Tech Stocks' Earnings Slated on May 10: SYMC, DBX & More

The earnings season that is well into the final phase, has proved to be one of the strongest in the past seven years with decent performance across the table. About 409 S&P 500 members have already released results till May 4. Total earnings for these companies are up 24% year over year on 9.3% higher revenues, with 78% beating earnings estimates and 75.6% surpassing top-line expectations. Based on the observed pattern, first-quarter 2018 is anticipated to register healthy double-digit percentage earnings growth on a year-over-year basis.

According to the latest Earnings Preview, technology is one of the six sectors predicted to report double-digit earnings growth in the to-be-reported quarter. Per the report, total earnings for the tech sector are projected to be up 28.5% on 12.6% higher revenues.

We note that the technology sector has been a robust performer over the past year. The sector has been benefiting from the increasing demand for cloud-based platforms, growing adoption of Artificial Intelligence (AI) solutions, Augmented/Virtual reality devices, autonomous cars, advanced driver-assisted systems (ADAS) and Internet of Things (IoT) related software.

Let’s find out what’s in store for the following technology stocks, all of which are slated to release quarterly figures on May 10.

Symantec Corporation SYMC is scheduled to report fourth-quarter fiscal 2018 results. Symantec’s continuous efforts to strengthen its product suite are likely to benefit its top line, given the surge in demand for cyber security-related products. Recently, the company announced that it is enhancing security for Microsoft’s Azure and Office 365 products. The stock carries a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%, which makes an earnings beat prediction difficult. Our proven model shows that stocks with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings estimates. Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

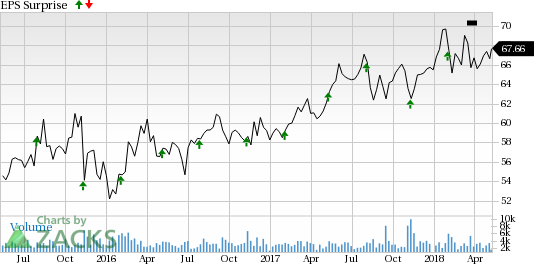

Symantec has a mixed earnings surprise history. In the trailing four quarters, the stock has surpassed the Zacks Consensus Estimate twice, matched it once and fell short of the same on one occasion. It delivered an average positive earnings surprise of 3.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

However, we remain slightly cautious about the company’s lower-than-expected revenues in the last reported quarter due to a faster-than-expected booking mix shift toward more “ratable revenue recognition.” This might impact financials in the soon-to-be-reported quarter. (Read more: What's in the Cards for Symantec in Q4 Earnings?)

Symantec Corporation Price and EPS Surprise

Symantec Corporation Price and EPS Surprise | Symantec Corporation Quote

Next up is Dropbox, Inc. DBX, which is set to report first-quarter 2018 results. The stock has a Zacks Rank #3 and an Earnings ESP of +8.33%, indicating a likely positive earnings surprise in the quarter to be reported.

The Zacks Consensus Estimate for the quarter under review is pegged at 40 cents, representing year-over-year growth of 42.86%. Additionally, analysts polled by Zacks project revenues of roughly $1.19 billion, up 7.07% from the year-ago quarter.

Another technology company, Amdocs Limited DOX, is scheduled to report fiscal second-quarter 2018 results. The Zacks Consensus Estimate for the company’s revenues and earnings is pegged at $980.6 million and 95 cents per share, respectively, indicating growth of 1.51% for revenues and an increase of 1.06% for earnings on a year-over-year basis.

Amdocs continues to expand its global client base by signing long-term contracts and collaborating with major telecommunication industry players worldwide. It recently completed the acquisition of Vubiquity, a leading provider of premium digital content services and technology solutions, to expand its footprint in the Media and Entertainment Business. The company has also inked a strategic agreement with Amazon Web Services to offer AmdocsONE on the cloud. We believe that product innovations and successful acquisition will act as a catalyst, going forward.

The stock carries a Zacks Rank #2 and an Earnings ESP of 0.00%, which does not indicate a likely positive earnings surprise in the to-be-reported quarter.

Amdocs Limited Price and EPS Surprise

Amdocs Limited Price and EPS Surprise | Amdocs Limited Quote

Yelp Inc. YELP is scheduled to report first-quarter 2018 results. The Zacks Consensus Estimate for the company’s revenues and earnings is pegged at $220.1 million and 16 cents per share, respectively, indicating growth of 11.56% for revenues and an increase of 366.7% for earnings on a year-over-year basis.

The stock has a Zacks Rank #3 and an Earnings ESP of +9.78%, which indicates a likely positive earnings surprise in the quarter to be reported.(Read more: Yelp Q1 Earnings: Will it Surpass Estimates Again?)

Yelp Inc. Price and EPS Surprise

Yelp Inc. Price and EPS Surprise | Yelp Inc. Quote

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yelp Inc. (YELP) : Free Stock Analysis Report

Amdocs Limited (DOX) : Free Stock Analysis Report

Symantec Corporation (SYMC) : Free Stock Analysis Report

DROPBOX INC-A (DBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance