Expert: 'I’m not so sure that I trust government' on student loans

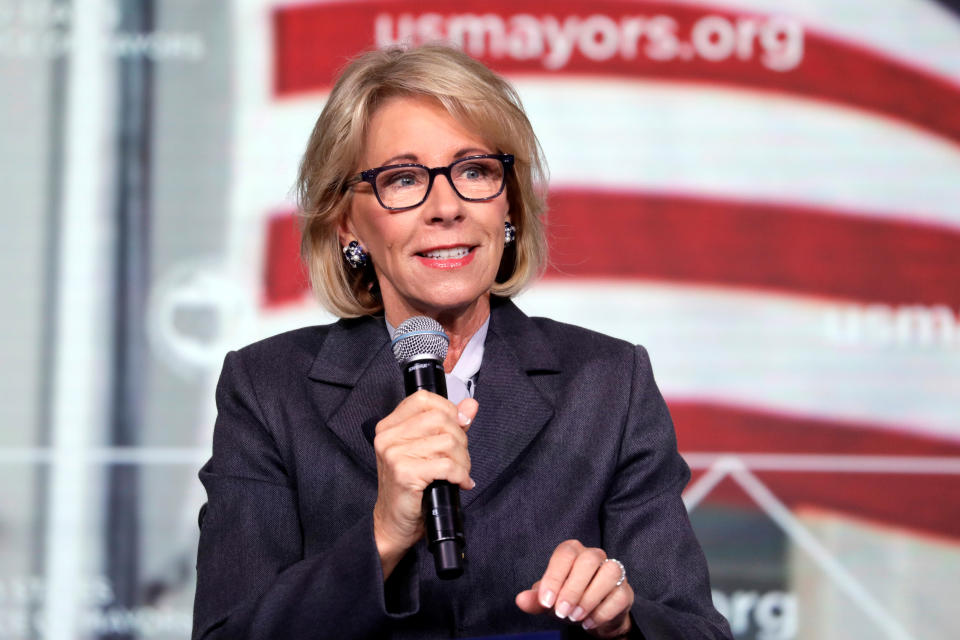

Department of Education Secretary Betsy DeVos turned heads this week by suggesting that the $1.5 trillion federal student loan portfolio should be managed by a new federal agency.

Although this seems like a potential solution to the serious pushback for the large number of outstanding student loans, one expert argued that this isn’t the way to do it.

DeVos is “looking at it and saying this is a no-win situation for [her] department,” Geltrude & Company Founder Daniel Geltrude told Yahoo Finance’s On The Move. “So the best way for [her] to handle is to push it somewhere else. Now, that could be the right answer if they have the ability to do a better job, but I'm not so sure that I trust government to really be able to get this situation under control.”

Geltrude, who calls himself America’s Accountant, added: “I would actually like to see this become privatized and have a little bit more oversight.”

An ‘untamed beast’

Speaking earlier this week at a conference in Reno, Nevada, hosted by the department’s Federal Student Aid (FSA) — which manages the vast majority of outstanding student loans — DeVos laid out her argument to spin off that office into a new agency.

“Since the federal government inserted itself everywhere in student lending, everything has become more cumbersome and more confusing for everyone,” Devos said. “Congress might've created the first financial aid program, but it set in motion an untamed beast.”

To make the FSA provide better services for borrowers, and to act “like a world-class financial firm” since it is effectively “the country’s biggest consumer lender” because of its trillion-dollar portfolio, DeVos suggested making the FSA “a standalone government corporation, run by a professional, expert, and apolitical Board of Governors.”

“Congress never set up the U.S. Department of Education to be a bank, nor did it define the Secretary of Education as the nation's ‘top banker’,” she added. “But that's effectively what Congress expects based on its policies.”

DeVos’ underlying belief — that the FSA requires serious reform — was echoed earlier this year by A. Wayne Johnson, who resigned as COO of the organization. Johnson told Yahoo Finance that the system in place today is “an abomination that’s in plain sight.”

DeVos idea ‘only works on paper’

Experts argued that DeVos’ proposal is theoretically difficult to achieve and would not likely benefit borrowers anyway.

Separating federal policy on student loans and actually managing the operations “has been a dream for 20 years, and it only works on paper,” Ben Miller, vice president for postsecondary education at the Center for American Progress, told The New York Times.

“The truth of the matter is that FSA and [the Education Department] work best when there is close collaboration and sharing of how policy ideas would affect operations or what operational challenges might need policy solutions,” Miller added. “Making FSA separate would just make it harder to have good coordination.”

Rep. Bobby Scott (D-VA), who chairs the House Committee on Education and Labor, also dismissed the suggestion.

“The department should focus its time and resources on implementing the existing student loan programs in good faith,” he said. “There’s nothing that could be done with a new agency that can’t be done today.”

And ultimately, “the proposal seems to absolve the Secretary and the industry from all responsibility for the mess that 44 million borrowers face today,” Student Borrower Protection Center Policy Director Mike Pierce told Yahoo Finance. “But in reality, she has spent her tenure shielding companies that rip off borrowers.”

Despite all the pushback, one group — the Consumer Bankers Association — commended DeVos’ overall push to reform the system.

“The fact the Department of Education is the nation’s fifth-largest bank speaks volumes to America’s federal student loan crisis,” CBA President and CEO Richard Hunt said in a statement. “Federal loans, with their double-digit delinquency rate, are not serving college students and their parents well. ... Secretary DeVos is right [in that] something must be done.”

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

‘I’m working until I’m 75’: Factory worker describes family’s student debt nightmare

Student loan reform group sues Education Secretary Betsy DeVos and CFPB Director Kathy Kraninger

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance