Solid Backlog, Buyouts Aid John Bean (JBT) Amid Cost Woes

John Bean Technologies Corporation JBT is well-poised to benefit from solid backlog levels in both its segments — JBT FoodTech and JBT AeroTech. The company’s strategic acquisition program to add complementary products to its portfolio and efforts to develop innovative products have been driving growth. While surging costs, supply chain and logistics disruptions are expected to weigh on its margins this year, expected gains from its Elevate 2.0 plan will prove beneficial.

Strong Backlog Levels to Fuel Revenues

The backlog in the FoodTech segment increased 5% year over year to $664 million as of Dec 31, 2022. The AeroTech segment’s backlog was $391 million at the end of 2022, up 5% year over year. JBT’s total backlog at the end of 2022 was around $1.1 billion, up 5% year over year. The company noted customer engagement and pipeline opportunities remain strong as it offers core technologies and solutions for food and beverage processing.

The AeroTech segment is showing signs of recovery on account of demand from infrastructure, cargo, and defense markets, and improvement in commercial airline markets. The passenger airline industry contributes a significant portion to the segment’s revenues. Passenger air travel has picked up post the pandemic, courtesy of the re-opening of travel routes. Airport infrastructure spending, which is subject to long lead time contracts, is expected to remain healthy. Aftermarket revenues are also gaining steam as equipment utilization increases for customers in line with air traffic demand. The AeroTech segment’s revenues are expected to increase approximately 10-13% in 2023 from last year’s levels. The segment’s operating margin is expected to be in the range of 11.25% to 11.75%.

Muted customer spending amid inflationary pressures might continue to impair the FoodTech segment’s demand levels. The revenue growth for the segment is expected at 5-9% in 2023. The segment’s operating margin is expected between 13% and 14%. The rising demand for digitally enabled customer-centric solutions, along with offerings that support automation and sustainability initiatives will boost the segment’s growth going forward.

In 2022, John Bean introduced its Elevate 2.0 strategy which is expected to drive continued growth and margin expansion. Also per the strategy, JBT is now focused on becoming a pure-play food and beverage technology solutions provider and considering strategic alternatives for the AeroTech segment. It will continue to introduce new products that support customers' needs for yield, capacity, automation and sustainability. The company will also look for strategic acquisitions that provide meaningful synergies with FoodTech's existing products and solutions.

Cost-Saving Actions to Ease Margin Pressure

The company has been witnessing material inflation, supply chain and logistics disruptions, and higher labor costs. The shortages of critical raw materials (particularly electronic components) and labor impeded its production and deliveries in both segments. It also increased the overall costs of running the business. These factors are expected to dent the company’s margins in 2023. John Bean’s Elevate 2.0 plan is likely to drive continued growth and margin expansion and will help the company counter the input cost inflation that is currently plaguing the industry.

Acquisitions Remain a Key Catalyst

John Bean has a strategic acquisition program focused on companies that add complementary products, which enables it to offer more comprehensive solutions to customers. In the last few years, the company acquired Proseal UK Limited, Prime Equipment Group and certain assets and liabilities of MARS Food Processing Solutions. In 2021 the company bought AutoCoding Systems to strengthen its abilities in the growing global market for in-line coding and inspection solutions.

The addition of Prevenio expanded the recurring revenue stream and ability to address the food safety needs of customers and the Urtasun addition expanded its product offering in fruit and vegetable processing. JBT recently acquired Alco-food-machines GmbH & Co. KG (Alco), a leading provider of further food processing solutions and production lines. It also completed the acquisition of Bevcorp, augmenting its capabilities in the carbonated beverage processing and packaging market.

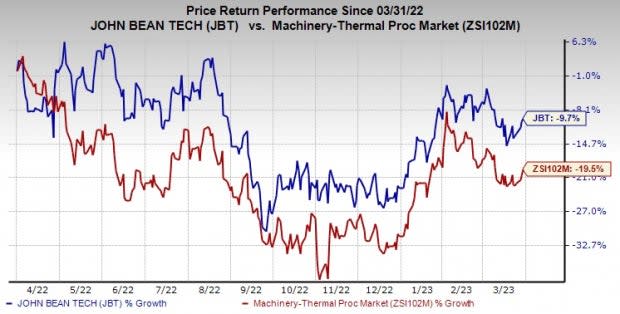

Share Price Performance

The stock has fallen 9.7% in the past year, against the industry’s 19.5% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

John Bean currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are OI Glass OI, Encore Wire WIRE and Illinois Tool Works ITW. OI and WIRE sport a Zacks Rank #1 (Strong Buy) at present, and ITW has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

OI Glass has an average trailing four-quarter earnings surprise of 16.4%. The Zacks Consensus Estimate for OI’s 2023 earnings is pegged at $2.57 per share. This indicates an 11.7% increase from the prior-year reported figure. The consensus estimate for 2023 earnings has moved 16% north in the past 60 days. OI’s shares gained 70.2% in the last year.

Encore Wire has an average trailing four-quarter earnings surprise of 146.8%. The Zacks Consensus Estimate for WIRE’ 2023 earnings is pegged at $19.76 per share. The consensus estimate for 2023 earnings has moved north by 1.7% in the past 60 days. Its shares gained 52.1% in the last year.

The Zacks Consensus Estimate for Illinois Tool Works’ fiscal 2023 earnings per share is pegged at $9.61, suggesting an increase of 4.8% from that reported in the last year. The consensus estimate for fiscal 2023 earnings moved 4% upward in the last 60 days. ITW has a trailing four-quarter average earnings surprise of 0.9%. Its shares gained 9% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

O-I Glass, Inc. (OI) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

John Bean Technologies Corporation (JBT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance