Sysco (SYY) Q4 Earnings & Sales Top Estimates, Increase Y/Y

Sysco Corporation SYY posted splendid fourth-quarter fiscal 2022 results as both the top and bottom lines grew year over year and came ahead of the Zacks Consensus Estimate. The company marked yet another solid quarter of sales and earnings growth despite the tough environmental landscape. Sysco’s growth outperformed the U.S. market by more than 1.3 times in the full year.

During the quarter, the company continued to progress well in its Recipe for Growth plan, witnessed volume growth and executed an efficient pass-through of high product costs. SYY’s International segment operating income continued to witness recovery.

Quarter in Detail

Sysco’s adjusted earnings of $1.15 per share beat the Zacks Consensus Estimate of $1.12. The bottom line increased from the year-ago period’s earnings of 71 cents per share. On a comparable 13-week basis, adjusted earnings per share (EPS) soared 74.2%.

Sysco Corporation Price, Consensus and EPS Surprise

Sysco Corporation price-consensus-eps-surprise-chart | Sysco Corporation Quote

The global food product maker and distributor reported sales of $18,957.3 million, which jumped 17.5% year over year and beat the Zacks Consensus Estimate of $18,270 million. Foreign currency had an adverse impact of 1.6% on the top line.

The gross profit surged 18.1% to $3,444.3 million, and the gross margin expanded 10 basis points (bps) to 18.2%. The adjusted gross margin rose 33% to 18.4%. This year-over-year growth in the gross profit was fueled by elevated volumes along with efficient inflation management. Foreign currency had a negative impact of 2% on the gross profit. The adjusted operating income of $876.8 million grew $271.6 million from the year-ago period.

Image Source: Zacks Investment Research

Segment Details

U.S. Foodservice Operations: In the reported quarter, the segment witnessed robust sales growth, overall share gains and higher profitability. Sales jumped 16.4% to $13,413.3 million. Local case volumes within U.S. Broadline operations fell 7.8%, and total case volumes dipped 2.1%. The gross profit escalated by 17.5% to $2,601.7 million, and the gross margin rose 17 bps to 19.4%. The U.S. Broadline saw 15.3% product cost inflation, mainly due to the poultry, fresh produce and dairy categories.

International Foodservice Operations: The segment’s sales soared 30.3% to $3,251.8 million in the quarter. Foreign-exchange fluctuations adversely impacted the segment’s sales by 10.1%. On a constant-currency (cc) basis, sales advanced 40.4%. The gross profit jumped 31.4% to $651.8 million, and the gross margin expanded 17 bps to 20%. At cc, the gross profit rose 42.9%. Currency movements hurt the segment’s gross profit by 11.5%.

SYGMA’s sales advanced 5.5% to $1,975.6 million. The gross profit fell from $159.7 million to $153.9 million, while the gross margin contracted from 8.52% to 7.79%.

The Other segment’s sales jumped 27.3% to $316.5 million.

Other Updates

Sysco ended the quarter with cash and cash equivalents of $867.1 million, long-term debt of $10,066.9 million and total shareholders’ equity of $1,382.3 million. In the year ended Jul 2, 2022, the company generated cash flow from operations of $1.8 billion, and free cash flow amounted to $1.2 billion.

During the year, Sysco returned $1.5 billion to shareholders through share buybacks worth $500 million and dividends of $959 million.

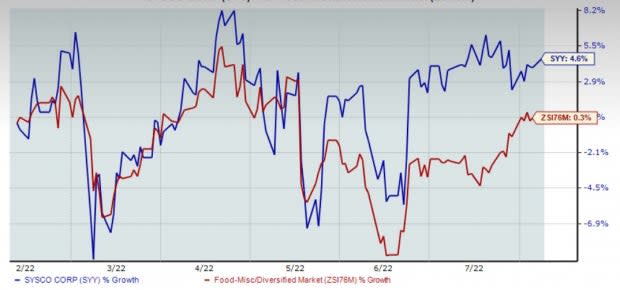

Shares of this Zacks Rank #2 (Buy) company have risen 4.6% in the past six months compared with the industry’s growth of 0.3%.

Other Solid Consumer Staple Stocks

Some other top-ranked stocks are The Chef's Warehouse CHEF, Campbell Soup CPB and General Mills GIS.

The Chef's Warehouse, which engages in the distribution of specialty food products, sports a Zacks Rank #1 (Strong Buy). The Chef's Warehouse has a trailing four-quarter earnings surprise of 372.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CHEF’s current financial-year EPS suggests significant growth from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, carries a Zacks Rank #2. Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 4.7% from the year-ago reported number.

General Mills, which manufactures and markets branded consumer foods, currently carries a Zacks Rank #2. General Mills has a trailing four-quarter earnings surprise of 6.5%, on average.

The Zacks Consensus Estimate for GIS’ current financial-year sales suggests growth of 1.7% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance