Target Hospitality (NASDAQ:TH) Delivers Impressive Q1, Provides Encouraging Full-Year Guidance

Workforce housing company Target Hospitality (NASDAQ:TH) reported Q1 CY2024 results topping analysts' expectations , with revenue down 27.8% year on year to $106.7 million. The company's full-year revenue guidance of $417.5 million at the midpoint also came in slightly above analysts' estimates. It made a GAAP profit of $0.20 per share, down from its profit of $0.38 per share in the same quarter last year.

Is now the time to buy Target Hospitality? Find out in our full research report.

Target Hospitality (TH) Q1 CY2024 Highlights:

Revenue: $106.7 million vs analyst estimates of $102 million (4.6% beat)

EPS: $0.20 vs analyst estimates of $0.15 (36.4% beat)

The company reconfirmed its revenue guidance for the full year of $417.5 million at the midpoint

Gross Margin (GAAP): 46%, down from 55.4% in the same quarter last year

Free Cash Flow of $50.46 million, up 62% from the previous quarter

Utilized Beds: 14,049

Market Capitalization: $1.11 billion

"Our first quarter results reflect the strength of our operating platform and network capabilities, which consistently support strong financial performance. We continue to focus on maximizing operational efficiencies, while simultaneously providing world-class solutions to our customers," stated Brad Archer, President and Chief Executive Officer.

Essentially a builder of mini communities, Target Hospitality (NASDAQ:TH) is a provider of specialty workforce lodging accommodations and services.

Hotels, Resorts and Cruise Lines

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Sales Growth

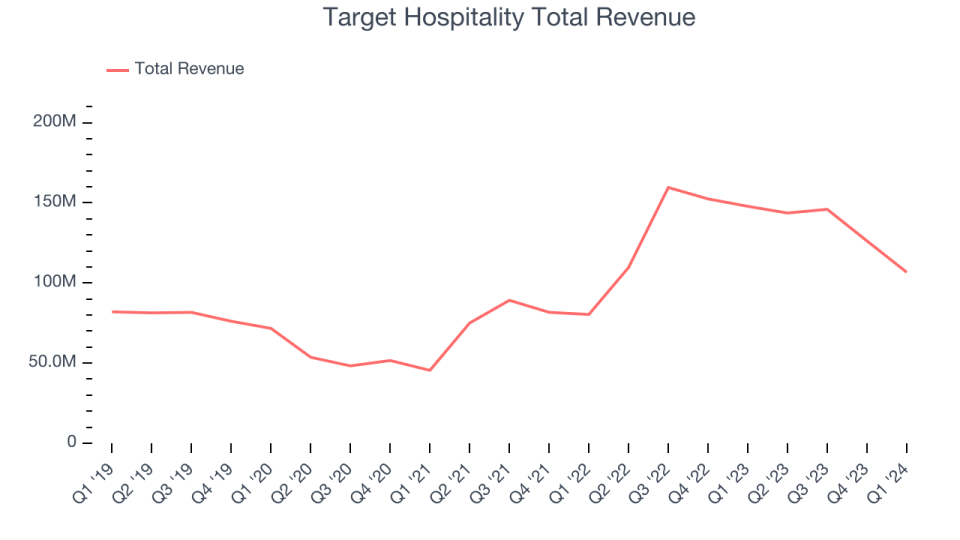

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Target Hospitality's annualized revenue growth rate of 13% over the last five years was mediocre for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new property or emerging trend. That's why we also follow short-term performance. Target Hospitality's annualized revenue growth of 26.6% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Target Hospitality's revenue fell 27.8% year on year to $106.7 million but beat Wall Street's estimates by 4.6%.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Over the last two years, Target Hospitality has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in the consumer discretionary sector, averaging 31.6%.

Target Hospitality's free cash flow came in at $50.46 million in Q1, equivalent to a 47.3% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter.

Key Takeaways from Target Hospitality's Q1 Results

We were impressed by how significantly Target Hospitality blew past analysts' EPS estimates this quarter, driven by its better-than-expected operating margin. The company's full-year revenue and EBITDA guidance also beat Wall Street's projections. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 3.5% after reporting and currently trades at $11.5 per share.

Target Hospitality may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance