SmileDirectClub (SDC) Hurt by Lower Spending, Margin Woe

SmileDirectClub’s SDC ongoing operating loss, leveraged balance sheet and tough competitive landscape remain overhangs. The stock currently carries a Zacks Rank #4 (Sell).

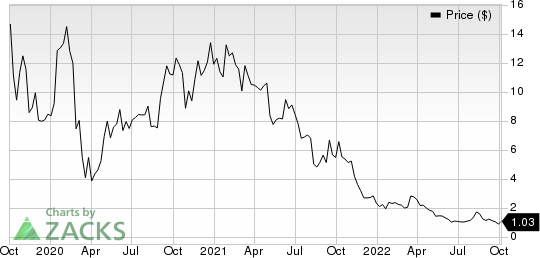

Over the past year, shares of SmileDirectClub have underperformed the broader industry. The stock has declined 84.4% compared with the industry’s 13.6% fall. SmileDirectClub exited the second quarter of 2022 with lower-than-expected earnings. The company registered a year-over-year decline in revenues in the quarter due to lower unique aligner shipments. The company also witnessed a drop in both net and financing revenues on a year-over-year basis.

Throughout the second quarter, the macroeconomic challenges continued to impact SmileDirectClub’s core demographic and business spending. According to the company, challenges to consumer spending accelerated faster than anticipated during the quarter. These, combined with reduced stimulus, sustained high inflation and a shift in discretionary spending toward services, will result in less predictable demand curves and lower overall expected demand in the balance of the year. Accordingly, SmileDirectClub reduced its 2022 guidance.

The contraction of gross margin does not bode well. Escalating operating costs are building pressure on the bottom line. SmileDirectClub’s second-quarter marketing and selling expenses contracted 25.7%. General and administrative expenses were down 14.9% year over year. The company incurred an adjusted operating loss of $51.8 million in the quarter, marginally narrower than the year-ago adjusted operating loss of $52.7 million.

SmileDirectClub, Inc. Price

SmileDirectClub, Inc. price | SmileDirectClub, Inc. Quote

A huge debt balance as well as a tough competitive landscape remains an overhang.

On a positive note, SmileDirectClub’s second-quarter average aligner gross sales price (ASP) was 1917, marking an increase of $27 from the first quarter. This was primarily driven by a price increase implemented in the United States in May and in the United Kingdom in late June. According to the company, additional geographies are targeted for increases during the second half of 2022.

Implicit price concessions, as a percentage of gross aligner revenues, are expected to trend back toward the company’s historical levels between 9% and 10%. Meanwhile, SmileDirectClub plans to hold its Investor Day at its manufacturing facility in Nashville at the end of the year or the first quarter of 2023.

SmileDirectClub is currently focused on developing products to further differentiate its offerings in the oral care industry. In May 2022, the company announced the expansion of its best-in-class oral care product offerings with its new Wireless Premium Teeth Whitening Kit. In February 2022, it expanded its award-winning oral care product offerings with the new Stain Barrier. The latest whitening innovation from SmileDirectClub, Stain Barrier, protects teeth with an invisible shield against common staining beverages, including coffee, tea, red wine and soda.

Key Picks

Some better-ranked stocks in the broader medical space are ShockWave Medical SWAV, AMN Healthcare Services AMN and McKesson MCK. While ShockWave Medical and AMN Healthcare Services sport a Zacks Rank #1 (Strong Buy), McKesson carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ShockWave Medical’s earnings per share rose from $2.02 to $2.57 for 2022 and from $2.95 to $3.42 for 2023 in the past 60 days. SWAV has gained 53.4% so far this year.

ShockWave Medical delivered an earnings surprise of 180.14%, on average, in the last four quarters.

Estimates for AMN Healthcare Services have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. AMN stock has declined 13.5% so far this year.

AMN Healthcare Services delivered an earnings surprise of 15.66%, on average, in the last four quarters.

Estimates for McKesson’s earnings per share increased from $23.27 to $24.42 for fiscal 2023 and $25.41 to $26.04 for fiscal 2024 in the past 60 days. MCK has gained 40.3% so far this year.

McKesson delivered an earnings surprise of 13.00%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

SmileDirectClub, Inc. (SDC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance