Skeptical of ICOs? Vox Token Supports Existing Business, Setting it Apart from the Crypto-Pack

Vox Utility Token Offering of $35 Million to Expand Internet Phone App in Emerging Markets

At last, a cryptocurrency offering that looks more a business than a gimmick.

Swiss technology company Horizon Globex is currently offering up to $35 million in security tokens to fund the international rollout of an existing Internet telephone and messaging app called Talketh. The Vox Utility Tokens don’t represent a stake in Horizon Globex, but instead will be redeemable for a possible profit as the app is used on smartphones around the world.

The idea behind Vox tokens arose from the need to serve roughly 2 billion people who don’t use traditional banking products. Of those people, hundreds of millions have smartphones but are unable to use pay services like Skype because they don’t have credit cards.

But with the Talketh app, users can buy scratch-off cards using local currency at kiosks and convenience stores to get phone and data credit. Users simply scratch a card, discover a code to enter in the app, and the phone is topped up with credit.

Importantly, Talketh works on 2G and 3G networks, which are still the predominant technology in dozens of emerging-market economies. That means Talketh users in places like Zimbabwe will be able to make calls on the app even without Wifi. Other popular Internet phone services including Skype and Facebook require more advanced networks that won’t be available in poor countries for years.

The business proposition may be exciting, but what separates Vox Tokens from the countless initial coin offerings (ICOs) and security token offerings (STOs) that have been pitched amid the crypto-boom? First, the tokens will be used to fund the growth of an Internet phone app that already works.

Brian Collins, CEO of Horizon Globex, Issuer of Vox Tokens

Indeed, IPO Edge downloaded and tested the app with both a domestic phone call and an SMS to Kenya. Both tests were successful using regular phone numbers on recipient phones that don’t have Talketh installed.

To develop Talketh and prepare for the blockchain launch, Horizon Globex invested millions of dollars over the last few years. The company’s CEO, Brian Collins, has been with the company since 2010 when he founded it.

Unlike most ICOs, which were conducted without an investment bank, Vox tokens are offered by a known institution. TriPoint Global Equities is a FINRA member firm, a broker-dealer, and has underwritten several recent IPOs. Those include FAT Brands, franchiser of Fatburger and other restaurants, along with luxury cinema operator iPic Entertainment – both of which are listed on Nasdaq.

Crypto investors say it’s critical to understand the mechanics of new ICOs after a recent string of fraudulent offerings. “ICO fundraising has this unfortunate association with scamming and fraud, mostly thanks to the 2017 ICO bubble. The reality is that, when done properly, ICOs allow fundraising for an entirely new class of securities,” says Michael Margaritoff, Portfolio Manager at Jefferson Capital, a wealth manager exclusively focused on digital assets, including cryptocurrency.

Skeptics might argue that Horizon Globex could raise money through debt or equity to invest in Talketh’s infrastructure – all without the blockchain. But Vox tokens have unique attributes: Investors are by definition the first to be paid back the moment Talketh generates revenue. Traditional securities don’t offer such a rapid, secure payback mechanism with the possibility of appreciation.

What’s more, Ethereum reduces financial transaction costs and Talketh has the potential to bring millions of users onto the blockchain. In fact, users are rewarded with token bonuses when they use scratch-off cards. That effectively makes them investors in the product who can benefit as the value of the tokens increases.

“We’re beginning to see crypto-asset startups popping up in every industry, offering cheaper and more efficient services to customers through the use of cryptocurrency smart contracts, which allow investors to be paid in real time,” Mr. Margaritoff says. “The ability to pay investors without having to worry about profit margins at the parent company means that these startups will have a tremendous competitive edge over traditional industry. Talketh is certainly utilizing this potential with their Vox token.”

How can token investors have confidence they will make money? The key is to understand the process of how scratch-off cards trigger a redemption of tokens. Consider the example of a $5 scratch-off card. Once redeemed, the user gets a fixed amount of credit for minutes or data on the Talketh app. All $5 of that money will effectively be used to fund a “bid” toward the lowest “ask” among all of the Vox token holders.

That transaction actually happens behind the scenes on the Ethereum blockchain – and is invisible to the scratch-card user. Holders of Vox tokens will be able to sell them on a decentralized exchange for units of the Ether cryptocurrency, which is highly-liquid and easily convertible into U.S. dollars.

The upshot is that token holders, rather than the company, get all of the scratch-off proceeds until the tokens have all been redeemed. In fact, the company bears the cost of purchasing the minutes, so in a way loses money along the way.

The reason that model works is twofold. One, the company’s cost of scratch-off cards is only about 1/7 of the sale price. That costs falls even lower as scratch-off volumes increase. Two, the company gets to keep the entire $35 million in proceeds from the token offering.

So long as Horizon Globex doesn’t lose too much money on the transactions, it can wind up with a tidy profit. And of course, once the tokens are all burned up, the company will keep future scratch-off proceeds for itself and command a large profit margin.

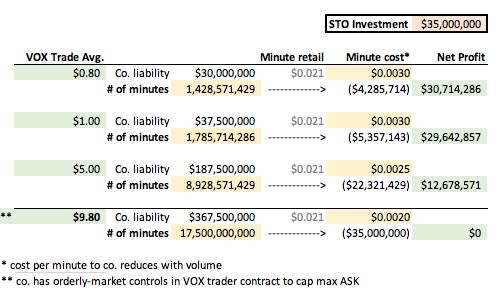

As shown in the table below, the company’s profit will depend on the sale price of the tokens. With a purchase price of $1 per token, or a discount for those who purchase some of the first few million tokens, there is potential for investors to easily make multiples of their money on strong scratch-off sales.

For example, the company forecasts $83 million of sales in the first four years. If it took exactly $83 million to burn through all of the tokens, investors would sell out at an average price of $2.22 per token.

It stands to reason that many investors will hold out before selling their tokens in hopes of securing a high price. Indeed, the shrinking token supply bears similarity to a stock buyback, where fewer shares drive higher prices.

One concern: The tokens appreciate to a price that makes Horizon Globex actually lose money. At $9.80 per token, the company would theoretically spend all $35 million on the cost of the scratch-off cards.

But the company could always raise the price of the call credit to consumers. Plus, it is keeping 2.5 million tokens for itself, a stash that could prove incredibly valuable.

Of course, the Vox tokens are the first of their kind, indicating there is some execution risk. But the company has adopted the most reliable blockchain technology available and already put money into a highly-functional telephony app. The real concern is that the scratch-off cards are slow to sell, which could mean it takes some time for the tokens to get redeemed.

Ultimately, the Vox tokens appear to be a carefully-planned solution to a problem with Internet calls in developing markets. While bearing risk, the tokens should reward those who invest the time to understand their underlying mechanics.

Contact:

John Jannarone, Editor-in-Chief

Instagram: @IPOEdge

Twitter: @IPOEdge

Yahoo Finance

Yahoo Finance