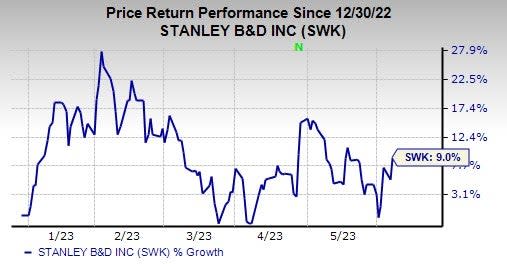

Stanley Black's (SWK) 9% YTD Gain Raises Longevity Questions

Shares of Stanley Black & Decker, Inc. SWK have gained 9% in the year-to-date period. The upside can be linked to accretive pricing actions and strength in its end markets.

Catalysts Behind the Share Price Increase

Stanley Black is benefiting from pricing actions, productivity gains and strength in aerospace and auto markets within the Industrial segment. The company expects low single-digit organic growth for the segment in 2023.

SWK is making efforts to eliminate and reduce overlapping capabilities and functions. The company is resizing its operations to ensure that resources better serve core businesses. In the first quarter of 2023, SWK generated pre-tax run rate savings of $230 million from the global cost reduction program. The company expects to generate run rate savings of $1 billion from this program in 2023. By 2025, Stanley Black expects run rate savings of $2 billion.

Image Source: Zacks Investment Research

SWK’s consistent measures to reward its shareholders through dividend payments are also likely to have boosted the stock. In the first three months of 2023, it paid dividends of $119.8 million to its shareholders, up 3% from the year-ago period. Stanley Black has been on track to buy back $4 billion worth of shares by 2023. It’s worth noting that in March 2022, the company initiated an accelerated share repurchase program, through which it repurchased shares worth $2.3 billion. SWK intends to buy back the remaining $1.7 billion worth of shares in 2023.

Will the Uptrend in Shares Last?

A reduction in raw material costs due to the deceleration in inflation is likely to support SWK’s performance in 2023. Stanley Black’s global cost-reduction program is also expected to aid its bottom line in the quarters ahead. Strategic investments in innovation engine, electrification and commercialization activation should also position the company well for sustainable growth and margin expansion.

Zacks Rank & Stocks to Consider

SWK currently carries a Zacks Rank #3 (Hold). Some better-ranked companies from the Industrial Products sector are discussed below:

Ingersoll Rand Inc. IR presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

IR delivered a trailing four-quarter earnings surprise of 12.6%, on average. In the past 60 days, estimates for Ingersoll Rand’s 2023 earnings have increased 7.5%. The stock has improved 17.7% in the year-to-date period.

Alamo Group Inc. ALG currently sports a Zacks Rank of 1. ALG delivered a trailing four-quarter earnings surprise of 17.7%, on average.

In the past 60 days, estimates for Alamo’s 2023 earnings have increased 12.7%. The stock has gained 26.9% in the year-to-date period.

Axon Enterprise AXON sports a Zacks Rank of 1 at present. The company has a trailing four-quarter earnings surprise of 44.4%, on average.

In the past 60 days, estimates for Axon’s 2023 earnings have increased 13%. The stock has rallied 17.5% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stanley Black & Decker, Inc. (SWK) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report

Axon Enterprise, Inc (AXON) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance