Is a Surprise in Store for Moody's (MCO) in Q2 Earnings?

Moody's MCO is slated to announce second-quarter 2019 results on Jul 31, before the opening bell. The company is expected to report marginal rise in revenues in its Corporate Finance line, the largest revenue contributor at the Moody's Investors Service (“MIS”) division.

Relatively higher interest rates and several geopolitical concerns adversely impacted debt issuances in the to-be-reported quarter. The second quarter witnessed weakness in investment grade bond and leveraged loan issuance volumes. Nevertheless, high yield bond issuance volumes were healthy.

Thus, Corporate Finance revenues are expected to rise modestly. The Zacks Consensus Estimate for the same is pegged at $381 million for the to-be-reported quarter, indicating marginal growth from the year-ago quarter’s reported figure.

While the quarterly issuance volume for commercial mortgage-backed securities remained healthy, collateralized loan obligations and asset backed securities issuance volumes were weak. Therefore, Moody’s will likely witness no change in Structured Finance revenues in the to-be-reported quarter. The Zacks Consensus Estimate for the same is pegged at $142 million, stable year over year.

Further, MIS division’s another revenue source — Financial Institutions — is anticipated to report revenues of $126 million, up 4.1% from the prior-year quarter. Also, Public, Project and Infrastructure Finance unit revenues are likely to increase. The consensus estimate for the same is pegged at $110 million, indicating 1.9% growth from the year-ago reported figure.

Overall, the MIS division is projected to witness a year-over-year decline in the top line. The Zacks Consensus Estimate for the division’s revenues is $719 million, suggesting a 4.4% decline from the year-ago quarter’s reported number.

Other Factors at Play

Moody's Analytics (“MA”) division to support revenues: The company continues to pursue growth in areas outside the core credit ratings service. Given the rise in demand for analytics, all three business units at the MA division are expected to witness rise in revenues.

The Zacks Consensus Estimate for Professional Services’ revenues is $47.50 million, indicating 27% rise from the year-ago quarter’s reported number. Also, the consensus estimate for Research, Data and Analytics revenues is $300 million, indicating rise of 7.1% year over year. Further, Enterprise Risk Solutions revenues are projected to be $111 million for the second quarter, suggesting 4.7% rise from the year-ago quarter’s reported number.

Thus, driven by growth in revenues in all three business units at the MA division, overall revenues for the division are expected to rise. The consensus estimate for revenues in the MA division is pegged at $468 million, indicating 10.6% growth year over year.

Expenses to remain high: Given Moody’s inorganic growth efforts; acquisition and restructuring costs are expected to remain high. Hence, overall expenses for the second quarter are likely to be elevated.

Here is what our quantitative model predicts:

Chances of Moody’s beating the Zacks Consensus Estimate in the second quarter are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for Moody’s is +0.65%.

Zacks Rank: Moody’s currently carries a Zacks Rank #2 (Buy). This, when combined with a positive ESP, makes us reasonably confident of a positive surprise.

The Zacks Consensus Estimate for earnings of $1.98 for the to-be-reported quarter has been revised 2.1% higher over the past 30 days. However, it indicates a 2.9% decline from the year-ago reported figure. The consensus estimate for sales of $1.18 billion suggests 0.8% marginal rise from the year-ago quarter’s reported figure.

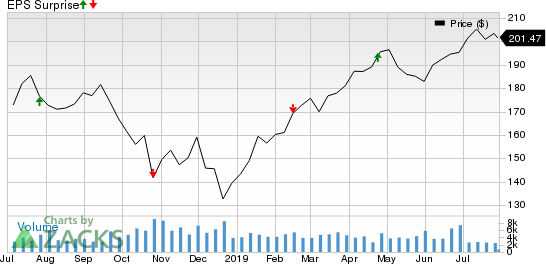

Moody's Corporation Price and EPS Surprise

Moody's Corporation price-eps-surprise | Moody's Corporation Quote

Other Stocks to Consider

Here are a few other stocks that you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat in their upcoming releases:

Apollo Investment Corporation AINV is scheduled to release results on Aug 6. It presently has an Earnings ESP of +3.97% and a Zacks Rank #2.

Banco Macro S.A. BMA is expected to release results on Aug 28. It has an Earnings ESP of +11.83% and a Zacks Rank #3.

Eaton Vance Corporation EV is expected to release quarterly results on Sep 4. It has an Earnings ESP of +3.21% and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Macro Bank Inc. (BMA) : Free Stock Analysis Report

Eaton Vance Corporation (EV) : Free Stock Analysis Report

Apollo Investment Corporation (AINV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance