Stock market pros are betting on value to outperform growth in 2019

Some big investors and a handful of Wall Street research departments are anticipating a shift on the horizon between growth and value stock investing styles.

There's a lot of ways of slicing and dicing the stock market, and one of them is between value stocks versus growth stocks. Over the last half-century, there have been periods where growth stocks outperformed value and periods where value beat growth on a relative basis. For the last decade, though, growth stocks outperformed value stocks, but now some investors are anticipating a reversion to the mean with value poised to outperform.

"[I] think now is the time to embrace value just like it was in 2000," Mark Yusko, the CIO of Morgan Creek Capital Management, said on a recent webcast with AdvisorShares DoubleLine Value Equity ETF (DBLV)'s lead portfolio manager Emidio Checonne.

On Wednesday, strategists from Deutsche Bank and JP Morgan advised clients to shift bets towards value type strategies. Deutsche Bank’s Binky Chadha noted “companies that are cheap on cash flow do very well in this environment.” Meanwhile, JP Morgan’s Dubravko Lakos-Bujas said “value is greatly oversold.”

Despite the recent volatility, most investors aren't fleeing the market, Yusko added. While many are allocating to cash, there will still be money invested long in the market.

Yusko made a case for why investors should reduce their exposure to beta and passive management and instead seek out active management and value.

"I think the combination of those things is going to generate fantastic returns over the next decade," Yusko said.

Growth wins in 2018

According to Bank of America's U.S. Mutual Fund Performance Update for the year ending 2018, growth funds had their best year since 2007, with 59% outperforming. Most of that performance was driven by the first quarter in 2018 when 77% of growth funds beat the Russell 1000 Growth Index, the report noted. Meanwhile, only 32% of value funds beat the Russell 1000 Value Index in 2018, with the average relative performance of -0.51%.

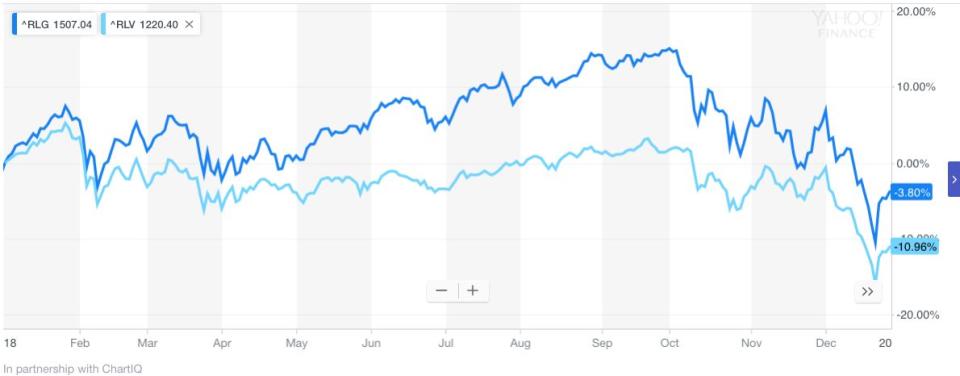

Growth stocks were on a tear at the beginning of 2018, with secular growth stories being the big theme of the market. The Russell 1000 Growth index (^RLG) finished the year down -3.8%, while the Russell 1000 Value index (^RLV) dropped -10.9%. During the fourth quarter, value outperformed growth on a relative basis, with the value index falling 12.4% and growth slipping 16.4%.

"I think what's happening is some of the air is coming out of the valuations for growth stocks," Jeremey Zirin, Head of Equities Americas for UBS, said in a recent phone interview about his 2019 outlook that makes a case for value to outperform growth.

According to Zirin, there's an opportunity for a catch-up trade for value stocks. Some of the areas of opportunity include financials and energy.

Value isn’t dead

DoubleLine's Emidio Checcone looked at market data going back to 1965 and found that value has outperformed growth by 2.7% per year over the long term.

"There are a lot of value investors right now losing faith in the long-term view of value," Checcone told Yahoo Finance in a recent phone interview, "There's very strong empirical evidence, that's been sustained periods in the past, where the premature demise of value investing has been declared only to watch it resurge. We think the reasons for that have to do with persistent quirks in the human mind, so-called cognitive biases, that cause value stocks to be dumped. Value investors, successful through time, have been able to capitalize on that."

Checcone sees a few catalysts to bring about this mean reversion, one of which is the transition from quantitative easing, which favored growth stocks, to quantitative tightening, which will benefit value. Growth stocks' significant outperformance coincides with QE programs expanding the balance sheets of central banks, artificially suppressing interest rates, and creating extremely loose money.

As part of his research, Checcone also looked at periods of tightening since World War II. What he found is that value outperformed growth in periods of tightening.

What's more, all of this is happening amid a period where markets look vulnerable. It's DoubleLine's house view that this is a bear market.

To be sure, it's not a bullish call that DoubleLine is making on value stocks. Instead, it's about the relative performance of value versus growth.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Yahoo Finance

Yahoo Finance