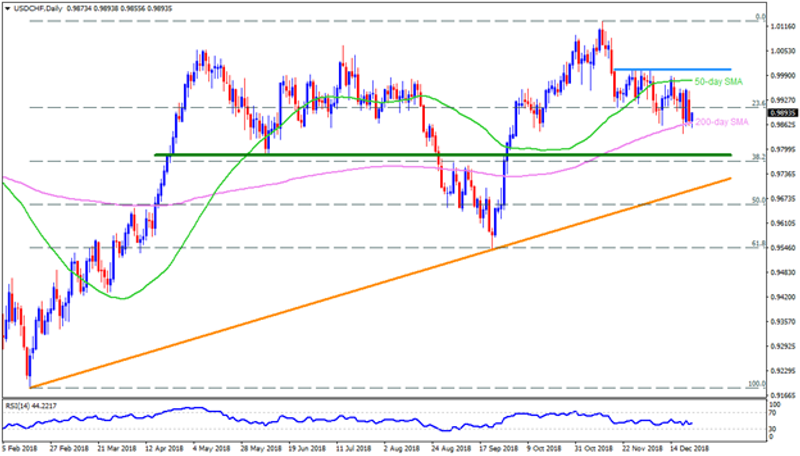

USD/CHF

Even after trading near the lowest levels in more than two-months, the 200-day SMA level of 0.9865 still acts as a strong support for the USDCHF, which if broken on a daily closing basis can drag the pair to 0.9820 and then to 0.9790-80 support-area. In case prices dip beneath 0.9780, the 0.9750 may offer intermediate halt during their plunge to 0.9680 support-line. On the upside, the 0.9900, the 0.9950 and the 50-day SMA level of 0.9980 can act as immediate resistances for the pair before diverting market attention to 1.0000-10 territory. Given the pair manage to cross 1.0010 and marches afterwards, the 1.0060, the 1.0100 and the 1.0130 may again mark their presence.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance