SM Energy (SM) Stock Jumps 17% Since Q3 Earnings Report

SM Energy Company’s SM shares have increased 17.2% since its earnings announcement on Oct 31.

The reasons for the rally were better-than-expected third-quarter earnings and improved 2019 production guidance. The upstream energy player expects to increase total production in 2019 despite maintaining capital budget. It has lowered estimates on the cost front.

SM Energy Company Price

SM Energy Company price | SM Energy Company Quote

Overall Earnings Picture

SM Energy reported third-quarter 2019 adjusted loss of 11 cents per share, narrower than the Zacks Consensus Estimate of a loss of 12 cents. The reported figure, however, widened from a loss of 1 cent a year ago.

Total revenues, which declined to $390.3 million from $459.4 million in the prior-year quarter, missed the Zacks Consensus Estimate of $399 million.

The better-than-expected quarterly earnings were supported by higher production levels. However, the positives were partially offset by lower commodity price realizations and higher unit lease operating expenses.

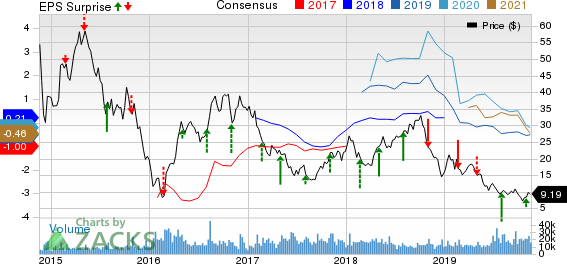

SM Energy Company Price, Consensus and EPS Surprise

SM Energy Company price-consensus-eps-surprise-chart | SM Energy Company Quote

Operational Performance:

Total Production Increases

The company’s third-quarter production was 134.9 thousand barrels of oil equivalent per day (MBoe/d), up 4% from the year-ago level of 130.2 MBoe/d. The production growth was supported by improved well performance.

Oil production increased 7% year over year to 59 thousand barrels per day (MBbls/d). SM Energy produced 320.6 million cubic feet per day of natural gas in the quarter, up 9% year over year. Natural gas liquids contributed 22.5 MBbls/d to total production volume, down 14% from the third-quarter 2018 level.

Realized Prices Decline

Excluding the effects of derivative settlements, the average realized price per Boe was $31.39 compared with $38.26 in the year-ago quarter. Average realized price of natural gas fell 39% year over year to $2.17 per thousand cubic feet. Moreover, average realized prices of oil fell 5% to $53.99 per barrel and that of natural gas liquids declined 49% from the prior-year quarter to $15.73.

Cost & Expenses

On the cost front, unit lease operating expenses increased 7% year over year to $4.73 per Boe. In addition, general and administrative expenses rose 7% to $2.63 per Boe from the prior-year level of $2.46. However, transportation expenses fell to $4 per Boe from $4.20 in the year-ago quarter.

Total exploration expenses fell to $11.6 million from $13.1 million in the year-ago quarter. Hydrocarbon production expenses in the quarter were recorded at $129 million compared with the year-ago level of $127.6 million. Total operating expenses in the quarter declined to $290.8 million from the year-ago period’s $568 million, primarily due to net derivative gains.

Balance Sheet

As of Sep 30, SM Energy had a cash balance of $10 thousand and long-term debt of $2,735.8 million. The company had a debt-to-capitalization ratio of 49%.

Guidance

SM Energy marginally raised its full-year 2019 production guidance to the range of 130-131 MBoe/d. Of the total production, 44% is anticipated to be oil. For 2019, the company reiterated capital spending budget in the range of $1,000-$1,050 million.

Production for fourth-quarter 2019 is projected within 12-12.4 million barrels of oil equivalent or 130.4-134.8 MBoe/d. The company expects capital spending for the quarter within $160-210 million.

It has lowered its full-year lease operating expense guidance to the range of $4.70-$4.80 per Boe. For the fourth quarter, the metric is expected within $4.80-$5.15 per Boe.

Zacks Rank and Stocks to Consider

Currently, SM Energy has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are World Fuel Services Corporation INT, CNX Resources Corporation CNX, and Contango Oil & Gas Company MCF. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

World Fuel Services’ 2019 earnings per share are expected to rise 18% year over year.

CNX Resources’ 2019 earnings per share have witnessed three upward movements and no downward revision in the past 30 days.

Contango Oil & Gas’ bottom line for the current year is expected to rise around 87% year over year.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CNX Resources Corporation. (CNX) : Free Stock Analysis Report

World Fuel Services Corporation (INT) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance