Synopsys (SNPS) Q4 Earnings and Revenues Surpass Estimates

Synopsys Inc.’s SNPS fourth-quarter fiscal 2019 non-GAAP earnings of $1.15 per share beat the Zacks Consensus Estimate by 1.77% and also the year-ago quarterly figure by 47.4%.

Further, revenues grew 7% year over year to $851.1 million and surpassed the Zacks Consensus Estimate of $846 million as well.

The company is benefiting from increasing global design activity and customer engagements. Rising impact of machine learning, AI, Automotive, 5G, IoT, Cloud and the proliferation of Smart Everything are boosting demand for its advance solutions.

However, challenging global market, geopolitical tension and unevenness in the semiconductor industry are key headwinds.

Quarter in Detail

Time-Based Products revenues (64% of the total generated) of $548.4 million were down 9.4% year over year. However, Upfront Products revenues (20%) soared 152.9% to $168.3 million. Maintenance and Service revenues (16%) too grew 9.3% to $134.4 million.

Segment wise, Semiconductor & System Design revenues (90% of total) were $765.8 million. Within the same, EDA revenues were $489.2 million and the metric from IP & Systems Integration was $275.5 million

Software Integrity revenues were 85.3 million, accounting for approximately 10% of the top line in the reported quarter.

Geographically, Synopsys’ revenues in North America (53% of total) were $450 million while Revenues in Europe (11%) were $91.5 million.

Asia Pacific revenues (26%) were $240.3 million whereas revenues in Japan (8%) were $69.2 million.

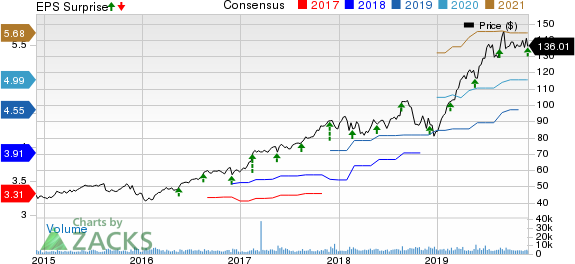

Synopsys, Inc. Price, Consensus and EPS Surprise

Synopsys, Inc. price-consensus-eps-surprise-chart | Synopsys, Inc. Quote

Margins

Per ASC 606, non-GAAP operating margin was 24.8%. While Semiconductor & System Design delivered an adjusted operating margin of 26.4%. Software Integrity’s margin came in at 11%.

Balance Sheet & Cash Flow

Synopsys exited the fiscal fourth quarter with cash and cash equivalents of $728.6 million compared with $686.8 million at the end of the previous reported quarter.

Operating cash flow for the year was $801 million.

The company completed buybacks of $329 million in the year and $1.8 billion over the past five years, returning approximately 75% of free cash flow to its investors over that period.

Guidance

For first-quarter fiscal 2020, the company’s revenues are expected in the $805-$835 million band. Non-GAAP expenses are anticipated within $635-$655 million. Management assumes non-GAAP earnings per share of 89-94 cents.

For the full fiscal, revenues are now projected in the range of $3.60-$3.65 billion. Non-GAAP earnings per share for the period are forecast between $5.18 and $5.25.

Double-digit growth in non-GAAP earnings is likely to be driven by a revenue rise in high-single-digits, indicating growth in mid-to-high single digits for EDA, low-double-digits’ growth for IP and Software Integrity growth within the 15-20% range.

The company estimates to boost its operating margin in the high-20s by 2021 and in the long haul, within the 30% range.

Zacks Rank & Stocks to Consider

Synopsys currently has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Keysight Technologies Inc. KEYS, Fortinet, Inc. FTNT and CommVault Systems, Inc. CVLT, each flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Keysight, Fortinet and CommVault Systems is currently estimated at 9.1%, 14% and 10%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

Keysight Technologies Inc. (KEYS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance