Southwestern Energy (SWN) Q3 Earnings & Sales Beat Estimates

Southwestern Energy Company SWN reported third-quarter 2018 adjusted earnings of 25 cents per share, which beat the Zacks Consensus Estimate of 21 cents. In the prior-year quarter, the company had delivered earnings of 6 cents.

Quarterly operating revenues of $951 million beat the Zacks Consensus Estimate of $889.1 million and also improved from $737 million in third-quarter 2017.

The upside can be attributed to higher production and realized prices of commodities.

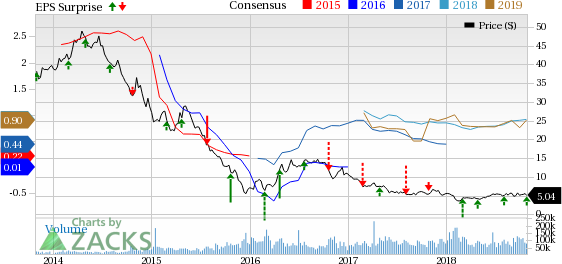

Southwestern Energy Company Price, Consensus and EPS Surprise

Southwestern Energy Company Price, Consensus and EPS Surprise | Southwestern Energy Company Quote

Production and Realized Prices

During the third quarter, the company’s total production grew 8.6% year over year to 252 billion cubic feet equivalent (Bcfe). This was primarily backed by a 22% year-over-year rise in output from the Appalachian assets. Moreover, the company recorded liquids production of 67.1 thousand barrels per day (MBbls/d), which includes 56.3 MBbls/d of NGLs and 10.8 MBbls/d of oil. Of the total production in the quarter, 85.3% was natural gas.

Notably, in this quarter, Southwestern Energy created a record by drilling two laterals of 15,559 feet (in West Virginia) and 16,272 feet (in Pennsylvania).

The company’s average realized gas price in the quarter, including hedges, increased to $2.16 per thousand cubic feet (Mcf) from $1.97 per Mcf in the year-ago quarter. Oil was sold at $59.96 per barrel compared with the year-earlier level of $40.49. Natural gas liquids were sold at $19.43 per barrel compared with $14.47 in the prior-year quarter.

Segmental Highlights

Operating income from the Exploration and Production (E&P) segment was $175 million compared with $64 million in the year-ago quarter. This increase was due to higher production and realized prices.

On a per-Mcfe basis, lease operating expenses were 92 cents compared with the prior-year level of 91 cents. General and administrative expenses per unit of production declined to 18 cents from 23 cents in the prior-year quarter.

Operating loss in the company’s Midstream Services segment was $108 million against operating income of $46 million in the year-ago quarter. The decline was primarily caused due to lower volumes in the Fayetteville Shale.

Share Repurchase

In the third quarter of 2018, the company spent $25 million and bought back 4.8 million shares.

Capital Expenditure

Total capital expenditure in the reported quarter was $298 million. The company’s total capital expenditure during the first nine months of 2018 was approximately $1,039 million.

Balance Sheet

As of Sep 30, the company had $9 million in cash and cash equivalents. Southwestern Energy’s long-term debt was $3.6 billion, which represents a debt-to-capitalization ratio of 61.8%.

Divestment

In the third quarter, Southwestern Energy agreed to divest its E&P and midstream assets in Fayetteville Shale for $1.9 billion. The company intends to use the proceeds from the divestment to reduce debt burden and increase shareholders’ value through buybacks. The company will also use part of the proceeds for developing its liquids-rich Appalachia assets. The transaction is expected to close by the end of 2018. The company plans to retire $900 million in senior notes, following the completion of the divestment procedures.

Southwestern Energy kept its full-year guidance unchanged.

Zacks Rank & Key Picks

Currently, Southwestern Energyhas a Zacks Rank #3 (Hold). Investors interested in the energy sector can opt for some better-ranked stocks given below:

El Dorado, AR-based Murphy Oil Corporation MUR carries a Zacks Rank #1 (Strong Buy). The company’s sales for 2018 are expected to grow more than 20% from 2017. You can see the complete list of today’s Zacks #1 Rank stocks here.

Brazilian state-run Petroleo Brasileiro S.A. or Petrobras PBR has a Zacks Rank #2 (Buy). The company’s earnings for 2018 are expected to surge more than 100% from the 2017 level.

Woodlands, TX-based Anadarko Petroleum Corporation APC holds a Zacks Rank #2. The company’s earnings for 2018 are expected to surge more than 250% year over year.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwestern Energy Company (SWN) : Free Stock Analysis Report

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

Anadarko Petroleum Corporation (APC) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance