Sunrun (RUN) Q3 Earnings Miss Estimates, Revenues Up Y/Y

Sunrun Inc. RUN reported third-quarter 2019 adjusted earnings of 23 cents per share, which missed the Zacks Consensus Estimate of 27 cents by 14.8%. However, the bottom line rose from a loss of 2 cents per share in the prior- year quarter.

Revenues

Sunrun’s revenues of $215.5 million in the quarter surpassed the Zacks Consensus Estimate of $207.5 million by 3.9%. Revenues also rose 5% from the year-ago quarter’s $204.9 million.

Operational Highlights

Total operating expenses were $275.9 million in the third quarter, up 20.7% year over year. Operating expenses in the reported quarter grew on escalated costs of customer agreements and incentives, high costs of solar energy systems and product sales, increased sales and marketing expenses, higher general and administrative costs, and elevated research

and development expenses.

Interest expenses were $43.9 million, up approximately 27.3% on a year-over-year basis.

Total cost of revenues was $159.4 million, increasing 14% year over year.

Key Highlights

In the reported quarter, Megawatt (MW) deployed grew 7% to 107 MW from 100 MW in the third quarter of 2018.

Creation cost per watt was $3.28 in the third quarter of 2019 compared with $3.34 in the year-ago quarter. Net Present Value (NPV) created in the quarter was $79 million, reflecting an 8.1% year-over-year decline from $86 million in the third quarter of 2018.

Sunrun’s net earning assets as of Sep 30, 2019, were $1.4 billion, up $48 million or 3% from the prior-year quarter.

The company’s customer base expanded 24% year over year to 271,000.

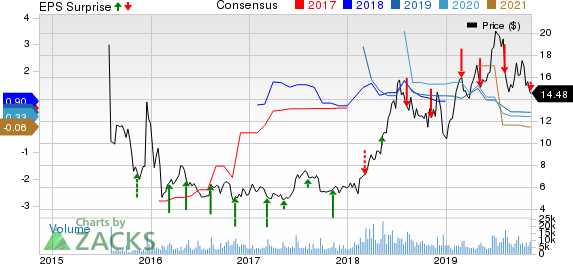

Sunrun Inc. Price, Consensus and EPS Surprise

Sunrun Inc. price-consensus-eps-surprise-chart | Sunrun Inc. Quote

Financial Performance

Sunrun had $324.7 million of cash, as of Sep 30, 2019, up from $226.6 million at the end of 2018.

Net cash outflow from operating activities was $106.1 million at the end of the third quarter compared with $40.7 million used for operating activities in the year-ago quarter.

Total recourse and non-recourse debt, net of current portion, was $2,015.9 million at the end of third-quarter 2019 compared with $1,713.4 million as of Dec 31, 2018.

Q4 Guidance

For the fourth quarter of 2019, Sunrun expects deployments of 115-118 MW.

Zacks Rank

Sunrun currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

SunPower Corp. SPWR reported adjusted earnings of 22 cents per share in third-quarter 2019. The Zacks Consensus Estimate was a loss of a penny. The company had incurred a loss of 29 cents per share in the year-ago quarter.

Enphase Energy, Inc. ENPH reported third-quarter 2019 adjusted earnings of 30 cents per share, which surpassed the Zacks Consensus Estimate of 25 cents by 20%. The bottom line also improved a massive 650% from 4 cents reported in the prior-year quarter.

First Solar Inc. FSLR reported third-quarter 2019 adjusted earnings of 29 cents per share, missing the Zacks Consensus Estimate of $1.06 by 72.6%. The reported number, however, grew from the prior-year quarter’s loss per share of 18 cents.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

Sunrun Inc. (RUN) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance