The stock market's biggest competition is under your mattress

The post-crisis bull market was defined for investors by low interest rates and rising stock prices.

Pushing stock prices higher was a phenomenon known to investors as TINA — there is no alternative.

Low interest rates made the nominal yield on fixed income assets paltry and the zero interest rate policies pursued by central banks around the globe left cash yielding nothing.

But with the Federal Reserve raising interest rates three times so far in 2018 — and now seven times since the financial crisis — cash actually does present an alternative to investors for the first time in a decade.

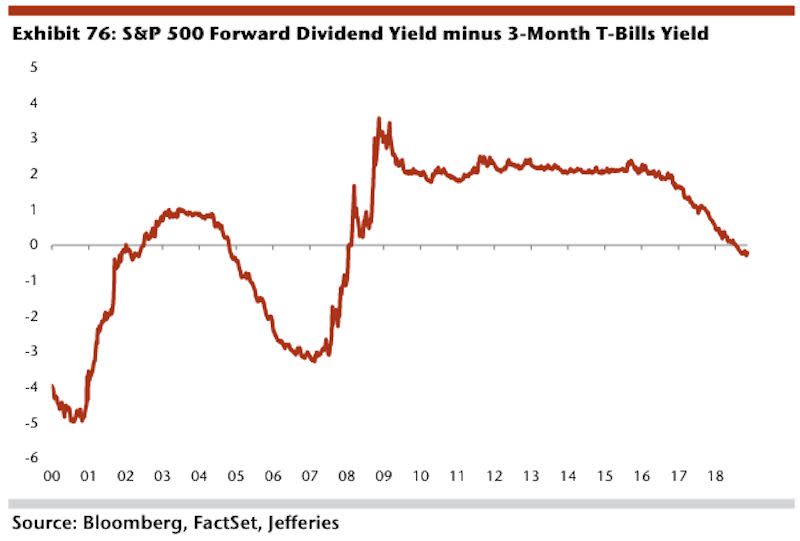

In its year-ahead equity outlook, Jefferies highlights the following chart, showing the yield on 3-month Treasury bills now exceeding the forward dividend yield for the S&P 500. Three-month bills are currently yielding about 2.4%; the S&P 500’s dividend yield is around 1.98%.

“The equity market is facing some competition from higher rates,” Jefferies wrote in its note. In other words, investors may serve themselves well by just sitting on cash and let it generate a risk-free return in an interest-bearing bank account.

Similarly, equity strategists at Goldman Sachs and Bank of America Merrill Lynch have characterized cash as “competitive.”

Markets continued their volatile trading on Tuesday with the major indexes again closing little-changed after a sharp move early in the session.

On Tuesday, it was a positive open that faded throughout the day with markets turning red after President Donald Trump saying in the Oval Office that he would welcome a government shutdown over funding for the border wall. On Monday, a quick sell-off during the morning hours was bought aggressively with stocks eventually closing in the green.

And with investors now seeing markets transition into the third straight month of heightened volatility, getting 2% for nothing continues to sound like a decent deal.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

The outlook may have dimmed, but the U.S. economy still looks strong

Almost one-third of investors think the stock market has peaked

Yahoo Finance

Yahoo Finance