Shareholders Are Thrilled That The Kratos Defense & Security Solutions (NASDAQ:KTOS) Share Price Increased 205%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. Long term Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) shareholders would be well aware of this, since the stock is up 205% in five years. It's also up 20% in about a month. We note that Kratos Defense & Security Solutions reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

Check out our latest analysis for Kratos Defense & Security Solutions

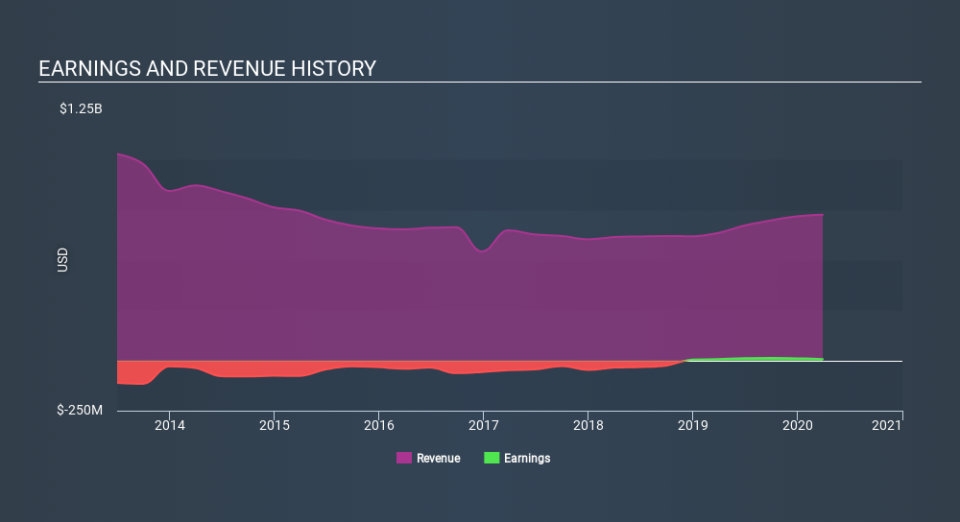

While Kratos Defense & Security Solutions made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Kratos Defense & Security Solutions's revenue has actually been trending down at about 0.08% per year. On the other hand, the share price done the opposite, gaining 25%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think Kratos Defense & Security Solutions will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 9.5% in the last year, Kratos Defense & Security Solutions shareholders lost 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 25%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Kratos Defense & Security Solutions better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Kratos Defense & Security Solutions (at least 1 which is significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance