New Strong Buy Stocks for June 6th

Here are 5 stocks added to the Zacks Rank #1 (Strong Buy) List today:

Barrett Business Services, Inc. (BBSI): This company that provides business management solutions has seen the Zacks Consensus Estimate for its current year earnings increasing 1.7% over the last 60 days.

Barrett Business Services, Inc. Price and Consensus

Barrett Business Services, Inc. price-consensus-chart | Barrett Business Services, Inc. Quote

Israel Chemicals Ltd. (ICL): This specialty minerals and chemicals company has seen the Zacks Consensus Estimate for its current year earnings increasing 2.4% over the last 60 days.

Israel Chemicals Shs Price and Consensus

Israel Chemicals Shs price-consensus-chart | Israel Chemicals Shs Quote

Kemper Corporation (KMPR): This diversified insurance holding company has seen the Zacks Consensus Estimate for its current year earnings increasing 3.6% over the last 60 days.

Kemper Corporation Price and Consensus

Kemper Corporation price-consensus-chart | Kemper Corporation Quote

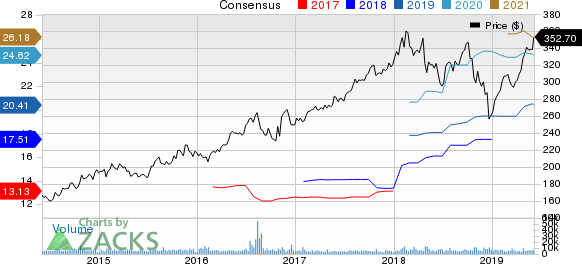

Lockheed Martin Corporation (LMT): This security and aerospace company has seen the Zacks Consensus Estimate for its current year earnings increasing 4.7% over the last 60 days.

Lockheed Martin Corporation Price and Consensus

Lockheed Martin Corporation price-consensus-chart | Lockheed Martin Corporation Quote

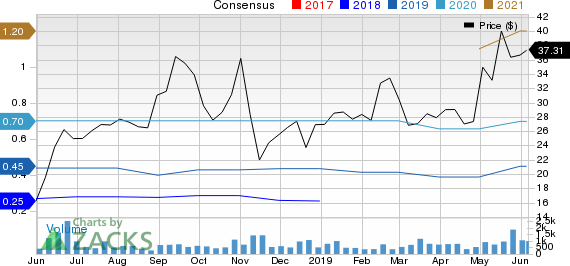

Goosehead Insurance, Inc (GSHD): This company that provides personal lines insurance agency services has seen the Zacks Consensus Estimate for its current year earnings increasing 15.4% over the last 60 days.

Goosehead Insurance Inc. Price and Consensus

Goosehead Insurance Inc. price-consensus-chart | Goosehead Insurance Inc. Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Kemper Corporation (KMPR) : Free Stock Analysis Report

Israel Chemicals Shs (ICL) : Free Stock Analysis Report

Goosehead Insurance Inc. (GSHD) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance