T. Rowe Price (TROW) Q4 Earnings Surpass, Revenues Rise

T. Rowe Price TROW delivered fourth-quarter 2021 adjusted earnings per share of $3.17, which outpaced the Zacks Consensus Estimate of $3.07. The reported figure also climbed 9.7% year over year.

Results were driven by higher revenues, backed by an upsurge in investment advisory fees and administrative, distribution and servicing fees. Also, assets under management (AUM) improved. However, escalating expenses were an undermining factor.

Including certain non-recurring items, net income was $740.6 million or $3.18 per share compared with the $783.4 million or $3.33 per share recorded in the prior-year quarter.

For 2021, T. Rowe Price reported an adjusted net income of $2.99 billion or $12.75 per share, comparing favorably with the year-ago income of $2.23 billion or $9.58. The bottom line also beat the Zacks Consensus Estimate of $12.68 per share.

Revenues Improve, Expenses Rise

Net revenues in the fourth quarter increased 13.2% to $1.96 billion from the year-ago quarter’s figure. This upswing primarily resulted from higher investment advisory, and administrative, distribution and servicing fees. The reported figure also surpassed the Zacks Consensus Estimate of $1.97 billion.

Revenues for the full year came in at $7.67 billion, surpassing the Zacks Consensus Estimate of $7.65 billion. Revenues also increased 23.6% year over year.

Investment advisory fees climbed 13% year over year to $1.81 billion. Additionally, administrative, distribution and servicing fees rose 16.3% to $152 million.

Investment advisory revenues earned from T. Rowe Price mutual funds distributed in the United States were up 11.4% year over year to $1.1 billion. Investment advisory revenues earned from other investment portfolios managed by TROW increased 15.5% from the prior-year quarter’s level to 694 million.

Total adjusted operating expenses flared up 14.7% year over year to $1.04 billion in the reported quarter. Including certain one-time items, expenses came in at $1.09 billion, up 12.5%. Rise in compensation costs and distribution, servicing costs induced this increase.

Moreover, as FIS began providing technology development and core operations on Aug 1, 2021, the firm incurred higher costs for recordkeeping, technology development, associate transition and core operations, partially offset by a lower compensation expense related to nearly 800 associates who transitioned to FIS in August 2021.

As of Dec 31, 2021, T. Rowe Price employed 7,529 associates, down 1.9% from the prior-year level.

Assets Grow, Liquidity Position Strengthens

As of Dec 31, 2021, total AUM rose 14.8% year over year to $1.69 trillion. During the December quarter, net market appreciation and gains were $57.3 billion while net cash outflow was $22.7 billion after client transfers.

T. Rowe Price has substantial liquidity including cash and cash investments of $4.26 billion as of Dec 31, 2021. This will enable TROW to keep investing.

Capital-Deployment Activity

During the reported quarter, T. Rowe Price repurchased 3.1 million shares of its common stock.

Our Viewpoint

T. Rowe Price put up an impressive show during the December quarter on stellar revenues.

TROW has the potential to benefit from growth in domestic and global AUM even though higher operating expenses unfavorably impacted it and the pandemic-induced economic uncertainty is a major concern. Although the bank used $2.5 billion of cash to fund part of the acquisition of OHA, its balance sheet remains strong with more than $2 billion worth of cash and discretionary investments as of 2021 end.

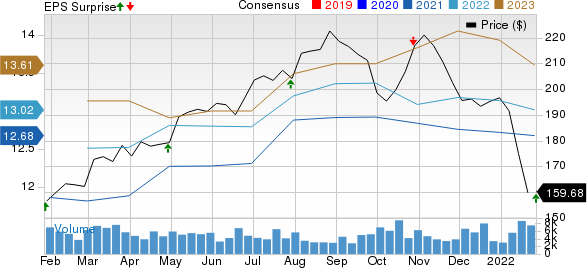

T. Rowe Price Group, Inc. Price, Consensus and EPS Surprise

T. Rowe Price Group, Inc. price-consensus-eps-surprise-chart | T. Rowe Price Group, Inc. Quote

Currently, T. Rowe Price carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

First Republic Bank’s FRC fourth-quarter 2021 earnings per share of $2.02 surpassed the Zacks Consensus Estimate of $1.91. Additionally, the bottom line improved 26.3% from the year-ago quarter’s level.

FRC’s quarterly results were supported by a higher net interest income and non-interest income. Moreover, First Republic’s balance-sheet position was strong in the quarter. However, higher expenses and elevated net loan charge-offs were the offsetting factors.

Citigroup Inc. C delivered an earnings surprise of 5.04% in fourth-quarter 2021. Income from continuing operations per share of $1.46 outpaced the Zacks Consensus Estimate of $1.39. However, the reported figure declined 24% from the prior-year quarter’s level.

Citigroup’s investment banking revenues jumped in the quarter under review, driven by equity underwriting and growth in advisory revenues. However, fixed-income revenues were down due to declining rates and spread products.

U.S. Bancorp USB reported fourth-quarter 2021 earnings per share of $1.07, which missed the Zacks Consensus Estimate of $1.11. Results, however, compare favorably with the prior-year quarter’s figure of 95 cents.

Though lower revenues and escalating expenses were disappointing factors, credit quality was a tailwind. Growth in loan and deposit balance and a strong capital position were also encouraging factors. Moreover, U.S. Bancorp closed the acquisition of San Francisco-based fintech firm TravelBank, which offers technology-driven cost and travel management solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance