Southern Copper (SCCO) Q1 Earnings Lag Estimates, Sales Beat

Southern Copper Corporation SCCO reported first-quarter 2020 adjusted earnings of 28 cents per share, which missed the Zacks Consensus Estimate of 39 cents. The figure also declined 44% from prior-year quarter figure of 39 cents primarily owing to lower sales and higher operating costs.

Net sales came in at $1,720 million, down 2% year over year. However, the top line surpassed the Zacks Consensus Estimate of $1,637 million. While the company witnessed higher volumes of copper, silver and molybdenum and zinc, lower metal prices led to lower sales in the quarter.

Total operating costs flared up 12% year over year to $1,186 million. Operating profit plunged 23% to $533 million on lower sales and higher operating costs. Adjusted EBITDA declined 19% year over year to $719 million in first-quarter 2020. Adjusted EBITDA margin was 42% compared with the prior-year quarter figure of 51%.

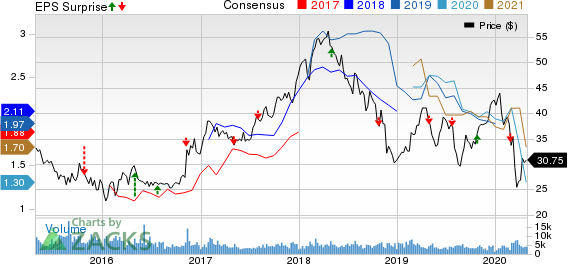

Southern Copper Corporation Price, Consensus and EPS Surprise

Southern Copper Corporation price-consensus-eps-surprise-chart | Southern Copper Corporation Quote

Operating Highlights

Copper: Southern Copper mined 241,967 tons of copper during the reported quarter, up 6% year over year.

Molybdenum: The company mined 7,185 tons of molybdenum during the reported quarter, indicating year-over-year growth of 40%.

Zinc: The company’s zinc production improved 4% year over year to 19,263 tons in the quarter under review.

Silver: Southern Copper’s silver production surged 22% year over year to 5,278,000 ounces.

Financials

The company generated net cash from operating activities of $475 million in first-quarter 2020 compared with $371 million in the prior-year quarter.

Cash and cash equivalents were at $2,051.6 million at the end of first-quarter 2020, up from $737 million recorded at the end of the prior year and $1,925 million as of fiscal 2019 end. Long-term debt was $6,542 million at the quarter end compared with $6,541 million as of 2019 end and $5,960 million as of the prior-year quarter end.

The company made capital investments worth $101 million during the reported quarter.

On Apr 23, 2020, Southern Copper’s board of directors authorized a dividend of 20 cents per share payable on May 26, 2020, to shareholders of record at the close of business on May 13, 2020. Due to the uncertainty of the metal markets and world economy, and its planned expansions, the board has slashed the dividend to 50% of its former payout.

Price Performance

Shares of Southern Copper have fallen 20.9% over the past year compared with the industry’s decline of 29.2%.

Zacks Rank & Stocks to Consider

Southern Copper currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Kinross Gold Corporation KGC, B2Gold Corp. BTG and Franco-Nevada Corporation FNV. While Kinross Gold sports a Zacks Rank #1 (Strong Buy), B2Gold and Franco-Nevada carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kinross Gold has a projected earnings growth rate of 41.2% for the current year. The company’s shares have rallied 122% over the past year.

B2Gold has an estimated earnings growth rate of 217.4% for fiscal 2020. Its shares have appreciated 102% in the past year.

Franco-Nevada has an expected earnings growth rate of 19.45% for fiscal 2020. The company’s shares have soared 93% in a year’s time.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.1% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Southern Copper Corporation (SCCO) : Free Stock Analysis Report

B2Gold Corp (BTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance