Tech Innovation Could Change The Way You Pay For Everything

The FinTech revolution has done the unthinkable: It’s gone to war with time and distance, and it’s won.

Time and distance are no longer our masters. From anywhere, at any time we can order and pay for virtually anything with the click of a mobile phone button. We can even trade stocks, obtain home loans and access our banking services in seconds, and without unwanted human interaction.

Time is money, in more ways than one. In this revolution, the investor opportunities are vast, and it will be evolution that dictates who dominates this massive industry.

And the key to evolution is digital payment apps that focus on integration. Apps that focus equally on merchants and customers for maximum usage—and maximum revenue.

We’ve found that in GlancePay (CSE:GET; OTC:GLNNF) - the latest FinTech from a Vancouver entrepreneur who is gunning for a repeat of his earlier success, PayByPhone, a mobile parking payment system that took the market by storm before this was even a trend. It sold for $45 million, and Volkswagen now owns it.

If ‘FinTech’ is a word that isn’t yet in your vocabulary, it should be because companies in this industry are backed by legacy tech players who are raking in billions of investment. This year, global investment in FinTech will reach $150 billion, and the U.S. FinTech market alone is worth over $1 trillion.

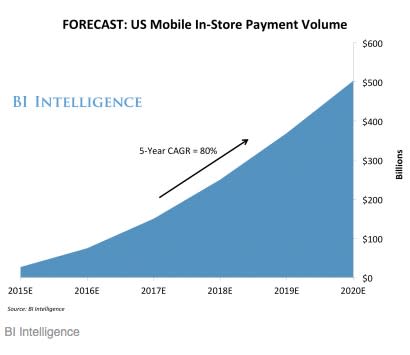

CAGR growth is expected to be anywhere from 36% to an unbelievable 80% by 2020, depending on whose statistics you use. Either way, it’s a market tremendous growth potential, cutthroat competition and amazing opportunities for early investors. But finding the next big thing in the form of a publicly traded company isn’t easy—some of the juiciest start-ups in this segment haven’t yet done their IPOs, but they’re in the billion-dollar club.

GlancePay by Glance Technologies Inc (CSE:GET; OTC:GLNNF), is the latest publicly traded opportunity, and it has the world’s only app that can simply take a glance at where you are... using proprietary and patent pending GPS / micro-location and image identification technology... and pay your merchant...in seconds.

It’s holistic, streamlined, and has the technology with patents pending to protect it that have kept major players from securing greater market share over the past few years.

Right now, it’s targeting the restaurant industry, which itself is worth over $500 billion in North America.

But that’s just the beginning.

With the launch of legalized marijuana for recreational use in Canada next July, GlancePay is already taking advantage of the mobile payment opportunities in this space that could be worth $22.6 billion annually.

And it’s also planning to integrate hotter-than-hot digital currencies like Bitcoin, Litecoin and Ethereum into its system.

The company is forward thinking, with light-speed momentum.

Desmond Griffin, the founder of the wildly successful PayByPhone, has long been one of the heaviest trendspotters in FinTech. In the past, he’s spotted trends before they were even trends, creating attractive acquisition targets.

With GlancePay, he’s looking to do the same, only bigger. For restaurants, mobile pay apps mean faster table turnover, and bigger revenues.

In the age of convenience, where time and distance become increasingly irrelevant, GlancePay is in front of the mobile payment app evolution. It’s spotted what existing offerings lack: integration and a much bigger picture.

Unlike all those startups whose stock investors can’t get their hands on yet, Glance Pay is publicly traded, and it’s already the #1 ranked mobile full service restaurant payment app in Canada—accounting for 92% of all mobile full service restaurant payment app downloads in Canada—and it’s hungrily eyeing all of North America, where it already accounts for 37% of all mobile full service restaurant payment app downloads.

Here are 5 reasons to keep a close eye on GlancePay (CSE:GET; OTC:GLNNF)

#1 The New Generation of Mobile Payments

GlancePay is a streamlined payment platform that allows customers to pay their bill instantly with their mobile device. It means no more waiting on waitresses; no more credit card machines; and a single app rather than one for each restaurant.

The app knows where you are using patent pending GPS / micro-location technology. And, if GPS isn’t available, it can even determine your location using a photo of where you are. Much like Google has mapped the world... GlancePay has quietly built a proprietary database of locations around the world.

It’s as easy as point, shoot, pay.

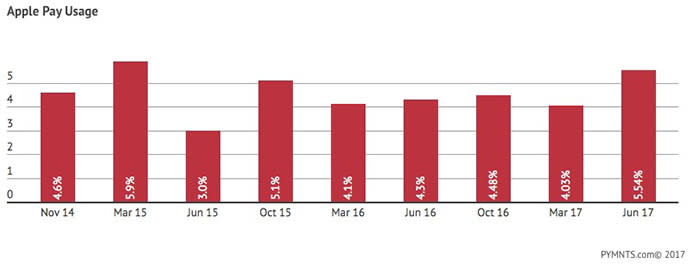

But it is also much more. It takes the mobile pay app experience much farther than Apple Pay, which only iPhone owners can use, and which has failed so far to gain widespread usage.

With GlancePay, you’re not just paying a bill: The system includes in-app marketing, in-store rewards, transaction history, payment confirmation, and even the ability to split the tab in a restaurant. It incentivizes users... and adoption is growing from this network effect.

It also helps you choose nearby restaurants, and soon, it will also let you order from your table, pre-order for pickup, or order for delivery.

For restaurants, it means better business, faster turnaround and potentially greater revenues.

The company estimates that restaurants will benefit from 10% faster table turnover during peak periods, improved server productivity, which should be bigger tips, and a loyalty/rewards program that could encourage customer returns and even attract new customers. The built-in feedback program also adds to the big-picture offering here, by giving restaurants a faster, easier way to earn reviews and ratings.

Bottom line: This isn’t just about making a payment with one click, it’s about streamlining the entire customer experience with a single app—from finding, ordering and paying, to rewards and reviews. And their plans to integrate multiple payment channels from Bitcoin to Litecoin and Ethereum will revolutionize the mobile payment industry.

#2 A Trillion-Dollar Market in the U.S. Alone

FinTech has taken the banking, payment services, digital currencies, investing and insurance industries by storm. That’s why Fintech funding hit $19 billion in 2015—with massive growth sped up by legacy players and their tech partners sitting on the cutting edge of business ideas and major first-mover advantage.

In the first half of this year, FinTech companies in the U.S. raised $3.5 billion, according to KPMG. Investors pounced on this scene in droves. And in the U.S. alone, there are more than a dozen Fintech heavyweights with valuations over $1 billion.

According to the annual FinTech Report from PwC, cumulative investment globally will exceed $150 billion in 2017.

As of this year, transaction value in the U.S. FinTech market alone is over $1 trillion. And the largest segment of this market is ‘digital payments’, which did nearly $740 billion in transactions so far this year.

In a global market that is poised for impressive CAGR growth, it pays to understand what consumers and vendors want.

Consider these statistics and future market estimates:

For GlancePay (CSE:GET; OTC:GLNNF), these statistics are the foundation of a major breakout in the North American restaurant segment, both full service and quick serve.

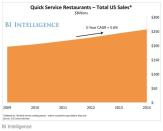

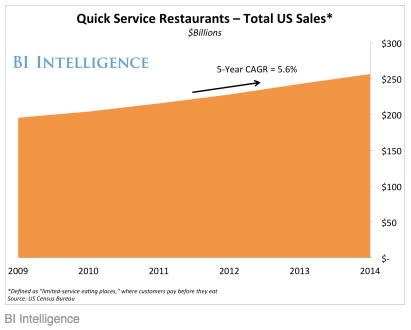

According to BI Intelligence, quick-service restaurants are increasingly offering mobile order-ahead apps as a way to drive higher revenues.

In 2015, the full-service restaurant industry in North America was worth $286 billion, while the quick service restaurant industry was worth over $230 billion. This is the market GlancePay is targeting, and it’s growing market share at an impressive rate.

#3 The #1 Payment App in Canada, Closing in on 40% North American Market Share

The app only launched in September 2016, and already it has 230 signed locations. That’s just the beginning: There are over 5,000 restaurants in the Metro Vancouver area alone, and GlancePay’s is planning to corner the market.

It has first-mover advantage in Western Canada, where there are only one or two platforms that will be able to build sufficient networks in any region.

GlancePay (CSE:GET; OTC:GLNNF) is already the No. 1 mobile full service restaurant payment app in Canada, ranking at over 92% of mobile pay app downloads. It’s also making big waves across North America, where it ranks 37% of all full service restaurant mobile pay app downloads.

As of August 2017, over 18,000 users were making mobile payments with GlancePay.

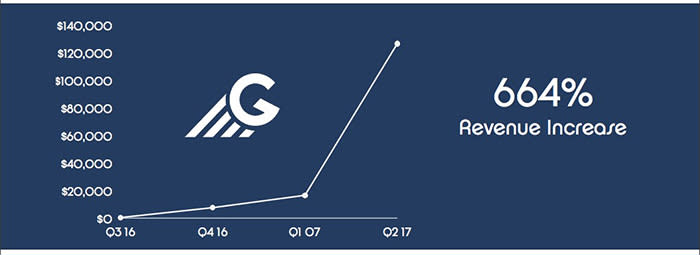

And revenues have spiked over 664% since it launched.

GlancePay seems to be way ahead of this game, but it’s done this before, so we’re not surprised.

All of the tech is proprietary, and several patent applications have already been filed, including for picture information and micro-location servicing. It’s all tech that can be applied outside of restaurants because GlancePay is unusually forward-thinking: It’s already tapping into the raging cannabis market, and is developing an in for the cryptocurrency market.

Deloitte estimates this legal recreational use marijuana industry could be worth a whopping $22.6 billion annually. In other words, more than the combined sales of beer, wine and spirits—all of which GlancePay is eyeing for mobile pay market share.

And it’s doing it all with unmatched anti-fraud protection—one of the biggest challenges facing this tech segment. Right now, the company says the launch of its anti-fraud technology over 7 months ago, it’s reported 0% fraud.

Its in-app marketing is also a disruptive addition to this space. Merchants can do location-based targeted communication, with digital receipts offering advertising opportunities. And they only need an hour to get up and running with GlancePay.

And revenue streams are locked and loaded. These are all the ways GlancePay can earn, now and in the future:

#4 Cut-Throat Competition—No Problem: GlancePay Casts Its Net Wider

So, this is a brilliant market with massive growth potential—but its future is still up for grabs, and that’s precisely because it hasn’t been holistic enough.

Only 14% of Android/Samsung users ever use Android or Samsung Pay. And Apple Pay has spent three years and a ton on money on promotion and still can’t get past 6% usage.

It’s the holistic approach that’s lacking, and this is why only Walmart Pay has broken the ceiling.

Since March, the first-time use of Walmart Pay increased by 31.7 percent to 19.1 percent of respondents. That’s because everything is integrated, streamlined, and lets you do more than just pay. Walmart Pay authenticates users before checking out, allows them to use coupons, promos, rewards, gift card balances and a number of other options prior to paying. It also lets you order ahead for groceries and pick them up at the curb, and even has financial services.

GlancePay (CSE:GET; OTC:GLNNF) offers a similar portfolio of value-added solutions, which make it stand out—like Walmart Pay—in a market that the first round of giant apps hasn’t gotten wrong.

GlancePay has positioned itself right between two giants, on two continents—in terms of technology:

In the US space, we have Square, which is enjoying a stellar stock price run. Square is now worth nearly $10 billion. But it has more of a merchant focus and requires hardware that is attached to your phone.

And then in China—the biggest mobile pay app market in the world—we have the behemoth, Alipay, which allows the user to initiate a payment to a merchant. And while Alipay is doing $1.7 trillion in business annually, it isn’t publicly traded.

GlancePay is eyeing the gap between these two offerings. A sort of Alipay for North America: The easy payment process that has taken China by storm, but with more of a merchant focus like Square—minus the burdensome hardware, which is more conducive to fraud.

It’s filling the gap where Alipay and Square left off—it’s doing what Groupon does as well. You can buy deals and receive digital coupons, but it’s smart. It knows where you are and what you like, so deals are relevant to the customer.

This gap GlancePay is seeking to fill is a lucrative one, and we believe it’s moving quickly towards its end goal.

#5 Pre-Trend Spotters Who Create Attractive Acquisition Targets

Desmond Griffin, the co-founder of GlancePay, and the mastermind of Glance Technologies (CSE:GET; OTC:GLNNF), is a household name in Vancouver, where he’s known for turning everyday problems and inconveniences into attractive takeover targets.

Griffin built PayByPhone from concept to a wildly successful mobile app for parking payments, servicing millions of customers in over 100 cities around the world. Then he sold it for nearly $45 million and it is currently owned by Volkswagen, which need a new stream of revenue and a distraction from its emissions scandal.

He has every intention of doing the same with GlancePay, but this time the market is many times bigger, and we believe the takeover potential much more attractive. We’re not just talking about parking anymore—we’re talking hundreds of thousands of restaurants, an explosive new cannabis market, and cryptocurrencies.

That’s why he’s teamed up with Penny Green, GlancePay president and co-founder, and one of PROFIT magazine’s W100 list of top Canadian female entrepreneurs. She was also at the head of one of the PROFIT 500 fastest-growing companies, Bacchus Law Corporation, in 2015 and 2016, and she knows how to create shareholder value. Additionally, she was the co-founder and director of Merus Labs International Inc. (TSX:MSL; NASDAQ:MSLI), a specialty pharmaceutical company that secured some $32 million in annual EBITDA.

The Bottom Line:

GlancePay (CSE:GET; OTC:GLNNF) appears to be on the cutting edge of everything that is happening in FinTech. It’s doing things PayPal can’t, and ultimately, there are very few competitors in this space, unless you combine Alipay, Square and Groupon into a single entity.

As FinTech bursts at the seams with innovation, GlancePay has already taken Canada, and now it’s preparing to take North America with an easy-to-use, simple solution.

When you consider that GlancePay only launched in late 2016 and already claims the top spot among Canada’s mobile payment apps, and is closing in on major North American market share right out of the starting blocks, we’re expecting this FinTech company to be a leader in the fast-paced evolution.

And when it opens up its digital wallet to legalized recreational cannabis and digital currencies … well, convenience might have a new name.

Honorable Mentions:

Information Services Corp. (TSE:ISV ): Information Services Corporation is a full-service provider of registry and information services and solutions to governments and private sector organizations. The Company’s segments include Registries and Services. Information Services Corp. has a steady market cap and should fare well as Canada’s economy is recovering.

VIQ Solutions Inc (TSX:VQS.V): is the leading technology and service platform provider for digital evidence capture and content management. VIQ operates worldwide with partners like security integrators, audio-video specialists, and hardware and data storage suppliers.

CGI Group Inc (TSE:GIB.A): This IT giant is sure to be one of the most informed companies in the market when it comes to cyber security, with years of experience. As the security market grows, CGI group is sure to benefit, offering its services to an increasingly broad set of customers. With very limited downside investors are sure to be interested.

Open Text Corp (TSE:OTEX): Open Text Corporation provides a platform of software products and services helping businesses find, locate, and share secure information from any device. As with any company dealing with information, Open Text Corporation security is a priority.

Computer Modelling Group Ltd. (TSE:CMG): Computer Modelling Group is a software technology company producing reservoir simulation software for oil and gas companies. Computer Modeling Group LTD. Is a tempting trade for investors as it brings together two essential industries - tech and resources- which are going anywhere any time soon. Especially as the need for security grows, a tech company involved in the oil and gas industry has an incredible opportunity to offer other services.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Yahoo Finance

Yahoo Finance