Should Swooning Sales at M.D.C. Holdings Make Investors Nervous?

Buying a new home isn't something you go out and do every day. So, as you can imagine, sales at homebuilders can be quite seasonal and a bit lumpy at times. One quarter of weak sales numbers isn't that big of a deal, really. However, this was the second quarter in a row where M.D.C. Holdings (NYSE: MDC) didn't look that great, especially when you consider the backdrop of an incredibly robust housing market and other homebuilders posting double-digit growth rates.

Let's take a look at the company's most recent earnings report to see why sales at M.D.C. haven't been living up to its peers and if there are any initiatives on the way that could turn things around for the company.

Image source: M.D.C. Holdings.

By the numbers

Metric | Q1 2018 | Q4 2017 | Q1 2017 |

|---|---|---|---|

Revenue | $607.6 million | $704.3 million | $563.7 million |

Pre-tax income | $50.5 million | $51.8 million | $36.3 million |

Net income | $38.8 million | $24.6 million | $24.2 million |

EPS (diluted) | $0.69 | $0.43 | $0.40 |

Data source: M.D.C. Holdings earnings release. EPS = earnings per share.

It's not easy to really assess M.D.C.'s earnings results because it's throwing up so many mixed signals. One the good side, revenue, gross margins, and net income all improved compared to the prior year. However, those gains came almost entirely from a higher average home sale price than any increase in homes delivered. Also, the benefit of a lower tax rate was perhaps the most significant factor for the company's increase in earnings per share. It should be noted, though, that M.D.C. gross and net income margins of 18.2% and 6.4%, respectively, are still well below that of its larger peers.

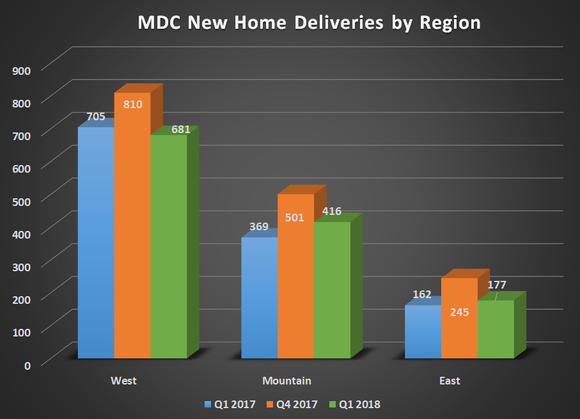

This is the second quarter in a row that M.D.C. has experienced weak results for new homes delivered. In the prior quarter, new homes delivered actually decreased 2%, while this quarter's 1% gain wasn't much to write home about. At the same time, though, net new orders were up 12% compared to this time last year, and its backlog of homes to be sold can support close to three-quarters of sales at this current pace.

Data source: M.D.C. Holdings earnings release. Chart by author.

Perhaps the largest reason M.D.C. has seen weak sales numbers is that it has fewer locations to sell homes. Since the end of 2016, its active subdivision count has dropped 5.5% as it completes sales at some of its developments.

Fortunately, it looks as though those trends will start to reverse soon as the company recently invested heavily in new land development. Management noted that its number of controlled lots were up 44% compared to this time last year, and that will eventually lead to more active communities or expanding existing ones.

What management had to say

Despite the tepid rate of homes delivered recently, CEO Larry Mitzel seemed quite optimistic about M.D.C. Holdings' future thanks to the addition of its new lots and its expanding gross margins. Here's his press release statement on how he anticipates the rest of the year will unfold:

We approved over 4,000 lots for purchase in the 2018 first quarter, with almost 50% of those lots designated for the Seasons(TM) collection, which is the centerpiece of our efforts to drive affordability. Even at this lower price point, we continue to offer the benefits of a build-to-order model, where our customers can personalize their homes to match their own unique preferences. We believe that this approach provides us with a competitive advantage as we look to continue to drive our growth through this important homebuyer segment.

With our ending backlog value up nearly 20% from a year ago, we enter our second quarter with the opportunity for more significant year-over-year growth in revenues for the balance of the year, which could drive enhanced operating leverage to complement our already significantly expanded gross margin from home sales. With that in mind, we are optimistic about our prospects for the continued growth of the Company's core* pre-tax operating margin and return on equity in 2018.

Too soon to tell

It's certainly discouraging to see M.D.C. Holdings' sales not quite keeping pace with the rest of the industry, and the declining active community would typically be a red flag that there are fewer places from where it can drive sales growth. However, the significant uptick in controlled lots that are getting ready for development is perhaps a sign that the company will be able to increase its active community count and accelerate sales growth.

From an investing standpoint, this is probably a sign that investors should wait and see if M.D.C. can deliver on these new lots. As is the case with any early investment, there's no guarantee that all of those land purchases will pan out.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance