Sysco's (SYY) Latest Move to Enhance Delivery to Aid Growth

Sysco Corporation SYY is focused on growth and is committed to enhancing services to customers. The company, together with Daimler Truck North America (DTNA), unveiled a Letter of Intent to allocate up to around 800 battery electric Freightliner eCascadia Class 8 tractors to cater to its U.S. customers by 2026. The first eCascadia delivery is likely to reach Sysco’s Riverside, CA site later this year.

This move not only underscores Sysco’s commitment to its customers but also highlights its focus on environmental goals. This investment will help SYY achieve its target of lowering its direct carbon emissions by 27.5% by 2030.

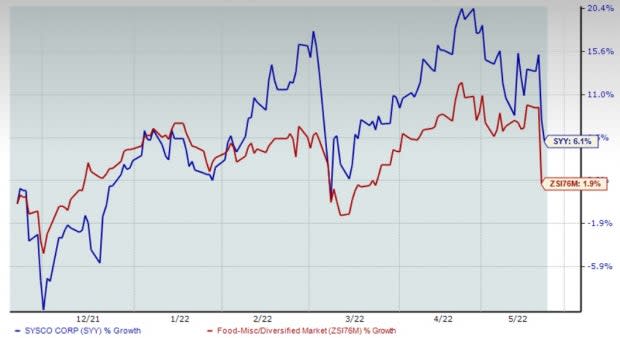

Image Source: Zacks Investment Research

What Else to Know?

Sysco has been benefiting from its focus on the Recipe for Growth plan and solid food-away-from-home trends. Gains from these factors were visible in the company’s recently reported third-quarter fiscal 2022 results, wherein the top and bottom lines rose year over year and beat the Zacks Consensus Estimate. It witnessed the strong consumer and customer away-from-home demand in late February and March as it snapped back from the Omicron impact. Further, the company continued to witness robust market share gains in the United States and internationally, reflecting strength in its Recipe for Growth plan.

Sysco’s Recipe for Growth program involves five strategic priorities aimed at enabling the company to grow 1.5 times faster than the market by the FY24-end. The five strategic pillars include enhancing customers’ experiences via digital tools. In this regard, the company’s Sysco Shop platform and the new pricing software are working well. Further, SYY is focused on improving the supply chain to cater to customers efficiently and consistently with better delivery and omnichannel inventory management.

Next, Sysco aims at providing customer-oriented merchandising and marketing solutions to augment sales. The company also targets having team-based selling, with an emphasis on important cuisines. Finally, Sysco is focused on cultivating new capacities, channels and segments alongside sponsoring investments via cost-saving initiatives. Sysco is progressing well with its Recipe for Growth and earlier unveiled plans to generate cost curtailments of $750 million for the period of FY21 to FY24.

Sysco made solid progress in the third quarter and expects to see further growth in the fourth quarter. It expects fourth-quarter earnings per share (EPS) in the range of $1.05-$1.15 compared with the 71 cents delivered in the fourth quarter of fiscal 2021. Management’s optimism for the fourth quarter is based on the expectations of a continued market revival, market share gains, the efficient pass-through of higher costs and improved operating expenses (stemming from reduced snapback and productivity-related costs). However, the fourth quarter of fiscal 2021 included an extra week, which is likely to affect comparisons.

However, management remains optimistic about its business and raised its adjusted EPS guidance for fiscal 2022. Sysco now expects an EPS of the $3.16-$3.26 band, up from the previous view of the $3-$3.10 band.

Shares of this Zacks Rank #1 (Strong Buy) company have risen 6.1% in the past six months compared with the industry’s rise of 1.9%.

Other Consumer Staple Bets Worth Noting

Some other top-ranked stocks are McCormick & Company MKC, Celsius Holdings CELH and Medifast MED.

McCormick, the manufacturer, marketer and distributor of spices, seasoning mixes and condiments, currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for McCormick’s current financial-year sales and EPS suggests growth of nearly 5% and 3.9%, respectively, from the year-ago reported figure. MKC has a trailing four-quarter earnings surprise of around 7.3%, on average.

Celsius Holdings, which develops, processes, markets, distributes and sells functional drinks and liquid supplements, carries a Zacks Rank #2 at present. Celsius Holdings delivered an earnings surprise of 200% in the last reported quarter.

The Zacks Consensus Estimate for CELH’s current financial-year sales suggests growth of 84.4% from the year-ago period’s reported figures.

Medifast, which manufactures and distributes weight loss, weight management, healthy living products, and other consumable health and nutritional products, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Medifast’s current financial-year sales and EPS suggests growth of nearly 19% and 11.5%, respectively, from the year-ago reported figure. MED has a trailing four-quarter earnings surprise of 12.9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance