How to spot a tax scam and what to do if you fall for one

Tax season often comes with its share of scams. And many of these are solely about attacking your bank account. Whether or not you know it’s happening to you is one thing, but either way, it’s more than a bit of a nuisance when you fall victim to the scheme, which has become easier to do as more and more information is shared online, often on platforms not having the proper safeguards and protections in place.

Take TrickBot, for example, which was developed in 2016 and has been a recent cause of concern, hitting people’s accounts on a global front. The malware targets vulnerable devices on networks, searching for passwords, banking information, or anything financial and sensitive that can further compromise a person’s data.

After collecting this information, those in charge of the operation can then steal money and information that can threaten a person’s livelihood. It happens, we know this. But, are we prepared for it to happen to us?

Right away if one suspects their data has been breached they should report it to the RCMP. But even before it gets to that stage, Canadians should be wary and on alert for scams.

“If someone receives an email they should never click on any links or confirm any information via emails,” says Jessica Gunson, Intake Unit Manager at the Canadian Anti-Fraud Centre (CAFC).

“If a consumer uses the CRA ‘My Account’ online services then logging into their account independently after receiving a call or email is the best step. While the CRA do have campaigns that include calls to consumers and businesses, they will never ask for money to be sent over the phone.”

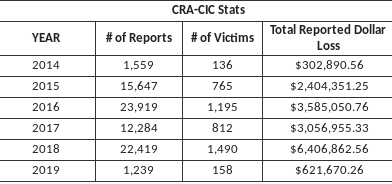

Below is a record of the number of reports and victims that have been affected, and reported dollar loss due tax scams. The information was provided to Yahoo Finance Canada, courtesy of the Canadian Anti Fraud Centre (CAFC).

Now that we’re in tax season, Canadians filing financial data is exactly the type of information fraudsters want to get a hold of. Also, with rising popularity among alternative currencies like bitcoin, the exchange of funds can be done with less discrepancy, for now at least.

Many Canadians do their taxes online and use software such as TurboTax, which sends email notifications whenever important changes have been made to one’s account (i.e. signing in for the first time on a new device, updating payment method or changing a password). TurboTax also sends a unique six-digit code to your device which can be used in combination with your password to access your account upon login. The more multi-authentication methods, the better.

Protecting yourself

Stealing tax documents and key information can lead to scammers filing fraudulent end-of-year tax forms, too. Below are warnings and general rules to abide by when it comes to safeguarding yourself against the threat of tax scams.

Now (and always) keep in mind the following:

The CRA never requests payment by Interac e-transfer, bitcoin, prepaid credit cards or gift cards.

The CRA does call taxpayers on the phone occasionally, but if a call seems suspicious or unprofessional (i.e. threatening, forceful and/or abusive language), hang up.

If you have any doubts about a CRA call, contact CRA to confirm your tax situation using the General Tax Enquiries phone number (1-800-959-8281), or through one of the CRA’s secure portals: My Account, My Business Account, or Represent a Client. Another number, 1-866-474-8272, is an automated service that provides you CRA Individual Tax Account Balance as well as your last payment amount and date.

The Canadian Anti-Fraud Centre (CAFC ) is Canada’s central repository for data, intelligence and resource material as it relates to fraud. The CAFC commits to providing timely, accurate and useful information to assist citizens, businesses, law enforcement and governments in Canada and around the world.

If you’ve happened to fall victim to a scam and paid money or exposed your financial information, contact local police to file a report, and also contact your financial institution. If you shared your social insurance number, contact Service Canada immediately.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance