Superior Industries' (SUP) Q3 Loss Narrower Than Expected

Superior Industries International, Inc. SUP incurred adjusted third-quarter 2019 loss of 8 cents, narrower than the Zacks Consensus Estimate of 19 cents. The lower-than-expected loss can be attributed to higher-than-expected shipments and revenues in European markets. The loss per share also narrowed year over year by 175%.

The aluminum-wheel manufacturer reported revenues of $352 million, beating the Zacks Consensus Estimate of $336 million. However, the top line was higher than the year-ago figure of $347.6 million.

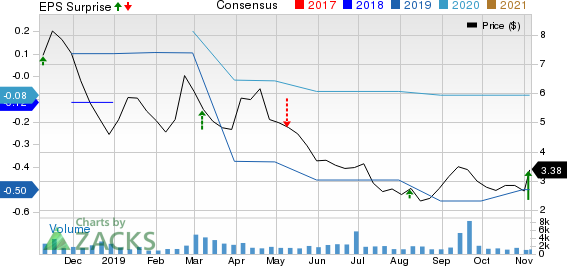

Superior Industries International, Inc. Price, Consensus and EPS Surprise

Superior Industries International, Inc. price-consensus-eps-surprise-chart | Superior Industries International, Inc. Quote

Quarter Details

During the third quarter, the company’s wheel unit shipments increased 2% year over year to 4.9 million. Higher shipments in Europe, were partly offset by lower volumes in North America amid a 40-day long strike between UAW and General Motors GM. Shipments in Europe came in at 2.3 million, increasing from 2 million recorded in the third quarter of 2018. The figure also outpaced the Zacks Consensus Estimate of 2.2 million.

Sales in the European market came in at $164 million, higher than $149.8 million recorded in the year-ago quarter, and topped the Zacks Consensus Estimate $160 million. The increase was driven by improved product mix and higher volumes, partially offset by weaker euro. Sales in the North American market totaled $188 million, down from $197.8 million in the third quarter of 2018.

The company’s operating profit declined from $7.7 million to $0.2 million in the quarter under review amid restructuring costs of $13 million related to the Fayetteville facility. Selling, general and administrative expenses inched up to $16.3 million from $16 million in the year-ago quarter.

Net cash provided by operating activities totaled $32.7 million in the third quarter, down from $33.5 million in the year-ago quarter. Capital expenditure amounted to $18.9 million.

During the quarter, Superior Industries suspended its quarterly dividend in a bid to reduce net debt and reinvest in business. As of Sep 30, the company’s net debt was $709 million, representing debt-to-capital ratio of 68.4%.

2019 Outlook Revised

Superior Industries projects unit shipments in the band of 19.5-19.7 million compared with the prior guidance of 19.5-19.9 million. Net sales is projected to lie between $1.39 million and $1.42 million compared with the prior range of $1.39-$1.44 billion. Cash flow from operations is projected at $135-$155 million, up from the previous guided range of $125-$145 million. Capex forecast is kept intact at $75 million.

Zacks Rank and Key Picks

Superior Industries currently carries a Zacks Rank #3 (Hold). Better-ranked players in the same industry include Spartan Motors, Inc. SPAR and BRP Inc. DOOO. While Spartan sports a Zacks Rank #1 (Strong Buy), BRP carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Superior Industries International, Inc. (SUP) : Free Stock Analysis Report

Spartan Motors, Inc. (SPAR) : Free Stock Analysis Report

BRP Inc. (DOOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance