‘Substantial deterioration’ in consumer expectations: NY Fed survey

The month of March saw a “substantial deterioration” in the main driver of the U.S. economy: the American consumer.

According to new data from the Federal Reserve Bank of New York, Americans reported greater concern of being laid off and heightened worries over being able to meet future debt payments.

Weaker consumer sentiment paints a bleak picture of where the U.S. is headed, since consumer activity represents about 70% of the economy. Federal Reserve officials have been saying that the economy is likely already in a recession.

The New York Fed’s Survey of Consumer Expectations reported that median expected year-ahead growth in income fell from 2.7% in February to 2.1% in March. With lower income, Americans also reported lower expectations for spending, which fell from 3.1% in February to 2.3% in March.

New York Fed researchers noted that a lot of the declines in consumer sentiment were not seen until later in March, when businesses across the country began closing en masse as people were directed to stay at home.

“While initially more stable, household spending growth expectations exhibited a sharp decline in the third week of March,” New York Fed researchers wrote in a blog post. “The average perceived risk of layoff continued to rise, while the probability of finding a job (given a job loss today) declined through March.”

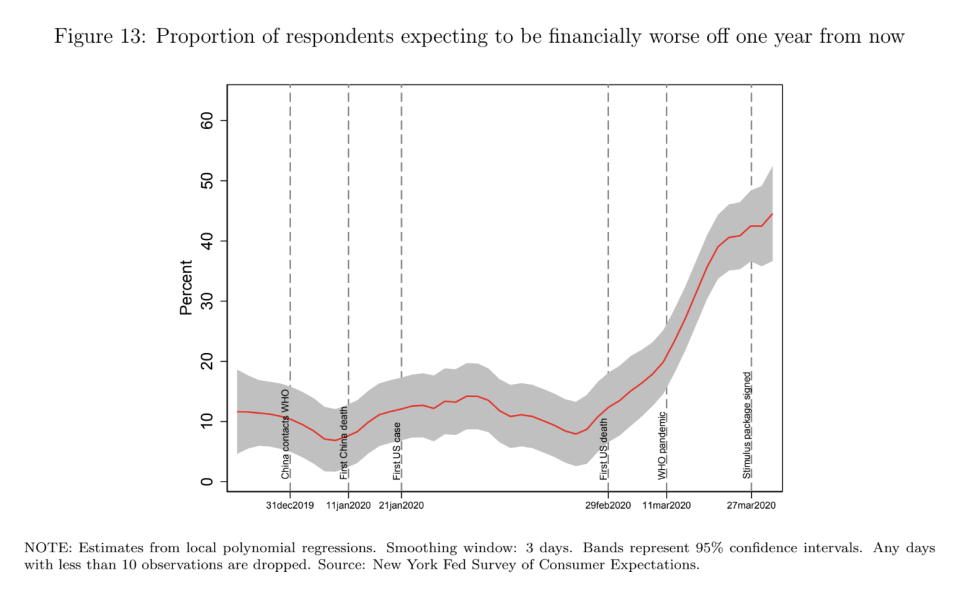

Over 40% of survey respondents said they expect to be financially worse off a year from now, a significant uptick from levels reported in February. As Congress worked through its $6 trillion relief package, the rapid deterioration in these expectations appeared to slow.

As public health officials continue attempts to slow the spread of the coronavirus, Americans are starting to worry about the virus lasting long enough to affect their ability to repay debt. The survey reported a higher average likelihood of households missing a debt payment over the next three months. In the longer-term, the New York Fed saw a “persistent deterioration” in consumers’ expectations to access credit at some point in the year-ahead.

The New York Fed said the sharp decline in consumer expectations was seen across all age, education, and income groups.

The survey is usually conducted by the Fed to get a pulse on inflation expectations, which was unchanged at a median measure of 2.5% for the year-ahead.

Brian Cheung is a reporter covering the Fed, economics, and banking for Yahoo Finance. You can follow him on Twitter @bcheungz.

SF Fed Chief: Central bank will ‘do whatever it takes’ to support economy

Federal Reserve opens up seventh liquidity facility, to supply US dollars abroad

Cracks in municipal debt markets raise questions about future Fed action

A glossary of the Federal Reserve's full arsenal of 'bazookas'

Fed makes 'aggressive' move to back corporate debt markets, Main St.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance