STERIS (STE) Q4 Earnings Beat Estimates, Gross Margin Falls

STERIS plc STE reported fourth-quarter fiscal 2023 adjusted earnings per share (EPS) of $2.30, up 12.7% from the year-ago quarter’s figure. The metric also exceeded the Zacks Consensus Estimate by 6.9%.

The adjustment excludes the impacts of certain non-recurring charges like the amortization of acquired intangible assets and acquisition and integration-related charges among others.

The company’s GAAP EPS was $1.88, up 75.7% from the year-ago quarter’s earnings of $1.07.

Full-year adjusted EPS was $8.20, up 3.5% from fiscal 2022.

Revenues in Detail

Revenues of $1.38 billion increased 14% year over year in the fourth quarter. The metric beat the Zacks Consensus Estimate by 8.7%.

Organic revenues at constant exchange rate or CER rose 16% year over year in the fiscal fourth quarter.

In fiscal 2023, the company reported revenues of $4.96 billion, up 8.1% from fiscal 2022.

Quarter in Detail

The company operates through four segments — Healthcare, Applied Sterilization Technologies (AST), Life Sciences and Dental.

Revenues at Healthcare rose 20% year over year to $884.6 million (up 21% on a CER organic basis). This performance reflected a 31% improvement in capital equipment revenues, a 15% increase in service revenues and a 15% rise in consumable revenues.

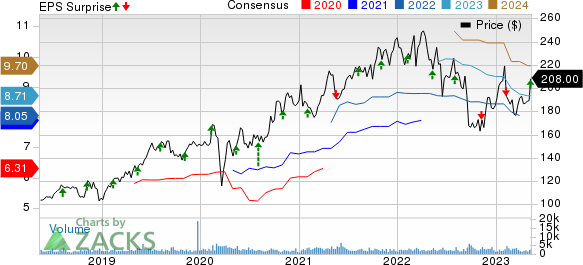

STERIS plc Price, Consensus and EPS Surprise

STERIS plc price-consensus-eps-surprise-chart | STERIS plc Quote

Revenues at AST improved 7% to $239.1 million (up 10% on a CER organic basis). Revenue growth was driven by increased demand from core medical device customers, partially offset by continued reduction in demand from single-use bioprocessing customers.

Revenues in the Life Sciences segment rose 10% to $157.5 million (up 11% year over year on a CER organic basis). Service revenues rose 6% and capital equipment revenues increased 8%. Consumable revenues rose 14%.

The Dental segment reported revenues of $103.6 million, down 2% year over year (down 1% on a CER organic basis).

Margins

Gross profit in the reported quarter was $558.1 million, up 2.9% from the prior-year quarter’s gross profit. Gross margin contracted 475 basis points (bps) year over year to 42.5% in the reported quarter.

STERIS witnessed a 25.9% year-over-year drop in selling, general and administrative expenses to $335.9 million. Research and development expenses rose 1.1% to $26.4 million. Adjusted operating expenses of $362.3 million declined 24.5% year over year. The adjusted operating margin expanded 871 bps to 16.3%.

Financial Details

STERIS exited fiscal 2023 with cash and cash equivalents of $208.4 million compared with $259.4 million at the end of the fiscal third quarter.

Cumulative net cash flow from operating activities at the end of fiscal fourth quarter was $756.9 million compared with $684.8 million a year ago.

Further, the company has a five-year annualized dividend growth rate of 8.44%.

Guidance

STERIS provided its fiscal 2024 financial guidance. Full-year revenues are expected to increase 7-8% from fiscal 2022. Organic revenues at CER are expected to increase 6-7%. The Zacks Consensus Estimate for fiscal 2023 revenues is pegged at $5.14 billion.

Adjusted earnings per share for fiscal 2023 are expected in the range of $8.55 to $8.75. The Zacks Consensus Estimate for the metric is pegged at $8.71.

Our Take

STERIS exited fourth-quarter fiscal 2023 with earnings and revenue beat. Barring Dental, each of STERIS’s operating segments reported robust organic revenue performance, which is encouraging. Yet, escalating costs are putting pressure on gross profit.

Heading into fiscal 2024, the company is optimistic that many of the challenges of fiscal 2023 are abating, including procedure volumes and supply chain constraints.

Zacks Rank and Key Picks

STERIS currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Edwards Lifesciences Corporation EW, Intuitive Surgical, Inc. ISRG and Johnson & Johnson JNJ.

Edwards Lifesciences, carrying a Zacks Rank #2 (Buy), reported first-quarter 2023 adjusted EPS of 62 cents, beating the Zacks Consensus Estimate by 1.6%. Revenues of $1.46 billion outpaced the consensus mark by 4.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences has a long-term estimated growth rate of 6.8%. EW’s earnings surpassed estimates in two of the trailing four quarters, missed the same in one and came in line in the other, the average being 1.2%.

Intuitive Surgical, having a Zacks Rank #2, reported first-quarter 2023 adjusted EPS of $1.23, which beat the Zacks Consensus Estimate by 3.4%. Revenues of $1.70 billion outpaced the consensus mark by 6.9%.

Intuitive Surgical has a long-term estimated growth rate of 13%. ISRG’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average being 1.9%.

Johnson & Johnson reported first-quarter 2023 adjusted earnings of $2.68 per share, beating the Zacks Consensus Estimate by 6.8%. Revenues of $24.75 billion surpassed the Zacks Consensus Estimate by 5%. It currently carries a Zacks Rank #2.

Johnson & Johnson has a long-term estimated growth rate of 5.5%. JNJ’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance