Stryker's (SYK) OptaBlate Tumor Ablation System Gets FDA Nod

Although Stryker Corporation SYK received the FDA’s 510(k) clearance for its OptaBlate bone tumor ablation system on Tuesday, shares of the company continued their declining trend amid Fed rate hike. The company’s shares have been down 3.6% since Sep 20, following the regulatory update.

OptaBlate is the first FDA-approved system with microinfusion technology anticipated to be a reliable solution for painful metastatic tumors in cancer patients.

The approval for OptaBlate boosts Stryker’s Interventional Spine (IVS) portfolio by expanding the company’s core competencies in vertebral augmentation and radiofrequency ablation. With OptaBlade approval, the company now has a complete portfolio of treatment options for metastatic vertebral body fractures.

The OptaBlaze system is likely to optimize all aspects of the bone tumor ablation procedure, starting from the set-up. The system is anticipated to reduce ablation time by three minutes versus alternative options. The OptaBlaze system has a few specific features. Using a bipedicular approach, the system can treat two vertebral body levels at once, providing quicker and consistent ablation. Microinfusion technology helps in reducing impedance errors and preventing charring.

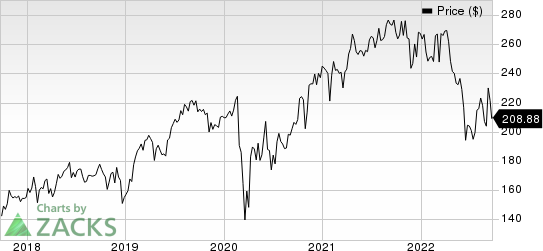

Stryker Corporation Price

Stryker Corporation price | Stryker Corporation Quote

Recent Notable Developments

In July, Stryker reported its second-quarter 2022 results, wherein it recorded an uptick in net sales, both on a reported and an organic basis. The growth momentum continued for both its reporting segments — Orthopaedics and Spine; and MedSurg and Neurotechnology.

In June, Stryker received the FDA’s 510(k) clearance for its Q Guidance System. The Spine Guidance Software is the first spine navigation software approved by the FDA for use in pediatric patients aged 13 years and above. It is worth mentioning that the Q Guidance System, when used with the Spine Guidance Software, is an advanced planning and intraoperative guidance system created to aid open or percutaneous computer-assisted surgery.

In February, Stryker completed the previously announced acquisition of Vocera Communications, Inc., which is expected to enhance its Advanced Digital Healthcare offerings and further advance its focus on preventing adverse events throughout the continuum of care.

Price Performance

Shares of Stryker have lost 21.9% so far this year compared with the industry’s 46.1% fall and the S&P 500's 21.2% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Stryker currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are ShockWave Medical SWAV, AMN Healthcare Services AMN and McKesson MCK. While ShockWave Medical and AMN Healthcare Services sport a Zacks Rank #1 (Strong Buy), McKesson carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ShockWave Medical’s earnings per share rose from $2.02 to $2.57 for 2022 and from $2.95 to $3.42 for 2023 in the past 60 days. SWAV has gained 45.1% so far this year.

ShockWave Medical delivered an earnings surprise of 180.14%, on average, in the last four quarters.

Estimates for AMN Healthcare Services have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. AMN stock has declined 14.9% so far this year.

AMN Healthcare Services delivered an earnings surprise of 15.66%, on average, in the last four quarters.

McKesson’s earnings per share estimates increased from $23.27 to $24.42 for fiscal 2023 and $25.41 to $26.04 for fiscal 2024 in the past 60 days. MCK has gained 39.6% so far this year.

McKesson delivered an earnings surprise of 13.00%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance