Sunak refuses to commit to tax cuts amid fears of cost-of-living crisis

Rishi Sunak has refused to commit to cutting taxes before the next general election despite concerns among Tory MPs at the growing squeeze on living standards.

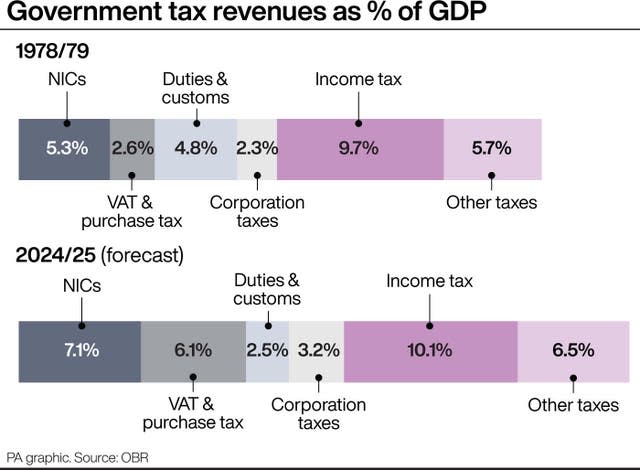

After his Budget on Wednesday took the tax burden to its highest level since the Labour government of Clement Attlee in the 1950s, the Chancellor said it had been necessary to take “corrective action” following the pandemic.

Mr Sunak said the measures he put in place to protect jobs when the crisis broke last year meant the economy was now recovering strongly while unemployment was far lower than many people had feared.

And he insisted that it remained his “ambition” to “lower taxes for people” when the fiscal conditions allowed but declined to be drawn on when that might be.

Concerns among Conservative MPs of a cost-of-living crisis were underlined by analysis by the Resolution Foundation think tank which warned the country could be facing a “flat recovery for household living standards”.

It said tax bills had risen by £3,000 per household since Boris Johnson became Prime Minister in 2019 while the weakest decade of pay growth since the 1930s combined with rising inflation meant real wages were set to fall again next year.

“Real wages are on course to grow by just 2.4% from May 2008 to May 2024 – a far cry from the 36% real wage growth experienced between May 1992 and May 2008,” it said.

That was echoed by the Institute for Fiscal Studies, which said there would be “very slow growth” in living standards over the coming years.

“A middle earner is likely to be worse off next year than this as high rates of inflation and tax rises more than negate small average wage increases,” said IFS director Paul Johnson.

“This of course comes on top of a decade of historically feeble increases in real incomes.

“The gap between what we might have expected on the basis of pre-financial crisis trends and what is actually happening is staggering.”

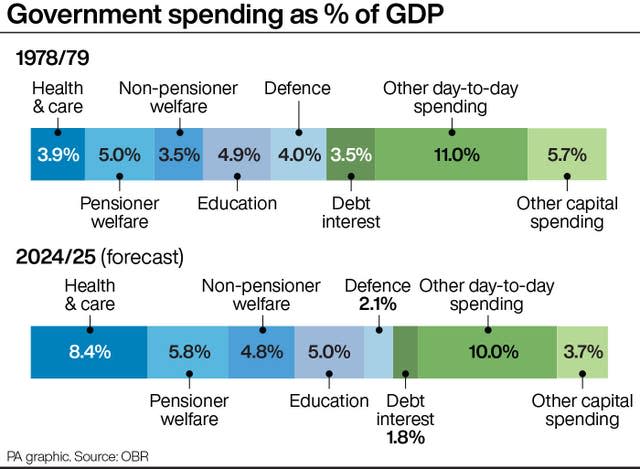

In his statement to the Commons, Mr Sunak took advantage of better-than-expected economic growth to announce across-the-board spending increases for Government departments.

At the same time he announced a £2.2 billion cut to the Universal Credit taper rate – allowing those on the benefit to keep more of their earnings as they find work.

Speaking on Sky News, the Chancellor said he hoped the need for tax increases was now done and that he would be able to make further cuts.

“As I said very clearly yesterday, my ambition is to lower taxes for people, that is what I would like to do as Chancellor,” he said.

“We had to take some corrective action as a result of the crisis and the response we took to it, but hopefully that now is done and, as we demonstrated yesterday, our priority is to make sure that work pays, that we reward people’s efforts and I’m delighted we could make a start on that yesterday.”

He said the country could now look forward to a strengthening economy as it continued to pick up following the pandemic.

“I think it is important to remember why we are in this position,” he said.

“A year ago we outlined our Plan for Jobs at a time when people feared the worst, and because of the plan we put in place we’ve managed to ensure that economic growth is recovering, the economy is growing well, many more people are in work, unemployment is far lower than feared.

“And because of that, yesterday we had a Budget that will deliver a stronger economy for the British people.

“Stronger public services, investment in our future growth, backing businesses but also supporting working families by freezing fuel duty and cutting taxes on the lowest paid.

“We were able to do all of that because of the action we took last year.”

Yahoo Finance

Yahoo Finance