Shorn Like A Sheep: Analysts Just Shaved Their Secure Energy Services Inc. (TSE:SES) Forecasts Dramatically

The analysts covering Secure Energy Services Inc. (TSE:SES) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

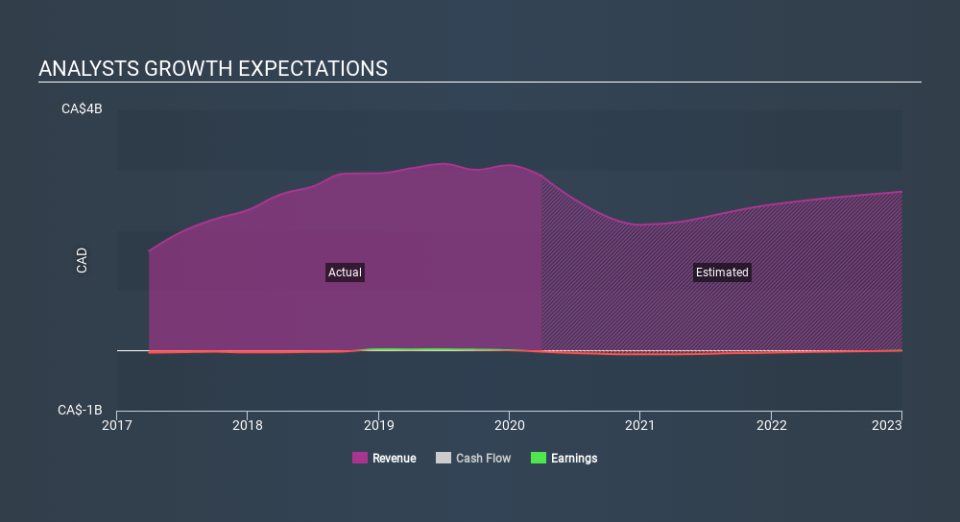

After the downgrade, the consensus from Secure Energy Services' nine analysts is for revenues of CA$2.1b in 2020, which would reflect a concerning 28% decline in sales compared to the last year of performance. Prior to the latest estimates, the analysts were forecasting revenues of CA$2.7b in 2020. It looks like forecasts have become a fair bit less optimistic on Secure Energy Services, given the sizeable cut to revenue estimates.

View our latest analysis for Secure Energy Services

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with the forecast 28% revenue decline a notable change from historical growth of 18% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 6.4% next year. So it's pretty clear that Secure Energy Services' revenues are expected to shrink faster than the wider industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Secure Energy Services this year. They're also forecasting for revenues to shrink at a quicker rate than companies in the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on Secure Energy Services, and a few readers might choose to steer clear of the stock.

That said, the analysts might have good reason to be negative on Secure Energy Services, given the risk of cutting its dividend. For more information, you can click here to discover this and the 2 other warning signs we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance