Silicon Motion (SIMO) Q2 Earnings & Revenues Top Estimates

Silicon Motion Technology Corporation SIMO reported second-quarter 2021 non-GAAP earnings of $1.50 per American Depositary Share (ADS), which surpassed the Zacks Consensus Estimate by 11.1%. The bottom line increased 85.2% from the year-ago quarter’s figure and rose 35.1% sequentially.

Net sales (non-GAAP) of $221.1 million beat the Zacks Consensus Estimate by 8.4%. On a year-over-year basis, sales rallied 61.6% driven by higher sales of SSD controllers as well as eMMC and UFS controllers. Net sales also increased 21.2% sequentially in the second quarter.

Performance in Detail

Management noted that sales of SSD controllers rallied 30-35% sequentially.

Revenues from SSD solutions increased 30-40% quarter over quarter. Revenues from eMMC and UFS controllers rose 10-15% sequentially.

In the second quarter of 2021, sales of SSD controllers surged 105-110% year over year, while sales of eMMC and UFS controllers increased 25-30% on a year-over-year basis. In the quarter under review, SSD solutions’ sales declined 15-20% year over year.

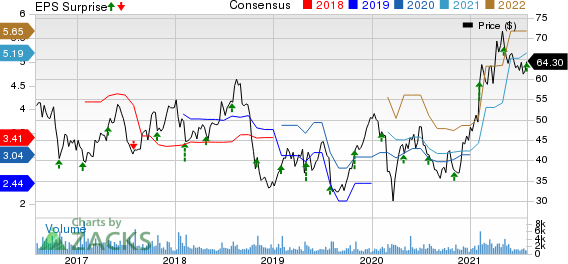

Silicon Motion Technology Corporation Price, Consensus and EPS Surprise

Silicon Motion Technology Corporation price-consensus-eps-surprise-chart | Silicon Motion Technology Corporation Quote

Margins

Non-GAAP gross margin of 51% expanded 100 basis points (bps) on a year-over-year basis and expanded 30 bps sequentially.

Non-GAAP operating expenses, as a percentage of revenues, came in at 21.9%, contracting 590 bps year over year and 220 bps sequentially.

Non-GAAP operating margin expanded 700 bps on a year-over-year basis and 260 bps sequentially to 29.2%.

Balance Sheet & Cash Flow

As of Jun 30, 2021, Silicon Motion had cash, cash equivalents, restricted cash and short-term investments of $412.3 million compared with $371 million as of Mar 31, 2021.

The company generated $60 million cash from operations during the reported quarter compared with $17.4 million in the previous quarter.

On Oct 26, 2020, the company’s board of directors approved $1.40 per ADS of annual dividend, slated to be paid out in quarterly installments of 35 cents per ADS. On May 20, 2021, the company paid out $12.2 million as dividend to shareholders, which marked its third installment.

On Nov 21, 2018, Silicon Motion announced a new buyback program spread over a two-year period. Per the program, the company will repurchase approximately $200 million ADS. In the reported quarter, the company did not repurchase any ADSs.

Under the buyback program, the company repurchased shares worth $84.8 million of ADSs, with $115.2 million remaining untapped under the program. On Oct 26, 2020, the board of directors approved the extension of the conclusion of the program to Nov 21, 2021.

A Look at Guidance

For third-quarter 2021, Silicon Motion expects non-GAAP revenues in the range of $238-$249 million. The Zacks Consensus Estimate is currently pegged at $215 million.

Non-GAAP gross margin is anticipated in the range of 48.5-50.5%. Non-GAAP operating margin is projected in the range of 27.5-29.5%.

For 2021, Silicon Motion now expects non-GAAP revenues in the range of $890-$917 million compared with the previous view of $782-$836 million. The Zacks Consensus Estimate is currently pegged at $816.6 million.

Revenues are likely to reflect benefit from focus on sales of higher value products, noted the company.

Continued momentum in PC sales triggered by online learning and work-from-home wave hold promise. Strong PC shipments are expected to benefit the company’s PCIe NVMe SSD controllers.

Non-GAAP gross margin is anticipated in the band of 49.5-50.5% compared with earlier guidance of 47-49%. Non-GAAP operating margin is projected in the range of 27.5-29.5% compared with the range of 26-28% anticipated previously.

Zacks Rank & Stocks to Consider

Currently, Silicon Motion carries a Zacks Rank #3 (Hold).

Some better-ranked stocks worth considering in the broader technology sector are Avnet AVT, CyberArk Software CYBR and Digital Turbine APPS. Avnet and Digital Turbine sport a Zacks Rank #1 (Strong Buy), while CyberArk carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Digital Turbine, Avnet and CyberArk are scheduled to release earnings on Aug 9, Aug 11 and Aug 12, respectively.

Long-term earnings growth rate for CyberArk, Avnet and Digital Turbine is currently pegged at 12.2%, 22.7% and 50%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avnet, Inc. (AVT) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

CyberArk Software Ltd. (CYBR) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance