Technical Update For EUR/USD, AUD/USD, NZD/USD & USD/CHF: 26.09.2017

EUR/USD

Having witnessed a short-lived break of 1.2000 psychological magnet, the EURUSD finally dropped below more than five-month old ascending trend-line on Monday. Not only that, the pair continued extending its decline on Tuesday and conquered the 50-day SMA, which in-turn opens the door for its further downturn towards 1.1730 and then to the 1.1700 prior to re-testing the 1.1660-55 horizontal-line. In case if Bears keep dominating the sentiment and fetch prices beneath 1.1655 on a daily closing basis, the 1.1600, the 1.1580 and the 100-day SMA level of 1.1535 could come-back on the chart. Alternatively, inability to justify the recent break, by a close beyond 1.1865, could again propel the quote to 1.1920 and then to the 1.2000 resistance-marks. Should the pair manage to clear 1.2000, the 1.2030-35 and the 1.2090 – 1.2100 might appear in buyers’ radar, surpassing which they can aim for 1.2165-70 numbers to north.

AUD/USD

AUDUSD is another major pair that smashed an upward slanting trend-line support on a Daily chart and cleared the 50-day SMA buffer. As a result, the pair is expected to revisit the 0.7865 and the 0.7840-35 horizontal-support. If the 0.7840-35 isn’t being respected, the 0.7785 and the 100-day SMA level of 0.7750 are likely rests that the pair could avail. Meanwhile, a day’s close above 0.7950, comprising 50-day SMA, can trigger the recovery to 0.7985 and then to the 0.8015 upside figures. Moreover, pair’s successful trading beyond 0.8015, reignites the importance of 0.8060-65 and the 0.8100 resistances.

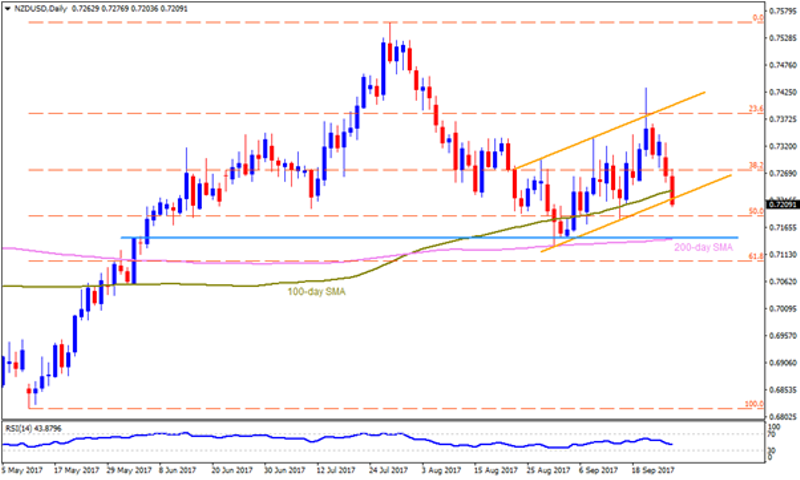

NZD/USD

Unlike previous two-pairs, the NZDUSD is yet to confirm its south-run by dipping below a short-term ascending trend-channel support of 0.7220, which could further weaken it towards testing 0.7165 and then to the 0.7140-45 support-area, encompassing 200-day SMA & a horizontal-line. Given the pair keep stretching its decline below 0.7140, the 0.7100 and the 0.7055-50 should be watched carefully. If at all the D1 closing remains above 0.7220, the 100-day SMA level of 0.7235, the 0.7250 and the 0.7300 can act as nearby resistances, clearing which 0.7335, the 0.7370 and the channel-resistance of 0.7400 may come into play. Moreover, pair’s successful break of 0.7400 enables it to target the 0.7460 and the 0.7525 upside numbers.

USD/CHF

With the steeply rising support-line limiting the USDCHF’s downside, the pair seems again aiming to confront the four-month old descending TL resistance of 0.9745. Should prices manage to surpass 0.9745, the 0.9770 and the 0.9810 could offer intermediate halts to the north-run targeting 200-day SMA level of 0.9855. On the downside, break of 0.9650 adjacent trend-line can drag the pair to 0.9600, the 0.9580 and the 0.9550 supports. During the pair’s plunge below 0.9550, the 0.9525, the 0.9490 and the 0.9435 may appear on sellers’ wish list.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance