Technical Checks For EUR/USD, USD/JPY, AUD/USD & USD/CAD: 06.11.2018

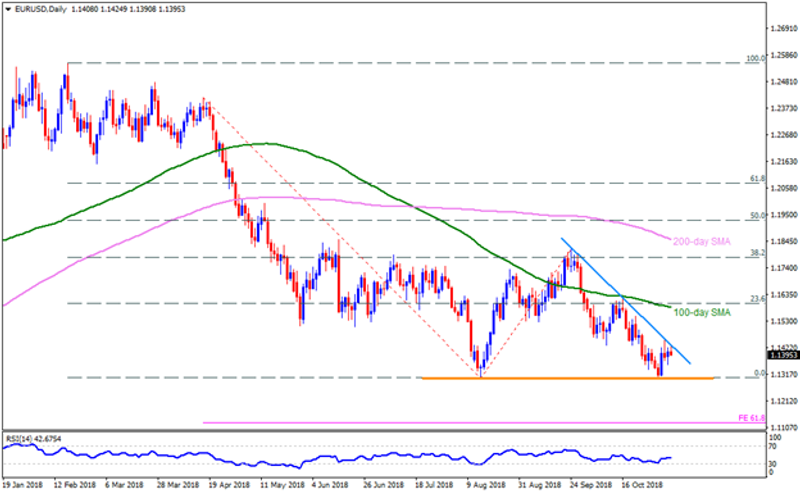

EUR/USD

With the fortnight long descending trend-line continue restricting EURUSD’s upside, the pair is likely returning back to 1.1300 support-mark that’s limiting its declines off-late; though, 1.1350 might offer an immediate rest during the quote’s dip. In case the pair refrains to respect the 1.1300 stop, the 1.1285-80 could rather become an intermediate halt prior to pleasing Bears with 61.8% FE level of 1.1120. Alternatively, pair’s successful clearance of 1.1435-40 resistance-line may fuel it towards 1.1510 and then to the 100-day SMA level of 1.1585. It should also be noted that the pair’s extended rise past-1.1585 might not hesitate challenging the 1.1650 and the 1.1720 numbers to north.

USD/JPY

Break of nearby support-line signals brighter chances for the USDJPY’s drop to 112.60 and to the 112.00 levels before highlighting the importance of 111.65-60 horizontal-area. Given the pair’s sustained downturn below 111.60, the 111.00, the 110.60 and the 110.35 may flash in the sellers’ radar to target. If at all prices take a U-turn after US election result, the 113.50-55 seem a concern as break of which could trigger the pair’s rally to 114.00. Moreover, buyers’ dominance above 114.00 might aim for 114.20 & 114.55 resistances.

AUD/USD

Even after crossing more than nine-month old resistance-line, the AUDUSD is yet to conquer the 100-day SMA level of 0.7270 on a daily closing basis in order to justify its strength to look for 0.7310-15 and the 0.7340-45 levels. Assuming the quote’s ability to smash 0.7345 hurdle, the 0.7410 and the 200-day SMA level of 0.7480 may gain market attention. Meanwhile, 50-day SMA level of 0.7155 and the resistance-turned-support line, around 0.7140, can confine the pair’s adjacent declines, if not then 0.7100 & 0.7040 are expected figures to again mark their presence on the chart. Additionally, pair’s failure to bounce off the 0.7040 may call the 0.7020, the 0.7000 and the 61.8% FE level of 0.6965 as quotes.

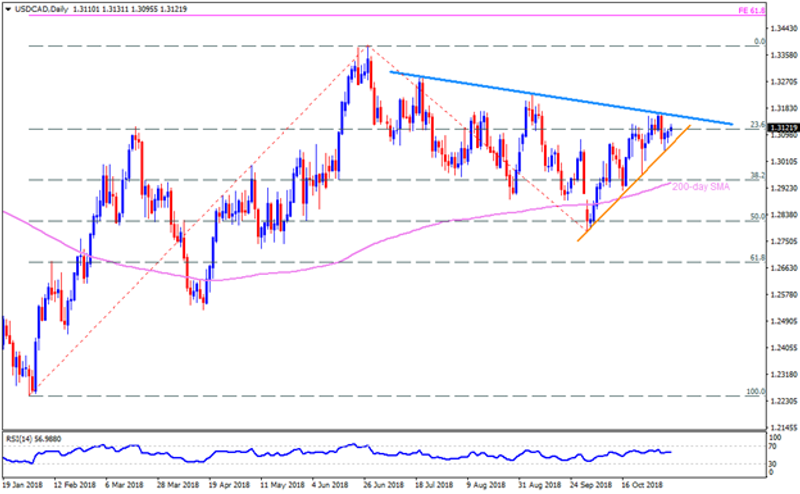

USD/CAD

Immediate upward slanting support-line favors the USDCAD’s advances to again confront the four-month long descending TL barrier, at 1.3165 now. However, pair’s capacity to rally beyond 1.3165 can have 1.3220 & 1.3260 as targets ahead of preparing for the 1.3340, the 1.3385 and the 1.3485, including 61.8% FE, landmark stats. On the downside, a D1 close beneath the 1.3060 support-line may entertain pessimists with 1.3010 and the 1.2960 but 200-day SMA level of 1.2940 could threaten their grip over prices. Should the pair weakens below 1.2940, the 1.2850 and the 1.2780 might grab traders’ eye-share.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance