TD SYNNEX's (SNX) Tech Data to Offer Simplifai AI Solutions

TD SYNNEX’s SNX wholly owned subsidiary, Tech Data, recently announced that it has entered into a strategic partnership with an AI (artificial intelligence) solutions expert – Simplifai. Headquartered in Oslo, Norway, Simplifai creates customizable digital transformation solutions that allow businesses to leverage the power of AI to streamline and automate their work processes.

As part of the agreement, Tech Data will offer Simplifai’s state-of-the-art automation solutions across the Asia Pacific and Japan. The deal also includes the distribution of Simplifai’s innovative all-in-one platform for intelligent process automation, Simplifai Studio.

The Simplifai Studio solution is a user-friendly AI platform that helps businesses automate their work processes with ease and enhance their daily work operations in their existing systems. The AI solution can configure and train a company’s own bots without coding and with minimal effort, thereby improving work productivity in just a few weeks. Tech Data revealed that Simplifai’s solutions will be currently available in Singapore, Malaysia and India.

With the latest expanded collaboration, Tech Data’s parent company, TD SYNNEX, will be able to empower its distribution partners and Independent Software Vendors (ISVs) to drive new businesses and further their channel capabilities across the APJ region.

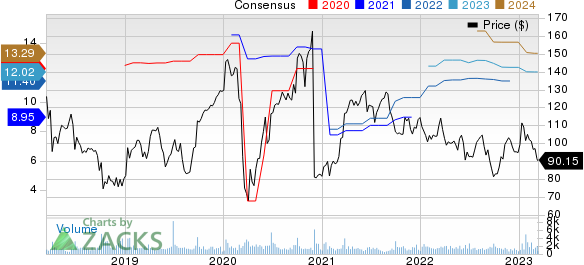

TD SYNNEX Corp. Price and Consensus

TD SYNNEX Corp. price-consensus-chart | TD SYNNEX Corp. Quote

TD SYNNEX’s sustained focus on partnerships with other tech companies is helping it enhance its product portfolio and expand its global footprint.

In January 2023, the company unlocked a Microsoft MSFT Azure integrated fraud defense solution designed for customers from small and medium businesses (SMBs) amid growing cyber threat vulnerabilities. The newly released fraud defense Click-to-Run solution raises security postures and lowers potential risks in daily cloud operations via phishing prevention, proactive alerts, warning signals and more. It enables a multi-layer defense against unprecedented security risks within cloud environments.

Incorporating Microsoft Azure Active Directory, TD SYNNEX’s SMB solution enables small and medium-sized businesses to enforce Conditional Access policies, aiding organizations to enhance the way users control access to corporate resources. Microsoft’s Azure Active Directory, part of Microsoft Entra, is an enterprise identity service that provides single sign-on, multifactor authentication and conditional access to guard against 99.9% of cybersecurity attacks. SNX’s pre-configured solution further allows organizations to exploit Azure's built-in cost management features.

In December 2022, SNX strengthened its collaboration with Alphabet Inc. GOOGL by expanding its cloud solution portfolio with the Alphabet’s Google Cloud offering in nearly 60 nations in Latin American, European and Asian regions.

Per the agreement, TD SYNNEX enables enterprise customers from 60 additional global markets, including Brazil, Mexico, Argentina and Uruguay, to gain access to its cloud experts and solution portfolio incorporated with Google Cloud’s capabilities in artificial intelligence, machine learning, data analytics, infrastructure, collaboration and many more things. This allows the business partners to generate positive business outcomes in the cloud market.

In October, TD SYNNEX subsidiary, Tech Data, expanded its strategic partnership with the leading endpoint backup, protection and security solutions provider, Cibecs. With this move, SNX intends to distribute Cibecs Endpoint Cloud, which offers best-in-class data protection with intelligent management capabilities, to customers in six markets across the Asia Pacific & Japan region, including Hong Kong, India, Indonesia, Malaysia, Singapore and Vietnam.

Prior to that, in August, TD SYNNEX partnered with the California-based spatial data company, Matterport Inc. MTTR, to help boost its presence in the North American market. A large network of 150,000 resellers of TD SYNNEX provides Matterport’s industry-leading technology to a huge customer base, including new enterprises, small & medium business customers and public agencies.

The abovementioned deal allows MTTR to gain a stronghold in the North American property market of approximately 1 billion spaces, enabling SNX clients to optimize operations through integration with Matterport’s platform.

Currently, TD SYNNEX, Microsoft, Alphabet and Matterport each carry a Zacks Rank #3 (Hold). Shares of SNX, MSFT, GOOGL, and MTTR have plunged 17.3%, 11.6%, 29.3% and 61.8%, respectively.

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

TD SYNNEX Corp. (SNX) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Matterport, Inc. (MTTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance