Tech Breakthrough To Clean Up Oil’s Dirty Image

The jury is in on global oil dominance: The U.S. is poised to become the definitive leader, driven by unparalleled technological advances that could lead to growth of 8 million barrels a day by 2025.

The judge is the International Energy Agency (IEA), and the ruling is clear: The U.S. oil boom was just getting started with fracking. The next phase is phenomenally high-tech, and should turn the U.S. into a net exporter of fossil fuels.

And the tech doesn’t get much higher than a breakthrough that can take the ‘dirty’ out of the oil sands production process and unlock trillions of barrels trapped in the sands in Utah, Colorado and Wyoming.

But that’s just where the dominance starts: The tech may be licensed globally where countless trillions of barrels of oil are waiting to be tapped into without leaving behind a toxic tragedy everywhere from Canada and Venezuela to Kazakhstan, Nigeria and Angola—as well as a handful of high-profile venues in between.

The technology is proprietary and patented, and it is expected to produce oil at around $22 per barrel, leaving clean, dry sands and without using all the water that is crucial to dry states.

The company behind it is Petroteq Energy Inc. (TSX:PQE.V; OTCQX:PQEFF), and it’s where North American oil gets another advancement which could form the backbone for Phase II of the oil boom.

And beyond market-defying $$22 oil production costs, and technology that renders dirty oil sands production clean, the upside in rising oil prices, increased heavy oil demand and global licensing opportunities ring loudly with people who are paying attention.

Here 5 reasons to keep a close eye on Petroteq Energy Inc. (TSX:PQE.V; OTCQX:PQEFF),

#1 The Key to Trillions of Untapped Barrels of Oil

Petroteq already has a significant claim to fame: Its patented oil extraction technology is the first ever to generate sales from Utah’s massive heavy oil resource.

Existing oil sands extraction technologies use tons of water and leaves behind toxic trailing ponds. Petroteq’s system produces oil and leaves behind nothing but clean, dry sand that can be resold as fracking sand or construction sand or simply returned to Mother Nature.

In tests to date, it extracts over 99% of all hydrocarbons in the sand, generates zero greenhouse gases and doesn’t require high temperatures or pressures.

For Utah’s 32 billion barrels, this tech is the Holy Grail.

This is how it works:

The end result? The extracted crude oil is free of sand and solvents and then pumped out of the system into a storage tank.

The only other place that has oil sands tech is Canada, and it doesn’t compete. It’s designed for wet oil sands and Petroteq is after the dry oil sands bonanza.

“The wet tech kills the environment,” says Petroteq Chairman and CEO Aleksandr Blyumkin, “but we use green additives that allows the sand to be removed in a very clean manner. No other company has what we have in this space.”

Technology like Petroteq’s can help make American oil for Americans at a time when energy dependence is as important to the national interest as security and diplomacy.

#2 New Production by February, 2018 at Market-Defying $$22 per Barrel Production Costs

Utah, Colorado and Wyoming represent over 1.2 trillion barrels of oil equivalent in oils sands and shale, and Petroteq is uniquely positioned to use its proprietary tech to tap into this resource and contribute to the U.S. energy independence equation in a significant way.

Utah alone is home to more than half of all U.S. oil sands deposits, and the Unitah region has been producing oil since the 1950s. It’s got more than 32 billion barrels of oil sands waiting to be extracted from 8 major deposits. It’s also got fantastic infrastructure, with 5 major refiners with truck routes to Salt Lake City, and a royalties set-up that makes great sense for operators.

And it’s right here—in Asphalt Ridge—that Petroteq has 87 million barrels of oil equivalent.

(Source: Petroteq)

Even better, this is heavy oil-producing oil sands that can be accessed directly from the surface, so there’s no risk of running into a ‘dry well’.

Better still, costs to produce are expected to come in at only $22 a barrel.

With one plant, Petroteq says it’s potential is $10 million a year in profit with $20-$30 per barrel production costs at today’s oil prices.

They acquired Asphalt Ridge for $10 million, and they’ve already proved that they can extract the oil from the sands and the shale. Permits to produce are already in place, and 10,000 barrels were produced in 2015.

Now the modular plant has been moved even closer to oil resources and is being reassembled. New production will launch in early 2018, and the goal is 5,000 bpd in 2019 at a cost of production of as low as $18 per barrel. And there’s potential, says Petroteq, to achieve 30,000 bopd with proven reserves.

Demand is expected to be voracious with oil that comes in at a $20 discount to WTI. And that’s just the oil from a single plant: This story gets much bigger if you read on…

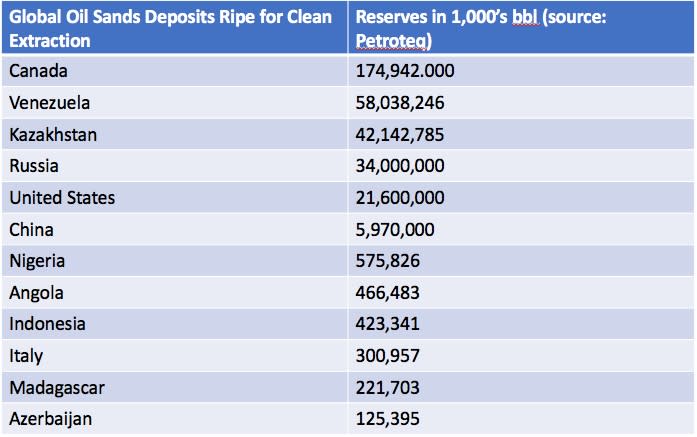

#3 Global Licensing Opportunity with 12 Hot Oil Sands Countries

Oil sands has long been sidelined because it’s dirty. So, proprietary technology that can extract oil sands without leaving behind toxic trailing ponds is highly sought after.

This is far from a simple story about another small-cap oil producer. Petroteq’s technology could generate millions in licensing fees around the world, and it is eyeing the opportunity to file patents in all countries with oil sands reserves.

This technology is aimed to be deployed to cleanly unlock oil resources representing hundreds of millions of barrels of oil around the world. Licensing is a revenue stream that can flow to Petroteq with no associated capital expenditure.

Worldwide, the licensing opportunities are vast, with over 12 countries home to major oil sands deposits.

Fortunes can be built on licensing fees, and Petroteq could have this segment cornered.

There’s even more upside beyond global licensing: Petroteq’s technology can be used for remediation, cleaning the tailing ponds created by traditional extraction methods for oil sands.

#4 Petroteq Thinks Big Picture with Blockchain Deal

Petroteq tech visionaries won’t be left out of anything. That’s why they’re also moving fast on the hottest industry the world has seen in a century: Blockchain technology, the backbone of cryptocurrency, and soon it could be the backbone of energy trading.

There is no industry that will remain untouched by the Blockchain revolution, and energy is no exception. It could make oil and gas trading phenomenally easier, and supermajors like Shell, BP and Statoil are hot on its trail.

Blockchain will make energy trading efficient and transparent, and it will save oil and gas companies money in the process, so Petroteq is poising itself as one of the earliest energy entrants on this revolutionary playing field.

The company is in the process of signing an agreement with First Bitcoin Capital, which specializes in crypto currency and Blockchain development. The visionary small-cap will be licensing the blockchain built by IBM and will use this to make it industry-specific, giving the entire spectrum of oil—from upstream to downstream—access to massive data.

The product is expected to be finished in 6 months, and when it’s unleashed it is intended to be a free, open-source Blockchain for massive oil trading data.

Petroteq’s masterminds have already been busy courting major energy players on multiple continents to get involved.

Bitcoin might be worth over $7,000 per coin, but the real cryptocurrency is data—and this could be a gold mine for the energy industry.

#5 Visionary Team with Impeccable Timing

This management team is savvy and forward-thinking. That’s why it sees the opportunity not only in producing the first clean production process for oil sands, but also in licensing its proprietary tech worldwide, and embracing the even bigger picture—blockchain.

And Petroteq is hoping to position itself as a sort of “Google” of the energy industry, at a time when oil prices are on the upswing and demand for heavy oil is set to rise.

When the Saudi Crown Prince arrested key members of the royal family on corruption charges last week—all of them his rivals--oil shot up. West Texas Intermediate (WTI) spiked more than $2 a barrel, closing around $57 a barrel—a nearly two-year high.

And prices could be kept higher by military action in the Middle East, the Kurdish independence drive and the specter of more U.S. sanctions on Iran, says Barrons. And Goldman Sach’s says near-term sentiment should remain bullish.

It’s a good time for heavy oil, too. Billions of dollars will be deployed to rebuild U.S. infrastructure and it requires exactly the kind of heavy oil that Petroteq is scheduled to start producing again in February, 2018.

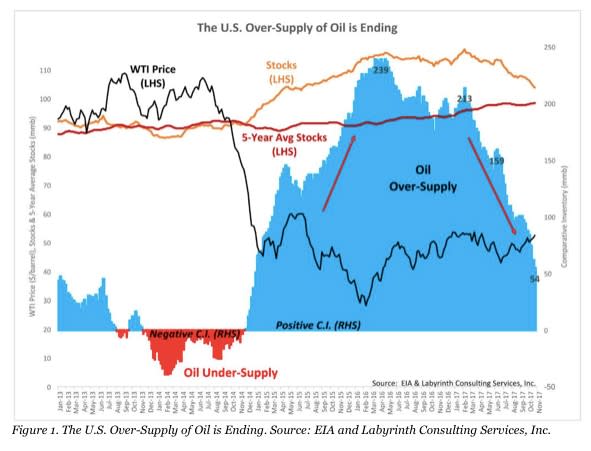

The U.S. over-supply of oil is ending, according to Forbes.

U.S. production growth has focused on light oil, and heavy oil is in strong demand, particularly on the Gulf Coast, where the billions of dollars put into heavy oil refineries means it needs a lot of oil to feed them. The discount for heavy oil is disappearing.

That’s why Petroteq Chairman and CEO Aleksandr Blyumkin is pumping millions of dollars into his company, including an interest-free loan to expand production at its Temple Mountain, Utah, facility.

It’s a superbly timed vision backed by an oil extraction tech genius, Dr. Vladimir Podlipskiy—a UCLA chemical scientist with a slew of patents behind him. The team also features another technology giant, President Dr. R. Gerald Bailey, a former Exxon president of Arabian Gulf operations.

Add to this the company’s Blockchain genius, Chief Geologist Donald Clark, PhD, and you have the brains behind a dual-sector hit that not only plans to produce the world’s first clean oil sands for the lowest costs around, but also plans to make it big with global technology licensing, and a Blockchain system that will change oil and gas trading forever.

By February 2018, when production is expected to resume from the relocation of their modular facility, Petroteq may be in the investor spotlight. And when Blockchain technology related to oil data is unleashed in about six months, it may change again. When this breakthrough tech starts licensing globally, it will be a great day for Petroteq and its shareholders.

Honorable Mentions:

Cenovus Energy (TSX:CVE): This is one of the most actively traded stocks on the TSX, and it’s been trending up for the second half of this year. The recent sell off represents a great opportunity for investors looking to buy the dip in a stock that climbed over $6 earlier in the year.

The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

Imperial Oil (TSX:IMO): Imperial oil could be one of the best contrarian bets in the oil markets for 2018, having missed its third quarter profit estimates and currently dealing with the resultant stock decline. It still has some of the lowest cost producing oil sands in Canada and that is going to pay off as oil prices continue to rise and new tech breakthroughs bring breakeven prices even lower.

The management is well known for being conservative, but that certainly shouldn’t put investors off in a time when recovery is the buzzword of the day and consistency is sure to be rewarded.

Crescent Point Energy Corp. (TSX:CPG): CPG is particularly attractive for the dividend that investors can expect back, but it is also now worth looking at for returning value in the coming months.

The recent fall in stock price provides investors with a great entry point for a company with a positive outlook in a market that is set to grow. The collapse in price over the last year appears to have stopped, with some great growth in late October and early November. This oil and gas company provides exposure in both the Canadian and U.S. markets.

MEG Energy Corp (TSX:MEG): is a Canada-based oil producer which operates primarily in Northern Alberta’s oil sands. The forward-thinking company uses steam-assisted gravity drainage to retrieve oil from the deep wells which it drills. The excess heat and electricity produced from this process is then sold to Alberta’s power grid.

The company’s large proven resources and their cutting-edge technology make MEG a promising company for investors looking to get in to the promising oil sands in Alberta.

Tourmaline Oil Corp (TSX:TOU) is another Canadian resource producer focusing on exploration, production, development and acquisition within Western Canadian Sedimentary Basin. The company is in possession of an extensive undeveloped land position with long-term growth opportunities and a large multi-year drilling inventory.

Tourmaline’s strong leadership make the company a promising pick for investors looking to take advantage of the tremendous Canadian oil opportunities which are due for a strong rebound as oil prices inch higher.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that PETROTEQ will be able to produce oil as currently scheduled and at the targeted low prices from its Utah property; that oil at cheaper prices will be as much in demand in future as currently expected; that PETROTEQ will obtain operating permits on its properties; that the oil when produced by PETROTEQ will be high quality suitable for standard use; that PETROTEQ’s technology is protected by patents and that it doesn’t infringe on intellectual property rights of others; that PETROTEQ will find licensees for its technology and that it can patent its technology in many countries; that PETROTEQ’s technology will work as well as expected; that blockchain technology will help PETROTEQ achieve its goals; and that PETROTEQ will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company’s patents and other technology protection are not valid, patents may not be granted in countries where PETROTEQ wants to license its technology; it may not get regulatory approval for its operations, aspects or all of the properties’ development may not be successful, production of oil may not be cost effective as expected, PETROTEQ may not raise sufficient funds to carry out its plans, changing costs for extraction and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; blockchain technology may not be developed to assist PETROTEQ achieve its goals; additional high value oil opportunities may not be available for PETROTEQ to acquire, or PETROTEQ may not be able to afford them; competitors may offer better technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the oil cannot be economically produced on its properties, or that the required permits to build and operate the envisaged facilities cannot be obtained. Currently, PETROTEQ has no revenues. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by PETROTEQ sixty two thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by PETROTEQ to conduct investor awareness advertising and marketing for TSXV:PQE and OTCQX:PQEFF. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.

Yahoo Finance

Yahoo Finance