Singapore SGX Showcases Three Key Dividend Stocks

As global markets navigate through varying economic climates, the Singapore Exchange (SGX) remains a focal point for investors seeking stability and consistent returns. In this context, dividend stocks often emerge as attractive options due to their potential to provide steady income streams. In light of current market conditions, a good dividend stock typically features robust fundamentals and a history of resilient performance across economic cycles, aligning well with the needs of investors prioritizing security and reliability in their portfolios.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.41% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.35% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.88% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.61% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.71% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.84% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.82% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.01% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

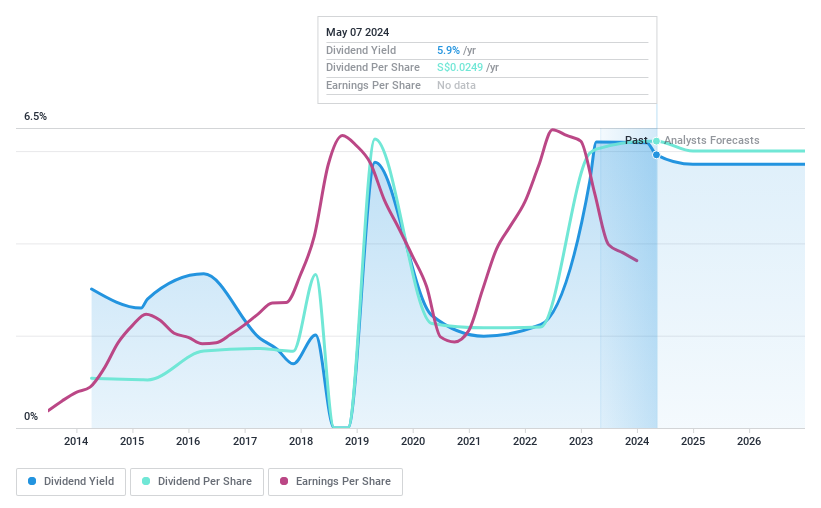

China Sunsine Chemical Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals across the People’s Republic of China, other parts of Asia, the United States, and Europe, with a market cap of approximately SGD 372.83 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue primarily through its Rubber Chemicals segment, which earned CN¥4.38 billion, supplemented by smaller contributions from its Heating Power and Waste Treatment segments, which brought in CN¥221.29 million and CN¥29.76 million respectively.

Dividend Yield: 6.4%

China Sunsine Chemical Holdings has maintained a low payout ratio of 20.8%, ensuring dividends are well-covered by earnings, alongside a cash payout ratio of 30.2%, indicating sound coverage by cash flows as well. However, its dividend history shows volatility and unreliability over the past decade, with significant annual fluctuations exceeding 20%. Recently, the company initiated a share repurchase program on May 13, 2024, highlighting potential confidence in its valuation and future prospects.

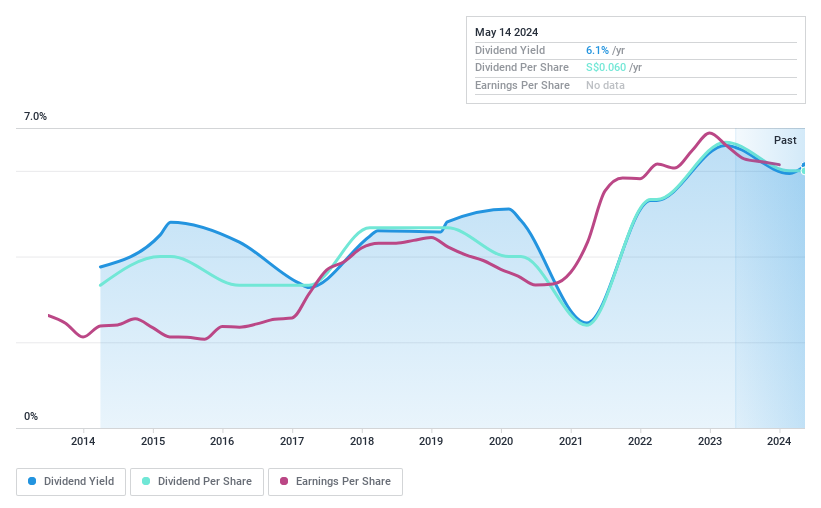

Sing Investments & Finance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited operates in Singapore, offering financing services to both individuals and corporations, with a market capitalization of approximately SGD 236.44 million.

Operations: Sing Investments & Finance Limited generates its revenue primarily through credit and lending services, totaling SGD 68.26 million.

Dividend Yield: 6%

Sing Investments & Finance maintains a low cash payout ratio of 9.6%, indicating strong coverage of dividends by cash flows, alongside an earnings payout ratio of 42.7%. However, the company's dividend history over the past decade reveals instability with significant volatility in payments. Currently, its dividend yield stands at 6%, slightly below the market's top quartile for dividend payers in Singapore at 6.25%. Additionally, it trades at a substantial discount to estimated fair value, suggesting potential undervaluation.

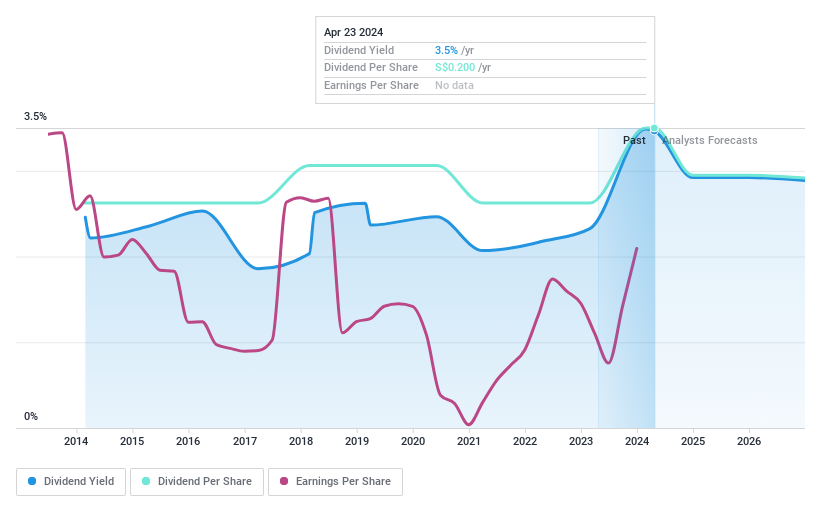

UOL Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality sectors across various countries including Singapore, Australia, the UK, China, and the US, with a market cap of SGD 4.40 billion.

Operations: UOL Group Limited generates revenue primarily through property development in Singapore (SGD 1.16 billion), property investments (SGD 518.93 million), and hotel operations in Singapore (SGD 464.93 million), Australia (SGD 125.64 million), and other locations (SGD 172.40 million), along with technology operations contributing SGD 110.08 million and investments adding SGD 67.79 million.

Dividend Yield: 3.8%

UOL Group Limited recently announced a special dividend and affirmed its annual dividend, reflecting a stable return to shareholders. Despite a low dividend yield of 3.84% relative to Singapore's top payers, the dividends are well-supported by earnings with an earnings payout ratio of 17.9% and cash flows with a cash payout ratio of 59.3%. However, earnings are expected to decline significantly over the next three years, which could challenge future dividend sustainability. The recent appointment of Mr. Ng Tiang Poh as CFO could influence financial strategies moving forward.

Where To Now?

Navigate through the entire inventory of 20 Top SGX Dividend Stocks here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:QES SGX:S35 and SGX:U14.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance