Signet's (SIG) Shares Decline Above 11% on FY23 View Cut

Shares of Signet Jewelers Limited SIG have plunged more than 11% during the trading hours on Aug 9, following its trimmed outlook for fiscal 2023. SIG revised guidance due to the increased pressure on consumers' discretionary spending and a challenging macroeconomic landscape. Management highlighted that it witnessed soft sales in July owing to customers being heavily impacted by inflation.

For fiscal 2023, Signet now projects total revenues of $7.60-$7.70 billion and an adjusted operating income of $787-$828 million. This indicates a decline from the prior guided range of $8.03-$8.25 billion for total revenues and $921-$974 million for adjusted operating income. In fiscal 2022, SIG delivered revenues of $7.83 billion and an adjusted operating income of $908.1 million. However, the updated view suggests revenue growth of about 25% from the fiscal 2020 pre-pandemic period. We note that the revised outlook excludes any further material worsening of macroeconomic factors that might affect consumer spending patterns, the related impacts on SIG’s business, and its pending buyout of Blue Nile.

Management also issued preliminary second-quarter fiscal 2023 guidance. Total revenues are expected to be $1.75 billion and the adjusted operating income to be approximately $192 million. On its first-quarter earnings call, management had forecast revenues of $1.79-$1.82 billion and an adjusted operating income of $188-$204 million. The updated view implies a decrease from $1.79 million of revenues and an adjusted operating income of $223 million reported in the year-ago fiscal quarter.

What Else?

Simultaneously, Signet announced that it agreed to buy Blue Nile, Inc. ("Blue Nile") for $360 million in cash. A pioneer and key innovator in online engagement rings and fine jewelry, Blue Nile generated revenues of more than $500 million in 2021. Its acquisition is likely to reinforce SIG’s Accessible Luxury banners with Jared, James Allen and Diamonds Direct. This buyout will help SIG expand the bridal offerings, strengthen its Accessible Luxury portfolio and enhance its digital leadership in the jewelry space.

The transaction, likely to conclude in the third quarter of fiscal 2023, is subject to some customary closing conditions. Synergies will start materializing as early as the fourth quarter of the current fiscal year and the acquisition is expected to be accretive after fiscal 2024. This buyout is anticipated to further strengthen Signet’s Inspiring Brilliance growth strategy.

Signet’s Inspiring Brilliance strategy focuses on expanding big banners, boosting service revenues, broadening the Accessible Luxury and Value segments, as well as accelerating digital commerce. As part of the Inspiring Brilliance growth strategy, SIG makes use of data-driven insights for targeting new and existing customers.

Image Source: Zacks Investment Research

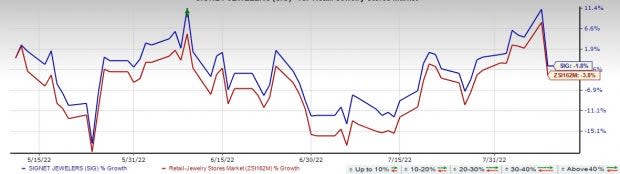

This currently Zacks Rank #3 (Hold) stock has lost 1.8% in the past three months, narrower than the industry’s 3.8% decline.

3 Hot Stocks to Buy

We highlighted three better-ranked stocks in the Retail - Wholesale sector, namely Tecnoglass TGLS, Chico's FAS CHS and Designer Brands DBI.

Tecnoglass manufactures and sells architectural glass and aluminum products for the residential and commercial construction industries. TGLS currently sports a Zacks Rank #1 (Strong Buy).

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and EPS suggests growth of 28.2% and 28.7%, respectively, from the corresponding year-ago period's reported figures. TGLS has a trailing four-quarter earnings surprise of 24.4%, on average.

Chico's FAS, an omni-channel specialty retailer, also flaunts a Zacks Rank of 1. CHS has a trailing four-quarter earnings surprise of 330.6%, on average.

The Zacks Consensus Estimate for Chico's FAS’ current financial-year sales and EPS suggests growth of 18.8% and 80%, respectively, from the year-ago period’s corresponding numbers.

Designer Brands, a national wholesale distributor of industrial and construction supplies, currently has a Zacks Rank #2 (Buy). DBI has a trailing four-quarter earnings surprise of 102.5%, on average.

The Zacks Consensus Estimate for Designer Brands’ current financial-year sales and EPS suggests growth of 6.9% and 16.5%, respectively, from the corresponding year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chico's FAS, Inc. (CHS) : Free Stock Analysis Report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance