Shareholders Are Thrilled That The IMPACT Silver (CVE:IPT) Share Price Increased 151%

IMPACT Silver Corp. (CVE:IPT) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that shareholders have received really good returns over the last five years. Indeed, the share price is up an impressive 151% in that time. We think it's more important to dwell on the long term returns than the short term returns. Ultimately business performance will determine whether the stock price continues the positive long term trend.

See our latest analysis for IMPACT Silver

IMPACT Silver wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years IMPACT Silver saw its revenue shrink by 4.0% per year. Given that scenario, we wouldn't have expected the share price to rise 20% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, this situation makes us a little wary of the stock.

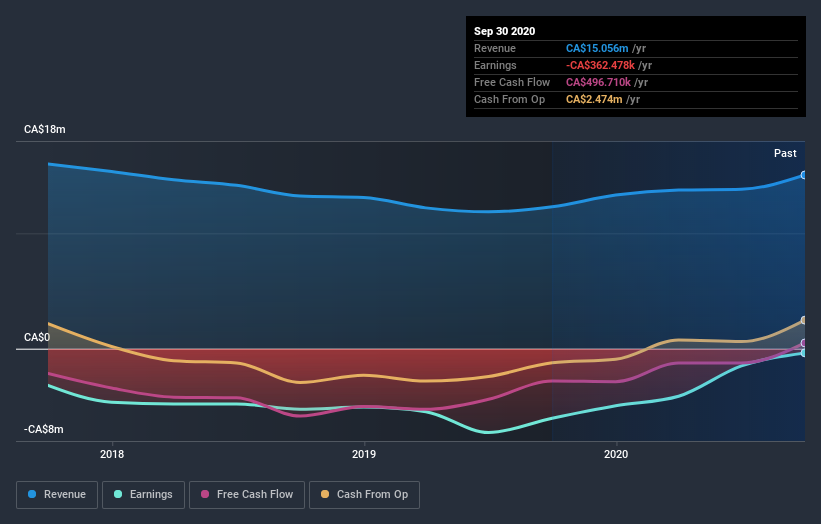

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling IMPACT Silver stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that IMPACT Silver has rewarded shareholders with a total shareholder return of 90% in the last twelve months. That's better than the annualised return of 20% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for IMPACT Silver (of which 1 is significant!) you should know about.

We will like IMPACT Silver better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance