Stock market meltdown post mortem

Today’s market rout is a continuation of Friday’s meltdown in the US equity markets, which capped off the worst weekly performance by all three major equity market indices in over a year. It’s worth looking at exactly what happened.

On Friday alone the S&P 500 (^GSPC, SPY) lost 59.85 points or 2.12%. The Dow Industrials (^DJI, DIA) (-665.75 pts/2.54%) and Nasdaq Composite (^IXIC, QQQ) (144.94pts/-1.96%) traded lower in lockstep. Adding significance to the trade, volume expanded dramatically for the week and in particular on Friday. On Friday NYSE volume surged 8.89%. Nasdaq volume jumped 12.65%. The negative price action coupled with the massive uptick in volume underscores my sense that we have reached an inflection point of sorts. Additionally, markets closed on their intraday lows — rarely a good sign.

The primary driver of the selloff was a result of dramatically rising interest rates. On Friday the closely watched US 10-yr yield rose 2.92% to close at 2.85%. Not only is that the highest yield for the 10-yr. over the past 12 months, it is it’s highest yield since January 6, 2014. That lurch higher in rates has altered the landscape for investors in a potentially meaningful way.

Including last week’s selloff, the S&P still has a relatively elevated P/E of 22.47 and a 52-week gain of 22.62%. It could be argued that as a result of stretched valuations alone that equity markets have been due for a pullback and ultimately a degree of valuation compression. I have made that argument here in the note, but that is not the whole story.

That valuation-centric premise has been buttressed by a dramatic shift higher in T-note yields—a move long anticipated but delayed by Federal Reserve monetary policy.

On Friday, the dramatic turn lower in equity prices coupled with the equally dramatic rise interest rates was captured by the long-dormant Volatility Index. On the day the VIX sharply rose 28.52% to close the session at 17.31 – the highest close since October 31, 2016.

We have finally reached an inflection point in markets. The long-awaited confluence of rising interest rates, fueled by improving inflation metrics found in employment and other economic data, has fueled active hedging on the part of portfolio managers. Traders are expecting the recent turn higher in rates to materialize as a trend. By historical standards, interest rates are still relatively low, and if forecasts for increased economic activity, continued gains in employment, expanding GDP and improving corporate results are any indication, they could potentially rise meaningfully higher in coming quarters.

In the first FOMC meeting of the year last week, the Fed left rates unchanged, as expected, but did lay the groundwork for further tightening in 2018. That guidance on Wednesday in conjunction with the Atlanta Fed’s call for a Q1 GDP reading of 5.4% on Thursday fueled a shift in investor expectations that lulled even the most hesitant bond bulls to reverse course—putting an exclamation point on the thesis that the 30-year bull market in US Treasuries has come to an end.

Adding addition pressure and uncertainty to the investing landscape is the prospect of another Federal government shutdown in the near term as I wrote here last Monday, January 29.

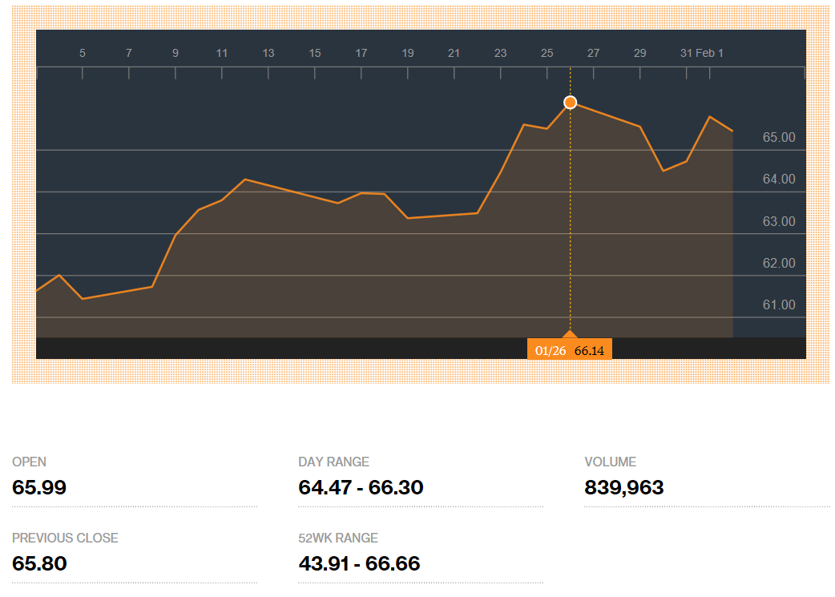

Last week’s turbulence in US equity and credit markets did to a degree also spill over and into energy markets. US WTI crude prices moderated in the week. From Friday, January 26 through last Friday, February 2, WTI slipped 1%. Though I do expect continued expansion of US shale oil production to impact energy prices in the form of a headwind, consumption will remain strong. Weakness in the US dollar should act as a counterbalance to that theme (see Sam Stovall’s mention of the weakness in the US dollar).

Baltic Dry Index

For years the BDI has been widely considered a leading global economic indicator. Since the onset of the global financial crisis in 2008, it has been in state or dormancy, as the long-term chart below suggests. In part that has to do with the collapse of global trade following the crisis. However, the industry has also gone through a period of rigorous consolidation as a result of oversupply. As an index, it has also shifted its weighting to focus on capsize ships and away from smaller vessels.

Indications are that the global economy is in the best shape it has been in a decade. In fact, since mid-2017, the global economy has largely been in sync. We have seen equity prices, economic data and asset reflation across developed and developing economies around the globe. If that trend continues, as I suspect it will, there may well be significant opportunity in the BDI. As shipping accelerates along with global economic expansion, so will shipping rates. Those increasing rates will be reflected in the BDI.

Economic data and earnings:

JOLTS, due out Tuesday, does normally receive a fair amount of attention but in my opinion is not very relevant in that it is backward looking. For example this release speaks to December of 2017. It is an employment-centric report of sorts and given the weekly jobless data and monthly data we receive, it is already a topline number that is baked into the economic landscape for investors.

On Wednesday we receive the weekly EIA Petroleum Status Report. Last week’s report reflected a 6.8 million bbl build in crude inventories which speaks to rising US production. Weekly jobless claims for the week ending 2/3 are expected to be 235k according to Bloomberg consensus. The four-week moving average is 234.5k. Wholesale Trade and the Baker-Hughes Rig Count totals round out the week. Last week’s totals reflected a climb in rigs to 1288 for North America.

Corporate Results:

Leaders in our recent leg up in the rally have been large-cap tech names. That reversed last week as both Alphabet (GOOGL, GOOG) and Apple (AAPL) shares lost significant ground. Both reported earnings on Friday. Alphabet lost nearly 5% while Apple lost 4.3% on the session. Apple lost 6% on the week. Naturally, Apple supply-chain names took it on the chin as well. Not to be outdone, energy names added to last week’s rout. Exxon-Mobil (XOM) and Chevron (CVX) fell sharply after delivering disappointing quarterly earnings reports.

Commentary by Sam Stovall, chief investment strategist at CFRA Research

In the past month, the U.S. dollar has come under pressure, as the DXY (DX-Y.NYB) fell below its beginning-of-year 92 level to the current 89 reading; we see it averaging close to 84 by the final quarter of this year. In the meantime, the 10-year yield (^TNX) has risen above 2.7% after starting the year below 2.45%; we see it averaging 2.85% in Q4 of 2018. Consensus S&P 500 EPS estimates for 2018 have climbed from the 12/29/17 forecast of $145.31 to the current projection of $153.11, according to S&P Capital IQ; we see the final tally coming in closer to $155. Finally, the large-cap S&P 500 outpaced its mid- and small-cap brethren YTD through 1/30/18, yet we see these roles reversing by year-end accompanied by a pick-up in stock market volatility in this traditionally challenging mid-term election year, which has historically seen the greatest number of 1% up/down days within the four-year presidential cycle since World War II.

Economic Calendar:

Tuesday

8:30 AM International Trade

8:55 AM Redbook

10:00 AM JOLTS

James Bullard, 8:50 AM

Wednesday

7:00 AM MBA Mortgage Applications

10:30 AM EIA Petroleum Status Report

3:00 PM Consumer Credit

William Dudley, 8:30 AM

Charles Evans, 11:15 AM

John Williams, 5:20 PM

Thursday

Chain Store Sales

8:30 AM Weekly Jobless Claims

9:45 AM Bloomberg Consumer Comfort Index

Robert Kaplan, 4:50 AM

Neel Kashkari, 9:00 AM

Esther George, 9:00 PM

Friday

10:00 AM Wholesale Trade

1:00 PM Baker-Hughes Rig Count

Kenny’s Commentary in the news:

http://money.cnn.com/2018/02/04/investing/stocks-week-ahead-main-street-wall-street/index.html

Yahoo Finance

Yahoo Finance