Technical Checks For EUR/USD, USD/JPY, USD/CAD & USD/CHF: 31.10.2017

EUR/USD

EURUSD’s latest recovery from two-month-old descending trend-channel support is likely to be challenged by the 1.1660-70 horizontal-region and the 100-day SMA level of 1.1690. Should the pair registers a daily closing beyond 1.1690, the 1.1730 and near-term downward slanting TL, at 1.1800, might question its follow-on upside before threatening buyers with a channel-resistance level of 1.1865. Meanwhile, 1.1580 and the 1.1560 channel-support could keep restricting the pair’s immediate declines, breaking which 1.1490 and the 1.1445 might come-back on the chart. Given the Bears’ dominance after 1.1445 breaks, the 1.1380 and the 1.1335-30 may become their favorite numbers.

USD/JPY

USDJPY recently cleared the support-turned-horizontal-resistance but its recovery might find it hard to surpass the 113.30 TL figure, which if broken could open the door for the pair’s advance in a direction to the 113.70, the 114.00 and then the 114.45-50 consecutive resistances. If at all the pair sustains the 114.50 breakouts, chances of its rally to 115.00 can’t be denied. Alternatively, pair’s inability to extend present up-moves above 113.30 can drag it to 112.90 and then to the 112.65 support-levels. Moreover, in case of the quote’s decline beneath 112.65, the 112.25 and the 112.00 might become intermediate halts during its southward trajectory to 111.50-45 support-area.

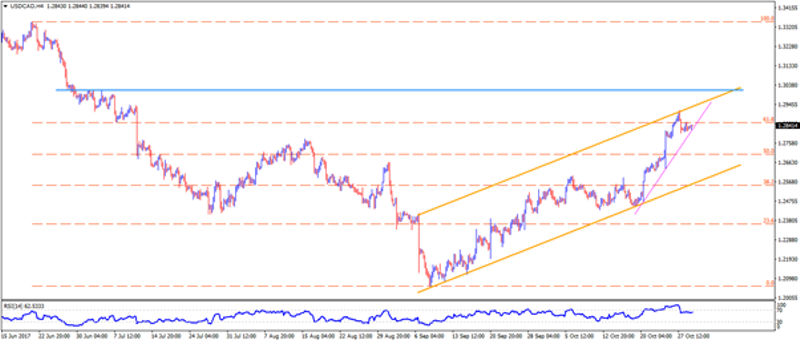

USD/CAD

Even if immediate ascending trend-line is likely to disturb the USDCAD’s current pullback, resistances-line of a short-term upward slanting channel, at 1.2940, might limit its advances, which if broken could further accelerate the north-run to 1.3015 horizontal-line and then to the 1.3040-55 resistance-zone. Should buyers manage to propel prices above 1.3055, the 1.3160 and the 1.3200 can be targeted. On the contrary, pair’s inability to respect the ascending TL support, at 1.2820 now, can activate its fresh downturn to 1.2780 and then to the 1.2700 round-figure ahead of aiming the 1.2660 support-mark. Given the increased downside momentum fetches the pair below 1.2660, the 1.2600 and the channel-support of 1.2550 becomes important to observe for traders.

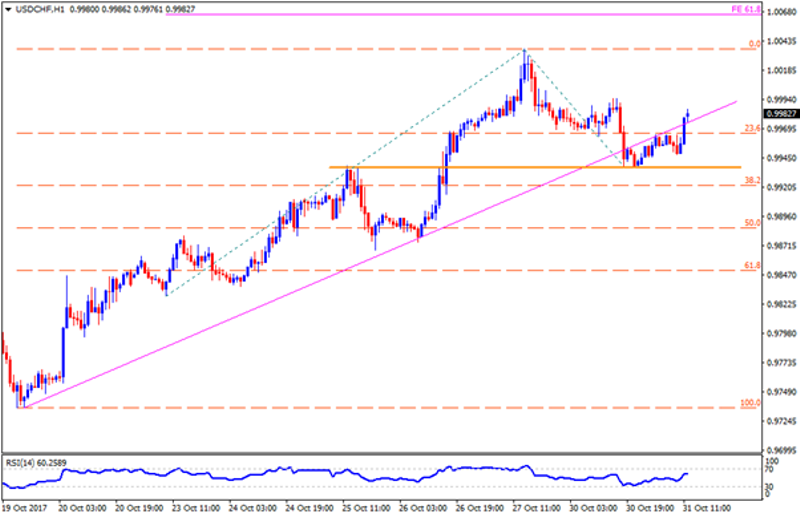

USD/CHF

While USDCHF’s latest uptick defied the BPC formation, the pair still needs to surpass the 1.0000 psychological magnets in order to aim for 1.0025 and the 1.0040 before rising towards 61.8% FE level of 1.0065. If Bulls continue fueling the pair beyond 1.0065, the 1.0110 and the 1.0165-70 may appear on the chart. In case of the pair’s failure to break the 1.0000 mark, the 0.9960 and the 0.9935 my try giving rests to it, breaking which 0.9890 and the 0.9875 could be considered as following supports. Further, pair’s extended south-run below 0.9875 may please sellers with the 0.9835, the 0.9810 and the 0.9775 supports.

Cheers and Safe Trading,

Anil Panchal

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance