Strong Demand to Drive Sealed Air (SEE) Despite Cost Woes

Sealed Air Corporation SEE is benefiting from strong demand for its automated equipment and sustainable packaging solutions. SEE’s focus on acquisitions, product innovation and investment in automation will also contribute to growth. Despite the ongoing supply-chain challenges in the industry and higher input costs, gains from volume growth, pricing and productivity upsides are expected to offset these headwinds in the near term.

Solid Demand Bodes Well for Revenues

Strong demand for automated equipment and sustainable packaging solutions continues to drive growth in Sealed Air’s food and protected packaging segments. In food, the retail channel and protein exports are expected to be strong. SEE’s protein automation pipeline continues to grow across all regions, with major food producers committing to its SEE Touchless Automation future.

Sealed Air is witnessing higher food service demand than last year owing to the reopening of restaurants and other public venues. Backed by this, its fluid solutions portfolio, which comprises Cryovac Barrier Bags and pouches for condiments, soups and sauces, is witnessing growth.

Considering that these categories account for 50% of the Food segment’s sales, the same might contribute to the total top-line growth. For the Protective Packaging segment, continued growth in e-commerce and fulfillment, and higher demand in the industrial end markets are likely to drive growth. E-commerce sales, accounting for around 11% to SEE’s sales, have also been on an uptrend for a while.

Automated Solutions: A Key Catalyst

Sealed Air’s focus on automation, digital and sustainability is likely to boost market-topping growth in its core business and enable it to expand into new and adjacent markets. SEE’s pipeline for automated equipment continues to improve and it set a target to more than double its automation business to above $1 billion by 2025.

Sealed Air is investing in capacity expansion to meet strong demand for equipment solutions. These investments and the acquisitions of Automated Packaging Systems, AFP, Inc and Fagerdala will bolster growth.

Reinvent SEE Strategy to Drive Margins

Sealed Air’s Reinvent SEE strategy, focused on innovations, SG&A productivity, product-cost efficiency, channel optimization and customer-service enhancements, has been driving its earnings growth for a while. One of the most vital aspects of this strategy is investment in technology and resources apart from a firm focus on the new and existing high-growth markets. In 2022, SEE expects around $20 million of benefits from the Reinvent SEE program and nearly $40 million benefits from the SEE Operating Engine. This will continue to boost its bottom-line performance.

Supply-Chain Issues, Cost Inflation Persist

So far this year, Sealed Air has been encountering supply-chain disruptions and higher raw material costs from various factors, including general inflationary pressure, limited availability of certain raw materials and global transportation disruptions. Higher freight costs associated with the sourcing and movement of raw materials due to overall tight market conditions heightened the pressure. These factors continue to weigh on its margin performance.

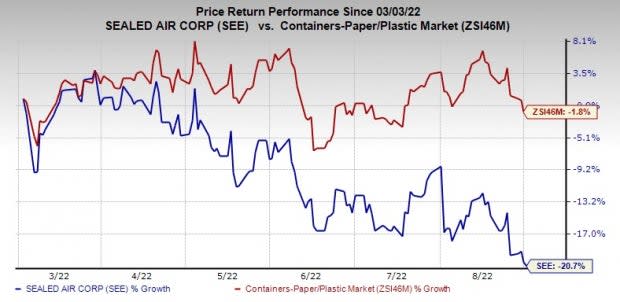

Share Price Performance

Over the past six months, Sealed Air’s shares have fallen 20.7% compared with the industry’s decline of 1.8%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Sealed Air currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the Industrial Products sector are Applied Industrial Technologies, Inc. AIT, Greif, Inc. GEF and Valmont Industries, Inc. VMI. While AIT sports a Zacks Rank #1 (Strong Buy), GEF and VMI carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

AIT’s earnings estimates have increased 5.8% for fiscal 2023 (ending June 2023) in the past 60 days.

Applied Industrial pulled off a trailing four-quarter earnings surprise of 22.8%, on average. AIT’s shares have gained 3% in the past six months.

Greif presently has a Zacks Rank of 2. GEF delivered a trailing four-quarter earnings surprise of 22.9%, on average.

GEF’s earnings estimates have increased 0.4% for fiscal 2022 (ending October 2022) in the past 60 days. Its shares have risen 11.6% in the past six months.

Valmont presently has a Zacks Rank of 2. VMI’s earnings surprise in the last four quarters was 13.7%, on average.

In the past 60 days, Valmont’s earnings estimates have increased 3.8% for 2022. The stock has rallied 25.3% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Valmont Industries, Inc. (VMI) : Free Stock Analysis Report

Sealed Air Corporation (SEE) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance