Stock Market Live Updates: Record highs amid strong economic data

Follow Yahoo Finance here for up-to-the-minute briefings on the financial markets, breaking news and other topics of interest to investors and traders. Please check back for continuing coverage.

-

4:00 p.m. ET: Happy Thanksgiving!

Stocks closed at record highs.

S&P 500 (^GSPC): +0.42%, or 13.11 points

Dow (^DJI): +0.15%, or 43.32 points

Nasdaq (^IXIC): +0.66%, or 57.24 points

10-year Treasury yield (^TNX): +2.9 bps to 1.769%

Gold (GC=F): -0.4% to $1,461.50 per ounce

-

2:43 p.m. ET: What’s next after this massive year-to-date rally?

The S&P 500 is up 25% since the beginning of the year. What’s next? It might help to review the history.

Bespoke Investment Group reviewed the 22 years where the S&P gained more than 20% through Thanksgiving. “the S&P has averaged a further gain of 1.80% from Thanksgiving through year end in the 22 prior years with positive returns 77.3% of the time. The strongest gain from Thanksgiving through year end in any of these years was +6.38% in 1958, while the biggest decline came in 1980 when the S&P fell 3.15% after gaining 29.86% through Thanksgiving. In no year did the S&P fail to finish up 20%+ YTD after gaining at least 20% YTD through Thanksgiving.“

-

2:03 p.m. ET: Record highs for the stock market

The three major U.S. indices are setting new record highs.

S&P 500 (^GSPC): +0.37%, or 11.75 points

Dow (^DJI): +0.15%, or 42.34 points

Nasdaq (^IXIC): +0.56%, or 48.37 points

10-year Treasury yield (^TNX): +2 bps to 1.76%

Gold (GC=F): -0.42% to $1,461.20 per ounce

-

2:00 p.m. ET: Beige Book: Growth is modest, and the outlook is positive

Like this morning’s economic data (see below), the Fed’s Beige Book – a collection of economic anecdotes from across the country – confirms things are looking pretty decent in the U.S.

From the Beige Book: “Economic activity expanded modestly from October through mid-November, similar to the pace of growth seen over the prior reporting period... Outlooks generally remained positive, with some contacts expecting the current pace of growth to continue into next year.“

-

1:37 p.m. ET: Toys R Us CEO: Company’s comeback is ‘a dream come true’

Yahoo Finance’s Brian Sozzi caught up with Toys R Us CEO Richard Barry on the day of its store opening.

From the interview: “It’s a dream come true for me personally, I have been around the company for decades. There are not many times when you can make a brand that has got such an incredible emotional connection like Toys R Us — a classic America brand —and have the opportunity to reimagine it and bring it back. I feel very humbled by being given that role to do that and I think we are executing in some interesting and different ways. The old playbook would have been put up stores and run e-commerce off that. We decided to go down a path of working through partnerships and really building relationships to help bring back the Toys R Us brand.“

-

12:27 p.m. ET: Mark your calendars

December marks the 10th anniversary of DoubleLine's founding. Yahoo Finance’s Julia La Roche will be reporting from DoubleLine in Los Angeles on Monday Dec 2nd. We'll have exclusive access to the trading floor with live interviews with DoubleLine portfolio managers. We’ll also have a live exclusive sit-down with founder and CEO Jeffrey Gundlach.

-

11:25 a.m. ET: The holiday shopping season is looking robust

From Adobe Analytics: “Based on Adobe Analytics data, the full holiday season is tracking at 15.0% YoY growth with $50.1 billion spent online between 11/1 and 11/26, representing a comparable* increase of 15.8% YoY. As forecasted, all 26 days in Nov. have surpassed $1B in online sales, with 7 days surpassing $2B, making this the first year of multiple $2B days at this point in the holiday season. As of this morning, $240M has already been spent online, representing 19.3% growth YoY, on track to hit $2.9B. We’re reaffirming our full season (Nov-Dec) forecast of $143.7B spent online.

“Looking ahead, Adobe Analytics is forecasting $4.4B (19.7% growth YoY) in online sales on Thanksgiving and $7.5B (20.5% YoY) for Black Friday. Adobe is forecasting that Cyber Monday will set a new record with $9.4B in sales, a 19.1% increase YoY.“

-

11:14 a.m. ET: Markets aren’t doing a whole lot

Chalk it up to traders and investors starting Thanksgiving early?

S&P 500 (^GSPC): +0.17%, or 5.43 points

Dow (^DJI): +0.01%, or 3.52 points

Nasdaq (^IXIC): +0.41%, or 35.71 points

10-year Treasury yield (^TNX): +2.7 bps to 1.767%

Gold (GC=F): -0.45% to $1,453.80 per ounce

-

10:38 a.m. ET: Netflix is having an incredible decade

Bloomberg’s Michael Regan tweeted this list of the 10 best and 10 worst performing S&P 500 stocks of the decade so far.

Best stock of the decade (in SPX) = Netflix, +3,884% pic.twitter.com/y3ul5rMpXi

— Michael P. Regan (@Reganonymous) November 27, 2019

-

10:16: a.m. ET: The $181,000 Thanksgiving dinner

How do your Thanksgiving dinner plans stack up?

This Thanksgiving dinner costs $181,000: https://t.co/4pO4xF3G0u pic.twitter.com/TmKm5qV5Eq

— Yahoo Finance (@YahooFinance) November 27, 2019

-

10:00 a.m. ET: Spending growth outpaces income

Some mixed data.

Personal income growth was flat in October (0.3% expected)

Personal spending growth was 0.3%, as expected

Pending home sales unexpectedly fell 1.7% in October (0.2% expected)

-

9:30 a.m. ET: Markets open mixed after rush of bullish data

S&P 500 (^GSPC): +0.22%, or 6.88 points

Dow (^DJI): +0.06%, or 17.12 points

Nasdaq (^IXIC): +0.25%, or 21.98 points

10-year Treasury yield (^TNX): +2.4 bps to 1.764%

Gold (GC=F): -0.41% to $1,454.30 per ounce

Highlight: “There's always that potential for some kind of news particularly around trade that could send stocks lower,” Invesco Chief Global Market Strategist @KristinaHooper says. “So certainly the bias is toward the upside.” https://t.co/Jb7k9twFHf pic.twitter.com/DKz8P6IuUP

— Yahoo Finance (@YahooFinance) November 27, 2019

-

9:25 a.m. ET: Economists are impressed by the economy

The wave of better-than-expected economic data released at 8:30 a.m. ET (see below) have given economists something to be cheerful about. (emphasis added)

From Capital Economics’ Michael Pearce: “The rise in durable goods orders last month was driven by a surge in orders for underlying capital goods, suggesting that business equipment investment is holding up better than anticipated... Headline durable goods orders unexpectedly rose by 0.6% m/m in October. We had been braced for a large fall in auto orders due to the GM strike but, in the event, transport orders actually rose by 0.7% m/m as a 1.9% m/m strike-related fall in motor vehicle orders was more than offset by an increase in orders for both defense and non-defense aircraft.”

From High Frequency Economics’ Jim O’Sullivan: “In short, claims fell after two slightly-above-trend readings. At 220K, the four-week average is up just slightly from the 217K year-to-date average. The data remain consistent with a still-strong labor market.”

From MUFG’s Chris Rupkey: “3.1 percent US GDP growth to start the year, 2.0 percent in the second quarter and 2.1 percent in the second look at the third quarter today. The consumer is still in the driver's seat when it comes to steering the economy forward as capital investment spending has cooled due to the uncertain business outlook. The news is not all bad as gains in software purchases, and R&D expenditures partially offset the decline in equipment spending and less investment in offices, warehouses, factories and especially, oil & gas drilling.”

-

8:39 a.m. ET: November was a month of market milestones

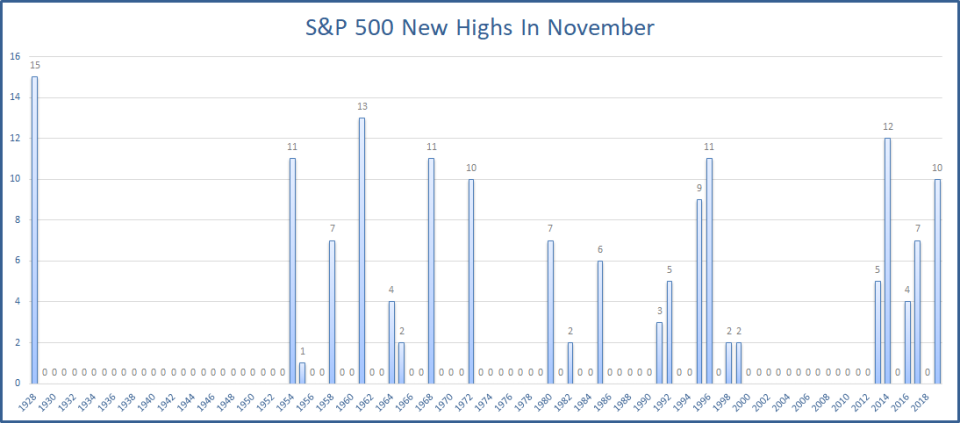

“The S&P 500 has made 10 new all-time highs this month, the most in the month of November since 12 in 2014,” LPL Financial’s Ryan Detrick observed.

-

8:30 a.m. ET: U.S. economic data offer something to be thankful for

GDP revisions, durable goods orders, and initial jobless claims all beat expectations, reflecting an economy that looks better than what many expected.

Q3 GDP growth was revised to 2.1% (1.9% expected) from last month’s estimate of 1.9%

Q3 personal consumption growth was unchanged at 2.9% (2.8% expected)

Durable goods orders unexpected climbed 0.6% in October (-0.9% expected)

Nondefense capital good orders ex. aircraft jumped 1.2% (-0.2% expected)

Weekly initial jobless claims fell to 213,000 (221,000 expected)

-

8:25 a.m. ET: Farm equipment maker Deere hurt by trade tensions

Deere & Co reported declining profits and warned of weakness in 2020 due to poor weather and the unresolved trade war between the U.S. and China.

"Lingering trade tensions coupled with a year of difficult growing and harvesting conditions have caused many farmers to become cautious about making major investments in new equipment," said CEO John May.

Shares are down 4% in pre-market trading.

-

8:21 a.m. ET: Futures are up a hair

Here were the main moves in markets so far:

S&P 500 futures (ES=F): +0.11%, or 3.5 points

Dow futures (YM=F): +0.01%, or 3 points

Nasdaq futures (NQ=F): +0.21%, or 17.5 points

10-year Treasury yield (^TNX): +1.2 bps to 1.752%

Gold (GC=F): -0.32% to $1,455.70 per ounce

-

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news

Yahoo Finance

Yahoo Finance